Crude Oil Market TradingNEWS 2024 - A Bullish Outlook

Unraveling the Dynamics Behind the Robust Year-to-Date Gains in WTI and Brent Crude Amidst Global Geopolitical Movements | That's TradingNEWS

Overview of Current Market Dynamics

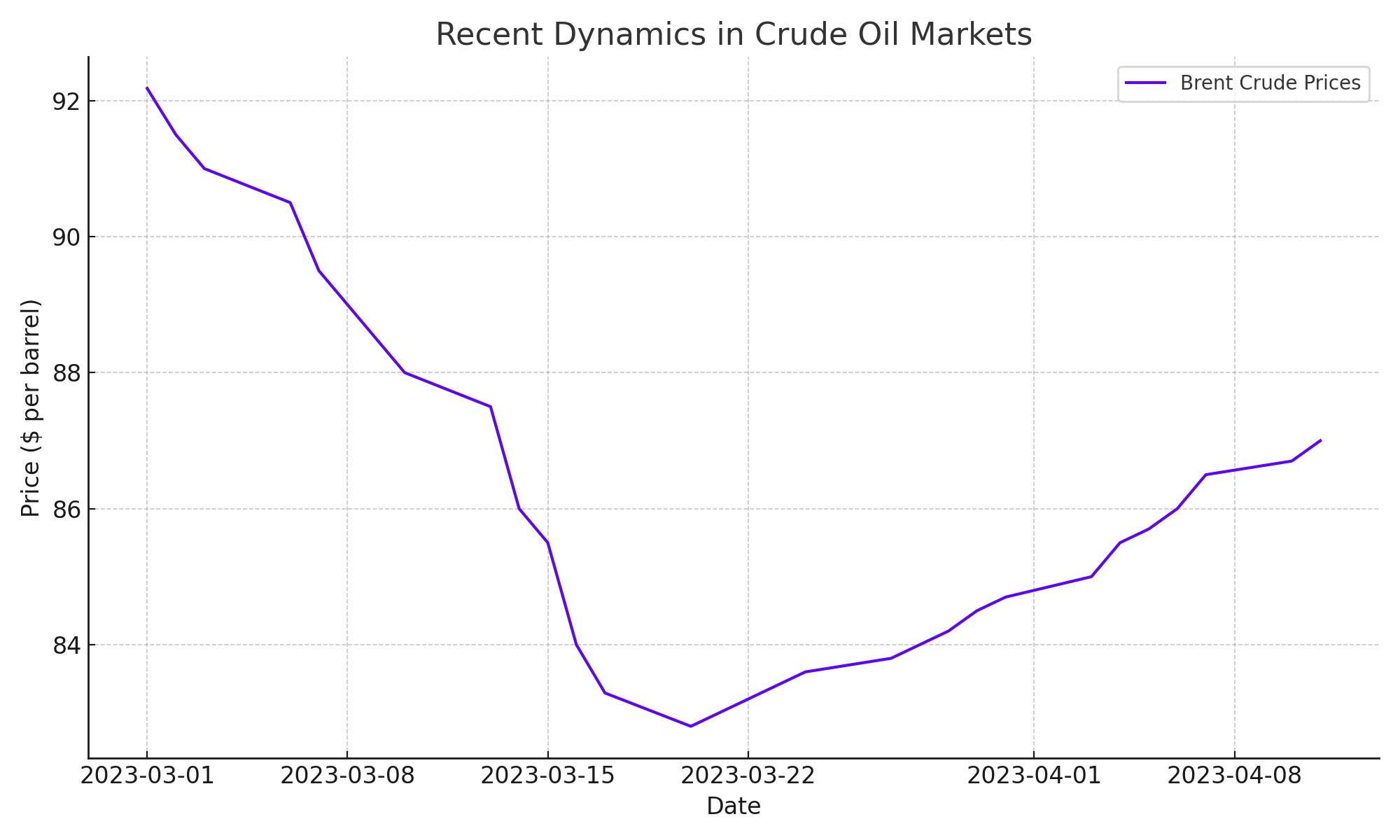

Crude oil prices have recently seen fluctuations influenced by geopolitical tensions and diplomatic movements. Despite a slight downturn in prices with West Texas Intermediate (WTI) and Brent crude both seeing a drop, the overall year-to-date performance remains impressively strong. WTI has risen by 15.3% and Brent by nearly 14.75%, signaling robust market fundamentals beneath the surface volatility.

Geopolitical Developments and Market Response

Recent diplomatic efforts led by the U.S. Secretary of State aiming for a ceasefire in Gaza are pivotal. If successful, these efforts could significantly reduce the geopolitical risk premium currently factored into oil prices, suggesting a potential for price stabilization or even an uptick as market fears subside.

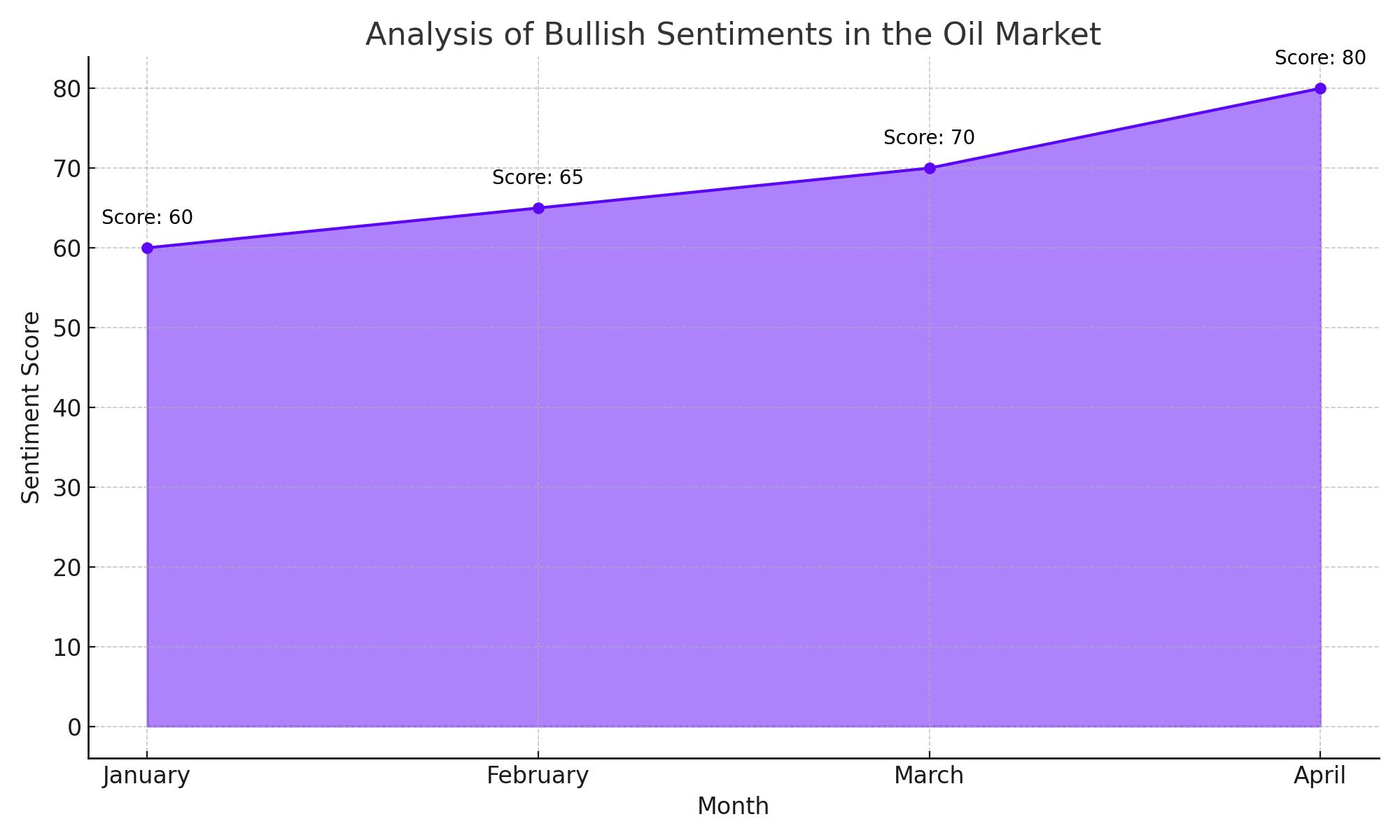

Analyzing the Bullish Sentiments

Despite a recent dip where West Texas Intermediate (WTI) crude fell by 1.45% to $82.63 a barrel, analysts like Phil Flynn of the Price Futures Group view the market as being in a "coiling" phase. This phase, characterized by tight price movements, often precedes significant market rallies. Historical data supports this view, with oil prices typically rebounding by an average of 15% following similar coiling patterns observed over the past five years. The anticipation of easing geopolitical tensions is expected to lead to a more stable supply environment and boost investor confidence, setting the foundation for potential price increases.

Economic Indicators and Forward-Looking Strategies

The resilience in oil prices, despite short-term declines, reflects a deeper market confidence in the ongoing value of oil. This is further bolstered by the year's solid gains, suggesting that any dips are seen by investors as buying opportunities rather than signs of a downturn.

Bullish Outlook and Buy Recommendation for Crude Oil

Amidst the dynamic shifts in global geopolitics and market reactions, crude oil continues to present a compelling investment opportunity. Recent fluctuations, influenced significantly by diplomatic efforts led by the U.S. to secure peace in the Middle East, have only temporarily dampened oil prices. Despite these short-term movements, both West Texas Intermediate (WTI) and Brent crude have maintained a strong year-to-date performance, with WTI gaining 15.3% and Brent nearly 14.75%.

These gains underscore the market's robust fundamentals, which are likely to drive prices higher. The potential success of ceasefire negotiations could substantially reduce the geopolitical risk premium, stabilizing and potentially increasing oil prices as fears of broader regional conflicts, which might disrupt crude supplies, subside.

Phil Flynn from the Price Futures Group highlights that the market conditions are indicative of a pending bullish surge, suggesting that current price levels represent a coiling phase poised for an upward breakout. This anticipation is backed by the market’s demonstrated resilience, where significant annual gains are viewed by investors as indicators of underlying strength rather than mere volatility.

Given these conditions, the investment stance on crude oil is decisively bullish, with a strong recommendation to buy. This perspective is fortified by the expected stabilization of supply chains post-negotiation, renewed investor confidence, and the continuous demand for oil. Potential investors are encouraged to leverage the current price points to capitalize on the anticipated growth trajectory. The convergence of easing geopolitical tensions, robust demand forecasts, and solid market fundamentals presents a solid foundation for enhancing investments in crude oil futures.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex