Gold Market Overview: Navigating Volatility Amidst Geopolitical Tensions and Economic Uncertainty

Gold Prices Near Record Highs

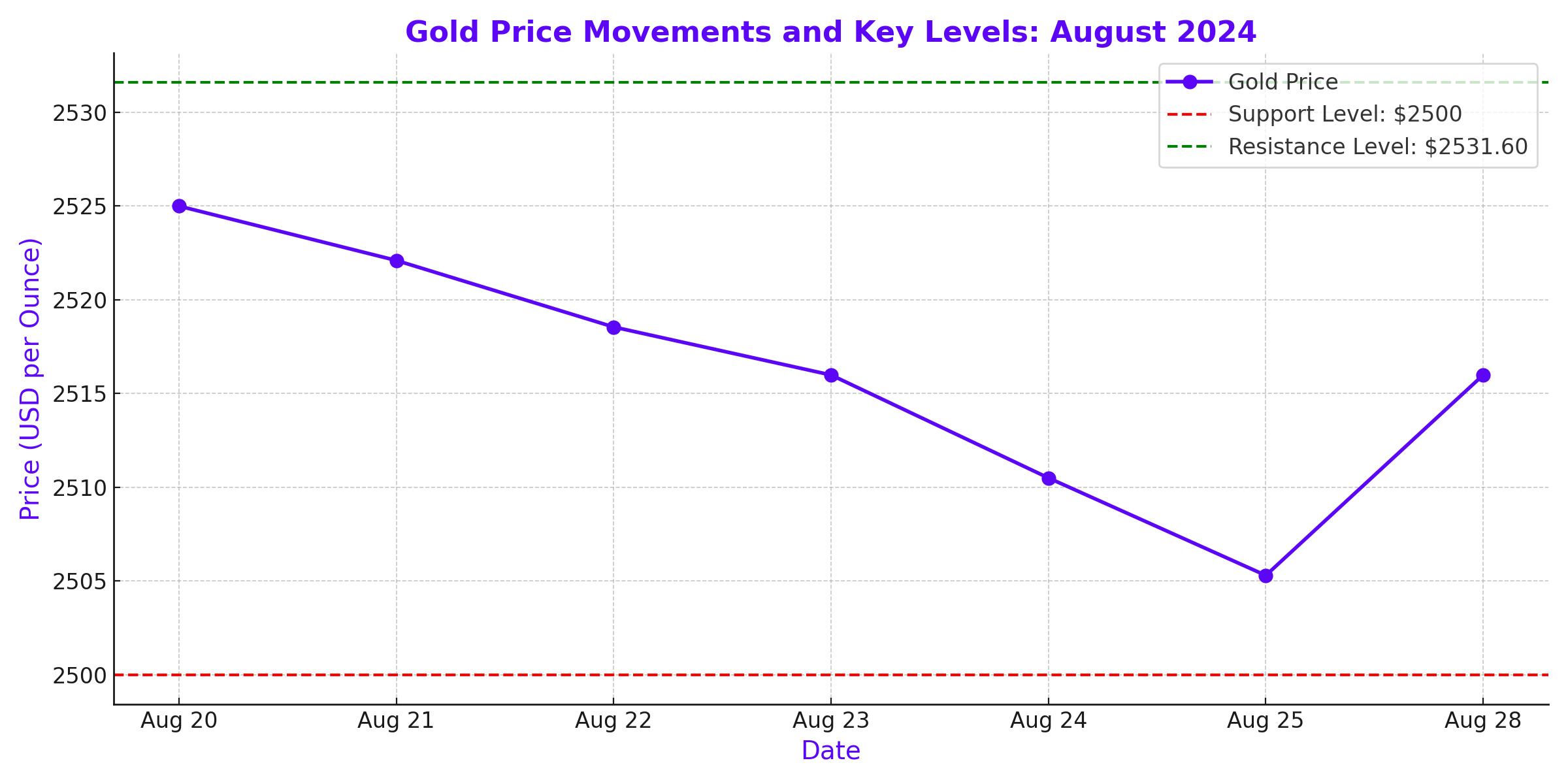

The spot gold price has been hovering near its recent highs, signaling potential for further upside as global markets remain volatile. Currently trading around $2,500 per ounce, gold has attracted significant attention from investors seeking a safe haven amidst economic uncertainty and geopolitical tensions. Despite a brief pullback, the overall trend for gold remains upward, driven by a combination of weakening U.S. dollar, central bank purchases, and ongoing global instability.

The recent dip in gold prices, which saw a decline from $2,518 to $2,504, tested key support levels but was followed by a rebound. This suggests that gold’s upward momentum is still intact, with potential resistance levels now at $2,533, $2,550, and $2,575. However, caution is advised as technical indicators show the market is in overbought territory, and any significant recovery in the U.S. dollar or easing of geopolitical tensions could lead to profit-taking and a subsequent decline in gold prices.

Impact of U.S. Economic Data and Federal Reserve Policies

The direction of gold prices is heavily influenced by U.S. economic data and the Federal Reserve’s monetary policies. Recent statements from Federal Reserve Chairman Jerome Powell and other Fed officials have reinforced expectations of interest rate cuts in the near future. The Fed is likely to implement a 50 to 100 basis point cut by the end of the year, which would support higher gold prices by reducing the opportunity cost of holding non-yielding assets like gold.

Moreover, the U.S. Dollar Index (DXY), which had recently hit a 13-month low, has stabilized around 100.9, reflecting increased demand for safe-haven assets amidst rising geopolitical risks. This stabilization in the dollar, coupled with expectations of lower interest rates, has provided a supportive backdrop for gold, even as the dollar shows signs of potential recovery.

Geopolitical Tensions and Safe-Haven Demand

Geopolitical tensions, particularly in the Middle East, continue to play a crucial role in driving gold prices. The exchange of missile strikes between Israel and Hezbollah has heightened fears of a broader conflict that could involve major regional powers like Iran. Such developments typically boost demand for safe-haven assets, with gold being a primary beneficiary.

In addition, rising tensions between major global powers and ongoing conflicts in other regions are likely to sustain the demand for gold as a hedge against geopolitical risks. Central banks, particularly in emerging markets, have been increasing their gold reserves, further underpinning the precious metal’s long-term bullish outlook.

Technical Analysis: Key Levels to Watch

From a technical standpoint, gold has been trading within a well-defined range, with support near $2,484 and resistance around $2,550. The formation of a symmetrical triangle pattern on the gold chart suggests a potential breakout, with a target of $2,605 if the breakout occurs to the upside. However, the recent decline in gold prices, coupled with a rebound in the U.S. dollar, has introduced some downside risk, with support levels at $2,472 and $2,450 being critical to watch.

The four-hour gold chart also indicates a bearish triangle pattern, which could lead to a further decline towards the $2,440 level if the downward momentum continues. This scenario would be consistent with a $60-$70 price correction, as suggested by the pattern’s guideline. Despite this, the overall trend remains bullish, and any significant pullback could present a buying opportunity for long-term investors.

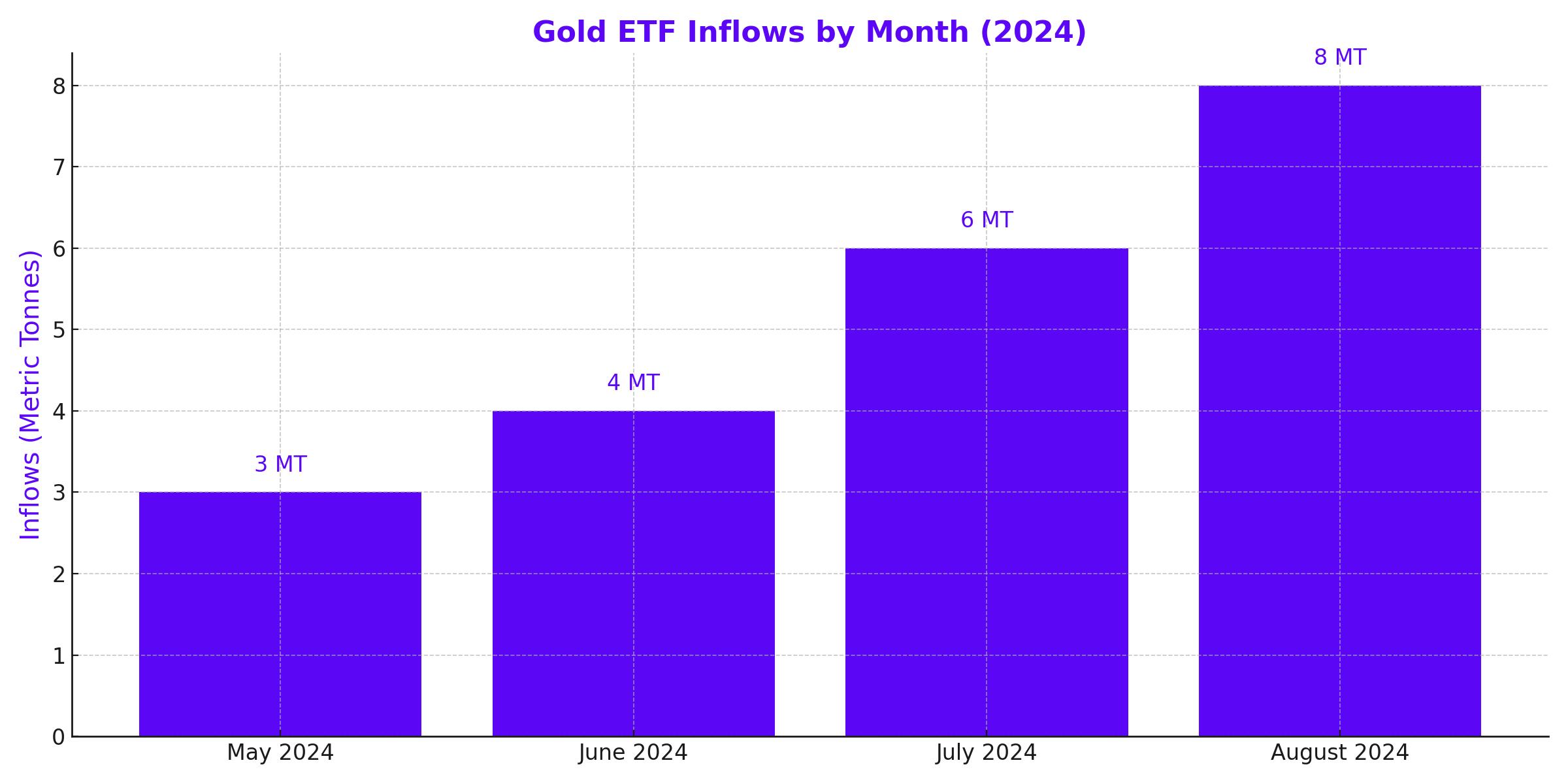

Gold ETFs and Investor Sentiment

Investor sentiment towards gold remains positive, as evidenced by continued inflows into gold exchange-traded funds (ETFs). August marked the fourth consecutive month of gains for gold ETFs, with inflows totaling around 8 metric tonnes, or approximately $403 million. This sustained interest in gold ETFs reflects broader market concerns about economic stability and the potential for further monetary easing by global central banks.

As markets await key economic data, including the upcoming Personal Consumption Expenditures (PCE) price index and jobless claims reports, the trajectory of gold prices could be influenced by any surprises in these indicators. A dovish stance from the Federal Reserve, combined with ongoing geopolitical risks, could lead to renewed buying pressure in gold, pushing prices higher.

Market Outlook and Strategic Considerations

Looking ahead, the path of least resistance for gold appears to be upward, with geopolitical tensions and central bank policies likely to play a significant role in shaping the market’s direction. Investors should remain vigilant, as the potential for volatility remains high. The key resistance levels of $2,533, $2,550, and $2,575 will be critical to watch, while support at $2,484 and $2,450 could provide buying opportunities if tested.

In conclusion, while the gold market faces potential headwinds from a recovering U.S. dollar and overbought technical conditions, the broader macroeconomic environment remains supportive of higher gold prices. With central banks continuing to purchase gold and geopolitical risks showing no signs of abating, the long-term outlook for gold remains bullish. Investors should consider maintaining or increasing their exposure to gold as part of a diversified portfolio, particularly in light of the ongoing economic and geopolitical uncertainties.