Gold Market: Economic Indicators and Geopolitical Tensions in Focus

A Deep Dive into Gold's Price Dynamics: From US Inflation Expectations to Middle East Tensions | That's TradingNEWS

The Dynamic Landscape of Gold Prices Amidst Economic Indicators and Geopolitical Tensions

Introduction to Recent Gold Market Movements

In recent trading sessions, the gold market has witnessed a notable decline, with prices edging lower to the vicinity of $2,020 per troy ounce. This movement underscores a broader trend of fluctuation influenced by a confluence of economic indicators and geopolitical developments. The downturn in gold prices is particularly noteworthy against the backdrop of a strengthening US Dollar and anticipations surrounding US inflation data.

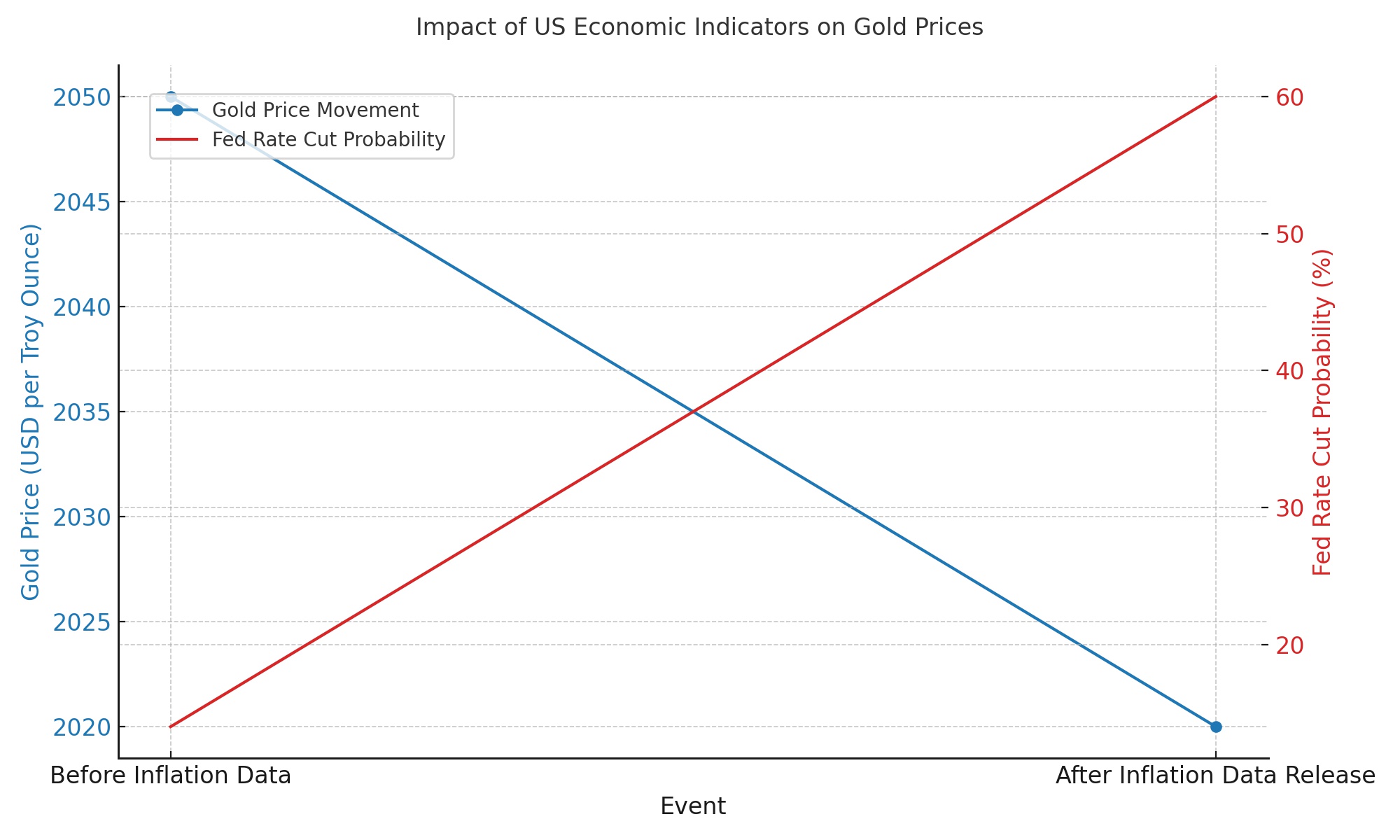

Understanding the Impact of US Economic Indicators

A pivotal factor in the current trajectory of gold prices is the market's anticipation of inflationary pressures within the United States. Expectations that the Federal Reserve may maintain interest rates in the near term have notably dampened the allure of gold, traditionally seen as a non-yield-bearing asset. Current market sentiment suggests a mere 14% probability of a rate cut by the Federal Reserve in March, with expectations for potential easing growing to around 60% by May.

Statements from Lorie K. Logan, President of the Dallas Federal Reserve Bank, have further cemented these expectations. Logan's acknowledgment of "significant progress" in combating inflation, coupled with a call for further evidence to ensure its sustainability, signals a cautious approach to monetary policy adjustments.

Geopolitical Tensions and Their Influence on Gold Prices

Geopolitical events have also played a critical role in shaping the gold market's dynamics. Recent missile attacks by Yemen's Houthi rebels and airstrikes in Gaza have escalated tensions in the Middle East, fostering a climate of uncertainty that typically boosts demand for safe-haven assets like gold. However, the strengthening US Dollar, buoyed by these geopolitical developments, has exerted additional downward pressure on gold prices.

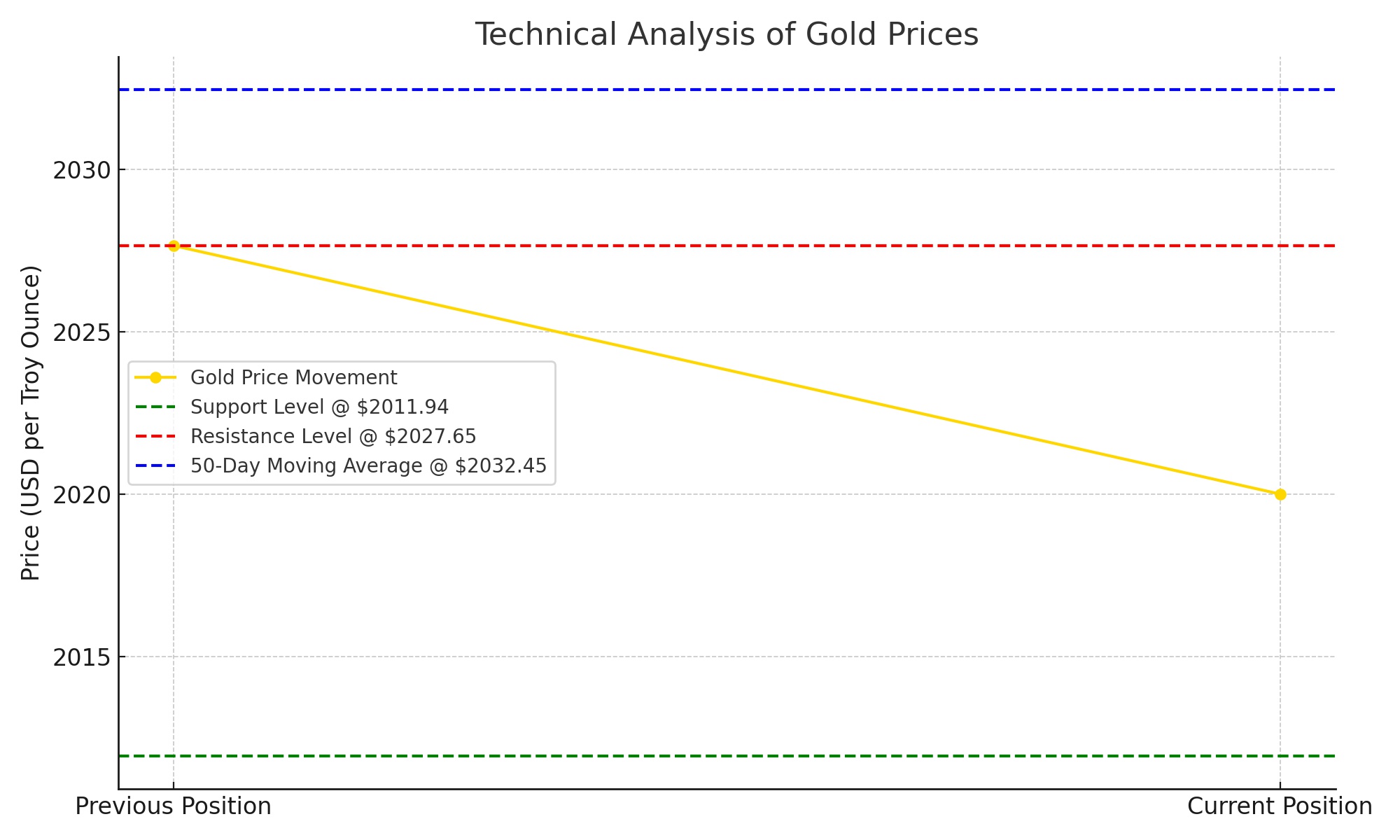

Technical Analysis: Key Levels and Trends

From a technical standpoint, gold prices have encountered resistance, struggling to breach the $2,027.65 high, with support found at the $2,011.94 low. The market's focus now turns to pivotal support and resistance levels that could dictate short-term movements. Notably, the 50-day moving average at $2,032.45 serves as a critical juncture, with sustained movements above or below this level likely to signal the market's future direction.

Short-term Prospects and CPI Report Implications

The upcoming US Consumer Price Index (CPI) report is eagerly awaited by investors, as it could significantly influence the Federal Reserve's interest rate decisions. A softer inflation reading may bolster gold's appeal, potentially reversing the recent downtrend. Conversely, higher-than-expected inflation figures could strengthen the dollar further, placing additional pressure on gold prices.

The Role of Market Sentiment and Technical Indicators

Market sentiment, as evidenced by the positioning of traders, suggests a bearish outlook for gold. The majority of traders remain net-long, indicating potential for further declines. Technical indicators, particularly the relationship between gold's price movements and moving averages, provide insights into the underlying momentum and potential reversal points.

Conclusion: Navigating the Complex Interplay of Factors Influencing Gold Prices

As we stand on the cusp of pivotal economic data releases and amidst ongoing geopolitical tensions, the gold market remains at a critical juncture. Investors and traders alike must carefully navigate the complex interplay of economic indicators, geopolitical developments, and technical levels to formulate their strategies. The upcoming period promises to be a litmus test for the resilience of gold's appeal as a safe-haven asset, with potential shifts in monetary policy and market sentiment poised to dictate the trajectory of this precious metal.

This analysis draws upon recent movements in gold prices, statements from Federal Reserve officials, and technical indicators to provide a comprehensive overview of the factors influencing the gold market. By examining these elements in detail, investors can gain insights into the potential future direction of gold prices and the impact of broader economic and geopolitical developments on this traditional safe haven.

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex