Current Market Trends

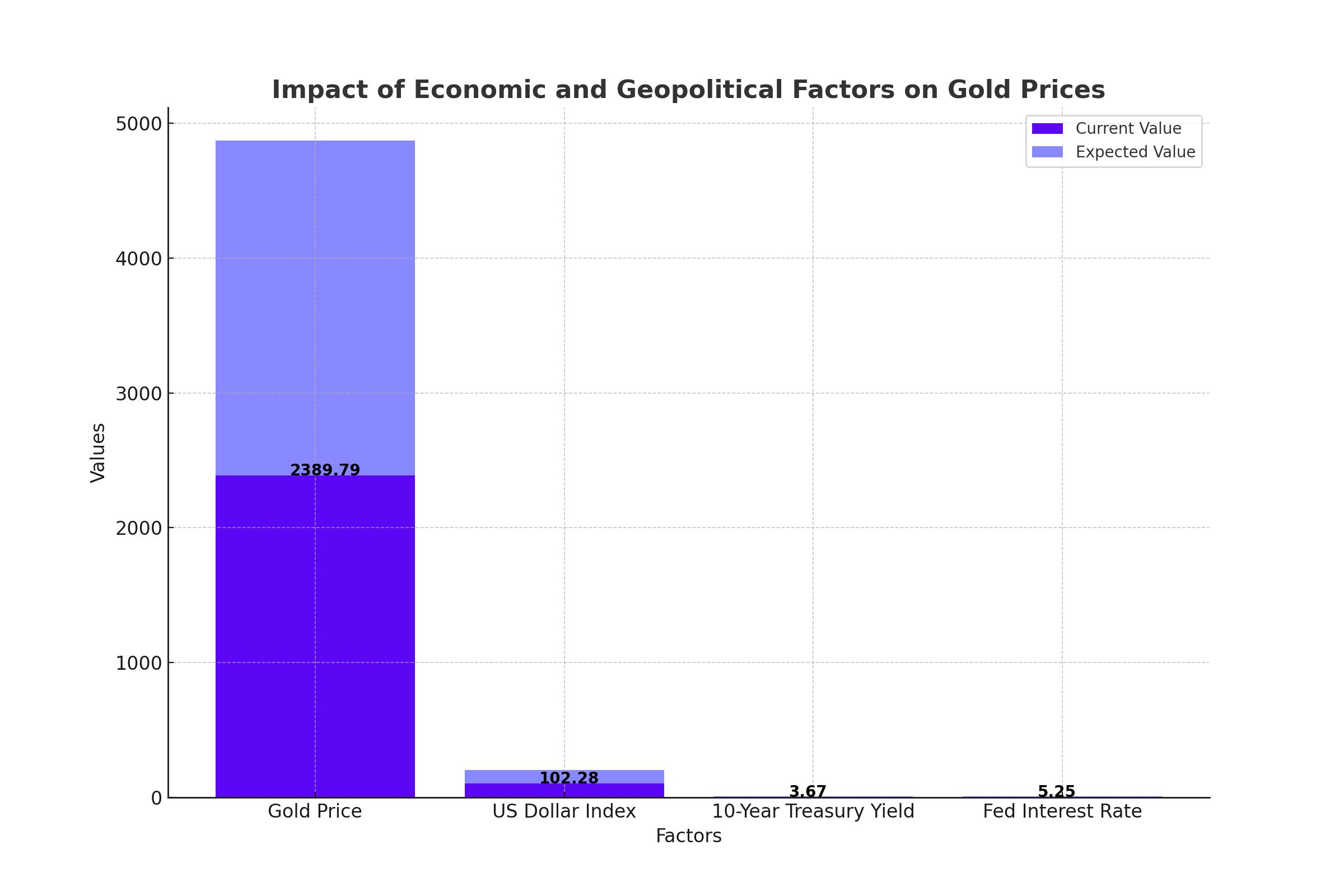

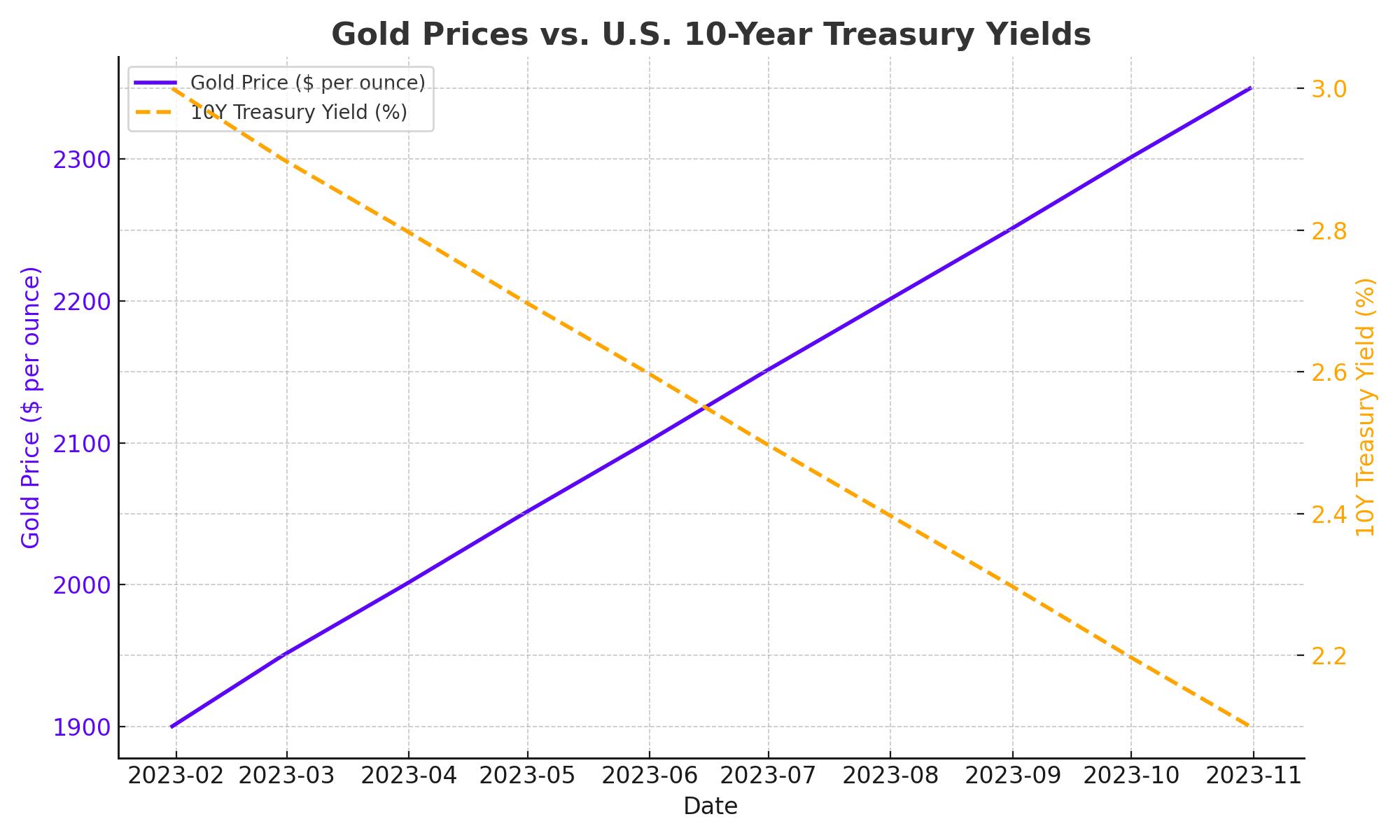

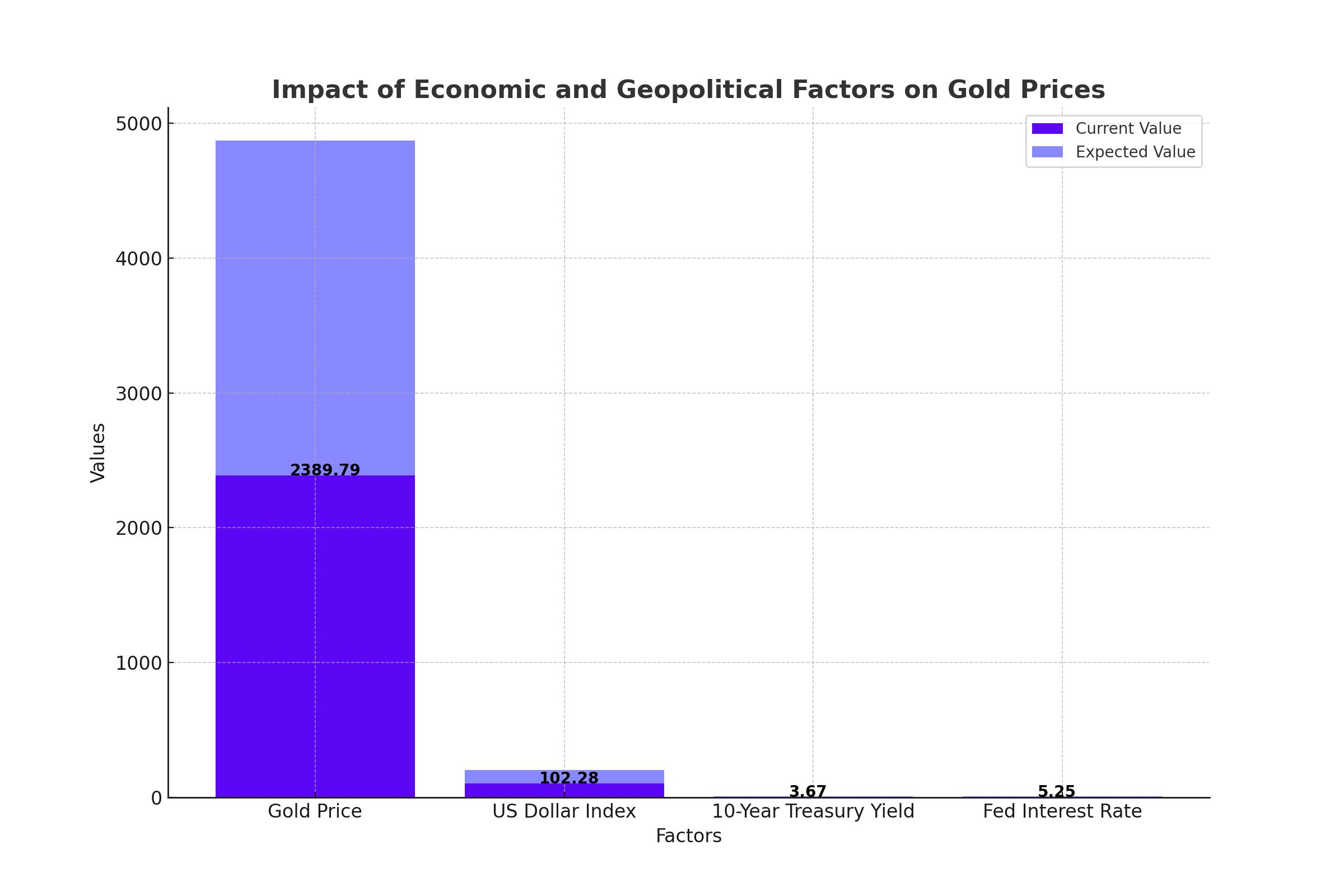

Gold (XAU/USD) prices have recently dipped below $2,400, driven by profit-booking but sustained by several supportive factors. The metal faced significant selling pressure, falling by more than 2% to trade at $2,389.79 per ounce, while U.S. gold futures dropped to $2,430.00. The decline follows an attempt to reclaim its all-time high of $2,480, highlighting market volatility. Despite this, the overall outlook for gold remains strong, supported by declining U.S. bond yields and geopolitical tensions.

U.S. Economic Indicators

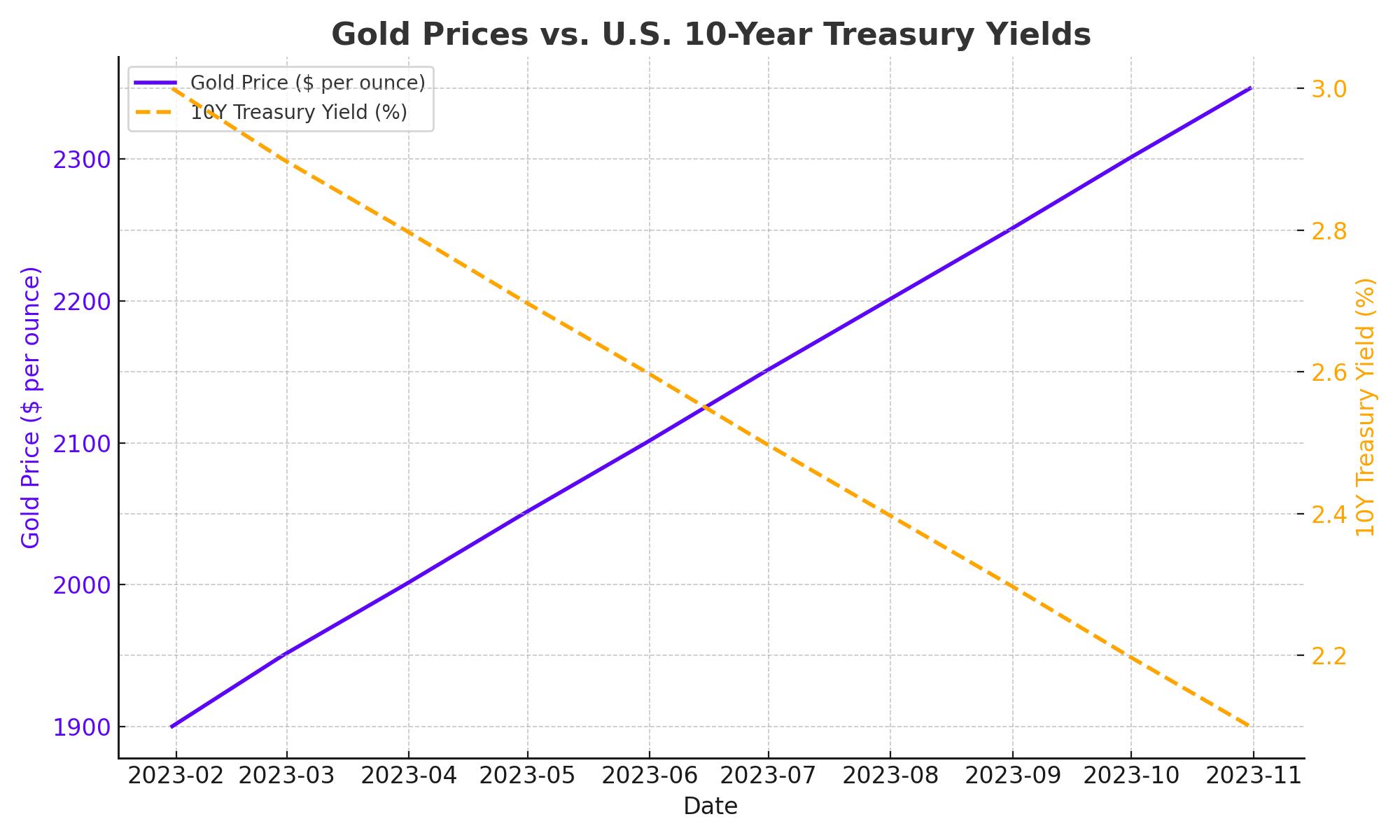

The U.S. economic landscape plays a crucial role in influencing gold prices. The July payrolls report showed a significant slowdown, with only 114,000 new jobs added, well below the expected 175,000, and the unemployment rate rising to 4.3%. This weak performance has exacerbated fears of a recession, driving investors to safer assets like gold. The U.S. Dollar Index (DXY) has fallen to its lowest level since March, now at 102.28, and 10-year Treasury yields have plunged to 3.67%, both of which are bullish signals for gold.

Federal Reserve's Monetary Policy

Expectations of aggressive interest rate cuts by the Federal Reserve have grown stronger. The CME FedWatch tool indicates a high probability of a 50-basis point cut in September, with more than 100 basis points in reductions expected by the end of the year. These expectations are fueled by deteriorating labor market conditions and a significant slowdown in the manufacturing sector, as evidenced by the ISM Manufacturing PMI, which contracted to 46.8 in July. The Fed's challenge is balancing inflation control with preventing a severe economic downturn, a scenario that generally supports higher gold prices.

Geopolitical Tensions

Geopolitical instability remains a significant driver of gold's appeal as a safe haven. The recent escalation in the Middle East, with Hezbollah launching missiles at Israel following the assassination of Hamas leader Ismail Haniyeh, has historically increased gold's attractiveness. While gold has traditionally benefited from such tensions, the current sell-off is more likely a result of profit-taking rather than a diminished safe-haven demand.

Global Economic Conditions

Global economic conditions further influence gold prices. China's economic slowdown is evident, with the Caixin Manufacturing PMI contracting to 49.8, signaling weak demand both domestically and internationally. Similarly, the Eurozone faces economic challenges, exacerbated by high-interest rates and slowing growth. These global factors reinforce gold's role as a hedge against economic uncertainty.

Technical Analysis

Technically, gold has been trading in a sideways pattern for over three months, with the 50-day Exponential Moving Average (EMA) near $2,370 providing strong support. The 14-day Relative Strength Index (RSI) oscillates within the 40.00-60.00 range, indicating market indecisiveness. A breakout above the all-time high of $2,483.75 could propel gold into new highs, while the upward-sloping trendline at $2,225 serves as a critical support level.

Market Sentiment and Future Outlook

Despite the recent dip, the long-term outlook for gold remains positive. Persistent geopolitical tensions, economic uncertainties, and anticipated monetary easing by the Federal Reserve suggest strong potential for gold price appreciation. Analysts predict that gold will regain its footing as the economic and political landscape evolves, making it an attractive investment for those seeking stability and growth.

Strategic Investment Decision

Given the current market conditions, gold presents a strategic buying opportunity. The metal's role as a hedge against economic and geopolitical uncertainties, combined with supportive monetary policies, indicates robust potential for price increases. Investors should consider adding gold to their portfolios to leverage its safe-haven appeal and long-term growth prospects.

In conclusion, while short-term fluctuations in gold prices are expected, the underlying factors supporting its value remain strong. As the U.S. economy faces challenges and global uncertainties persist, gold is well-positioned to continue its upward trajectory, making it a valuable asset for investors.

That's TradingNEWS