Gold Prices Rise - Weak US Dollar and Geopolitical Tensions

Economic Data, Fed Policy, and Global Events Shape Gold Market Dynamics | That's TradingNEWS

Gold Prices Rise Amid Weak US Dollar and Geopolitical Tensions

Gold Market Dynamics

Gold prices surged on Monday, rising nearly 1% to $2,354 per ounce amid thin trading due to holidays in the UK and the US. This increase followed a two-week low of $2,325. US Treasury yields dropped last week, weakening the dollar and providing a boost to the yellow metal. The current trading price of XAU/USD at $2,354 reflects a significant recovery.

Economic Data and Fed Policy Impact

Robust economic data from the US has dampened expectations for Federal Reserve monetary easing this year. Last week, gold prices tumbled more than 3% due to higher US Treasury yields and persistent inflation concerns. Federal Reserve officials acknowledged that reducing inflation to the 2% target might take longer than anticipated. UBS analysts forecast that gold prices will remain volatile but expect them to test new record highs later this year.

Key Economic Indicators and Market Movements

A sparse macroeconomic calendar this week will feature the release of April’s Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge. Estimates predict the core reading will be 2.8% year-over-year, with headline PCE edging up to 0.3% month-over-month. This data could significantly influence market sentiment and gold prices.

Gold Price Technical Analysis

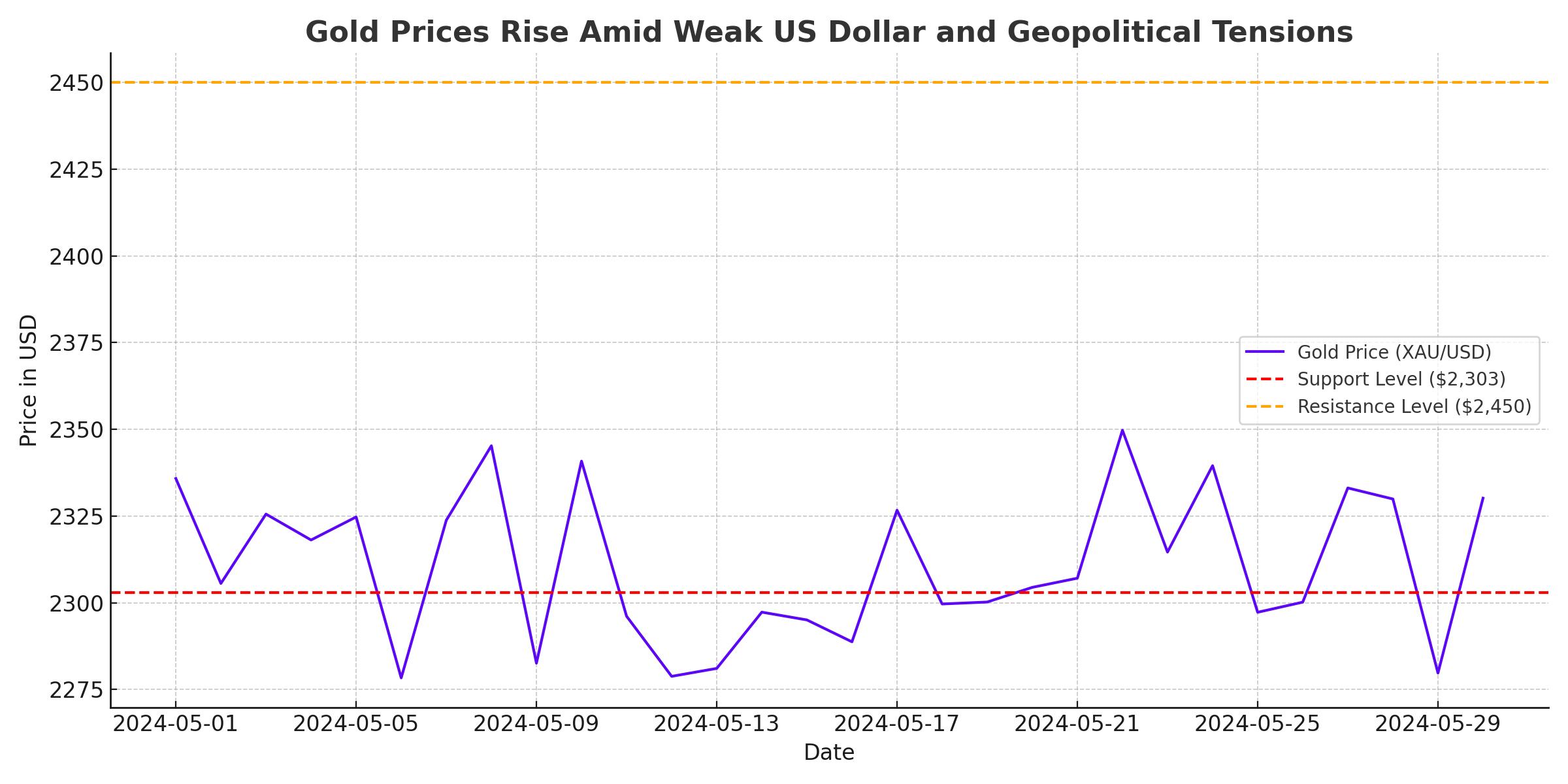

Despite recent setbacks, the gold price uptrend remains intact. The Relative Strength Index (RSI) has turned bullish, suggesting higher prices ahead. If XAU/USD clears $2,350, it could target the year-to-date high of $2,450, followed by the psychological $2,500 mark. On the downside, a drop below $2,350 could see prices fall to the May 8 low of $2,303, with further support at the May 3 low of $2,277.

Global Economic Events and Their Impact

The first quarter GDP growth for the US is expected to decline to 1.5% from the previous 3.4%. If this prediction holds, it might weaken the dollar, benefiting gold. Additionally, manufacturing data from China and the Eurozone could influence commodity prices, including oil and natural gas.

Oil Prices and OPEC+ Meeting

Oil prices remained stable following a significant weekly decline, with the market focusing on the upcoming OPEC+ meeting. OPEC+ is expected to extend supply cuts into the second half of the year to counteract high US output and support prices. Strong US demand ahead of the Memorial Day weekend and record flight activity are also expected to support oil prices.

Gold Market Sentiment and Future Outlook

Gold prices have rebounded after recent lows, driven by a weaker dollar and lower US Treasury yields. The upcoming PCE Price Index report will be crucial in shaping market expectations for future Fed rate cuts. Despite the recent sell-off, technical indicators suggest that gold could continue its upward trend, with significant resistance levels at $2,357 and $2,375.

Investor Sentiment and Predictions

Investors remain cautious but optimistic about gold’s future. The Federal Reserve’s latest minutes highlighted the uncertainty surrounding inflation control, affecting rate cut expectations. Traders currently see a 62% chance of a rate cut by November, according to the CME FedWatch tool. Analysts, including those from UBS, predict that gold prices will remain volatile but anticipate new record highs later this year.

Conclusion

Gold prices have shown resilience despite recent volatility, driven by economic data and Federal Reserve policies. The market's focus will be on upcoming inflation data and central bank actions, which will likely influence gold's trajectory. With strong technical indicators and ongoing geopolitical concerns, gold prices are expected to remain supported in the near term, offering potential buying opportunities for investors.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex