Gold Market Outlook Amid Economic and Political Uncertainties

Gold Prices and U.S. Election Impact

Gold prices are under significant scrutiny as the U.S. presidential election looms closer, with various scenarios likely to influence the precious metal's trajectory. Currently, gold (XAU) is trading just below the $2,500 mark, a critical level that has been maintained despite market volatility. Analysts anticipate that a Democratic victory may have a limited impact on gold, with prices expected to stabilize around $2,500 per ounce. However, a Republican victory could trigger more complex dynamics, potentially driving gold prices below $2,000 in the short term due to anticipated tariff implementations and a stronger U.S. dollar.

Economic Indicators and Gold’s Resilience

The resilience of gold prices above $2,500 per ounce has been notable, even as economic indicators such as the U.S. dollar index and interest rates exert pressure. For example, gold futures were recorded at $2,496.81 per ounce globally, reflecting a slight decrease from the previous highs but still within a critical support range. The market is closely watching upcoming data, including the U.S. Non-Farm Payroll (NFP) report, which could determine whether the Federal Reserve will proceed with an expected 25 basis point interest rate cut. This decision could either support gold prices or drive them lower if the cut fails to meet market expectations.

Fed Interest Rate Speculations and Gold’s Future

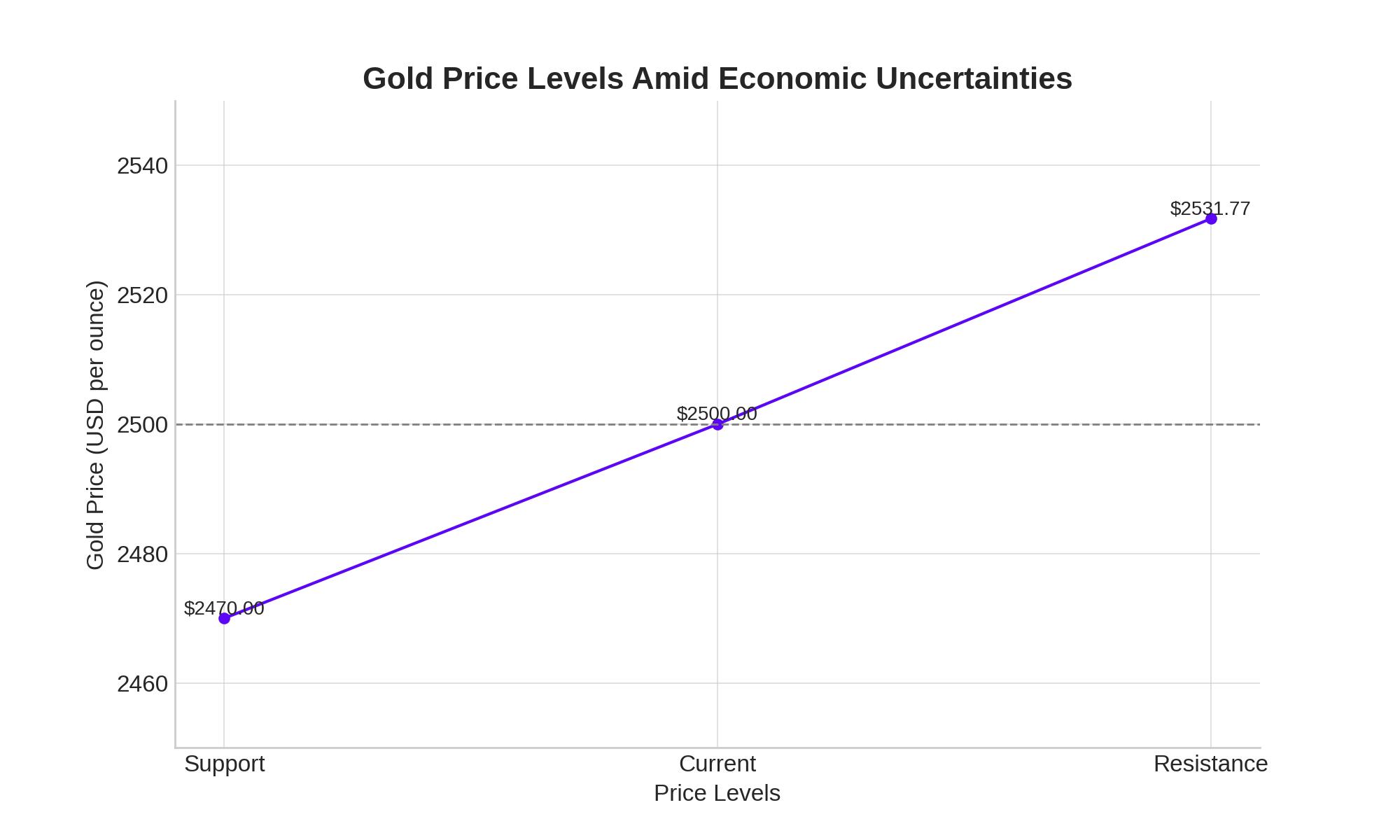

Speculation surrounding the Federal Reserve's next move on interest rates is creating a mixed environment for gold traders. The Fed is expected to cut rates by 25 basis points, which could bolster gold prices if the cut aligns with market expectations. However, any deviation, such as a more aggressive cut, could lead to a surge in the dollar, applying downward pressure on gold. Currently, gold is hovering between $2,531.77 and $2,470.85, reflecting uncertainty as traders await more definitive economic signals.

Global Factors Influencing Gold Prices

Global factors, including geopolitical tensions and central bank activities, are also playing a crucial role in gold's price dynamics. For instance, China's non-disclosure of its gold purchases since May adds an element of unpredictability to the market. Additionally, central bank buying is projected to reach 941 tonnes in 2024, which could further support gold's bullish outlook. In Europe, gold prices in Jordan remained stable despite global volatility, with 24-karat gold trading at 56.88 Jordanian dinars per gram, roughly USD 80.27.

Technical Analysis: Key Levels to Watch

From a technical perspective, gold remains within an ascending triangle pattern on the 4-hour chart, suggesting potential for an upside breakout. However, the price is currently below the 100-day Simple Moving Average (SMA), indicating cautious sentiment among traders. The key support level to watch is $2,470, with resistance at $2,531.77. A break above the resistance could lead to a retest of $2,600, while a drop below support might trigger a decline towards $2,400.

Market Sentiment and Future Projections

Overall, the sentiment in the gold market remains cautiously optimistic, with many investors holding positions in anticipation of favorable economic developments. The combination of expected rate cuts, geopolitical uncertainties, and strong central bank demand suggests that gold could continue to trade within its current range, with potential for a breakout if market conditions align. For investors, this environment presents both risks and opportunities, particularly as gold maintains its status as a safe-haven asset in times of economic uncertainty.

In conclusion, gold prices are likely to remain influenced by a complex interplay of economic data, political developments, and global market trends. Traders should keep a close eye on key support and resistance levels, as well as upcoming economic indicators, to navigate the ongoing volatility in the gold market.