Gold Prices Surge to Fresh Two-Week High Amid Fed's Policy Pivot

Gold Prices Hit Two-Week High

Gold price (XAU/USD) soared to a fresh two-week high at $2,462.30 during Thursday’s American session. The precious metal demonstrated significant strength as US bond yields plummeted on strong expectations that the Federal Reserve (Fed) will pivot towards policy normalization in September. Specifically, 10-year US Treasury yields dipped below 4.0% for the first time in six months. Lower yields on interest-bearing assets benefit non-yielding assets like gold, as they reduce the opportunity cost of holding such investments.

Fed's Dovish Guidance and Market Reaction

The Fed's dovish stance on interest rates further fueled the rally in gold prices. On Wednesday, the Fed left interest rates unchanged within the range of 5.25% to 5.50% and indicated cooling inflationary pressures and a softening labor market. This dovish guidance led to firm speculation that rate cuts could begin in September. Fed Chair Jerome Powell stated, "If we were to see inflation moving down more or less in line with expectations, growth remains reasonably strong, and the labor market remains consistent with current conditions, then I think a rate cut could be on the table at the September meeting."

Market Movers and Economic Data

In Thursday’s North American trading hours, gold prices climbed above $2,450. The near-term outlook for gold remains positive due to multiple tailwinds, including expectations of Fed rate cuts and rising geopolitical risks. The assassination of Hamas leader Ismail Haniyeh by an Israeli airstrike in Tehran has escalated tensions, with Iran vowing retaliation. This heightened geopolitical risk has bolstered gold's appeal as a safe-haven asset.

The US Dollar (USD) showed volatility due to weak preliminary Q2 Unit Labor Costs and the ISM Manufacturing PMI report for July. The US Dollar Index (DXY), which tracks the Greenback against six major currencies, faced pressure near 104.40 after recovering from an intraday low of 103.86. Q2 Unit Labor Costs fell to 0.9% from an estimated 1.8% and a prior revised figure of 3.8%. The ISM Manufacturing PMI dropped to 46.8, below the expected 48.8, indicating contraction in factory activities.

Upcoming Economic Indicators

Looking ahead, the US Nonfarm Payrolls (NFP) report, set to be published on Friday, is a key trigger for the FX market. Economists estimate that 175,000 new jobs were added in July, down from 206,000 in June. The Unemployment Rate is expected to remain steady at 4.1%. Investors will also focus on the Average Hourly Earnings data, a crucial indicator of wage growth influencing consumer spending and price pressures. Annually, wage growth is estimated to have decelerated to 3.7% from 3.9%, with the monthly figure growing by 0.3%.

Gold’s Technical Outlook

From a technical perspective, December gold futures are seeing robust support, with prices last reported up $17.10 at $2,490.10. September silver futures also showed gains, up $0.187 at $29.125. Gold's next upside target is a close above the contract high of $2,537.70, while key support is at $2,400.00. Silver faces resistance at $29.50 and then $30.00, with support at the July low of $27.45.

Comparative Performance of Precious Metals

As of 9 a.m. Eastern time today, gold was trading at $2,450.00 per ounce, up 1.18% from the previous day and 26.63% from a year ago. Silver was at $29.02 per ounce, platinum at $971.95, and palladium at $925.49. The strong performance of gold highlights its role as a hedge against inflation and a safe-haven asset during economic uncertainties.

Investment Strategies and Considerations

Gold is valued for its intrinsic worth and liquidity, making it a stable store of value during economic uncertainties. Investors have various options for investing in gold, including physical gold (bars and coins), gold ETFs, futures contracts, and gold funds. Each method has its advantages, with ETFs and funds offering easier rebalancing and liquidity.

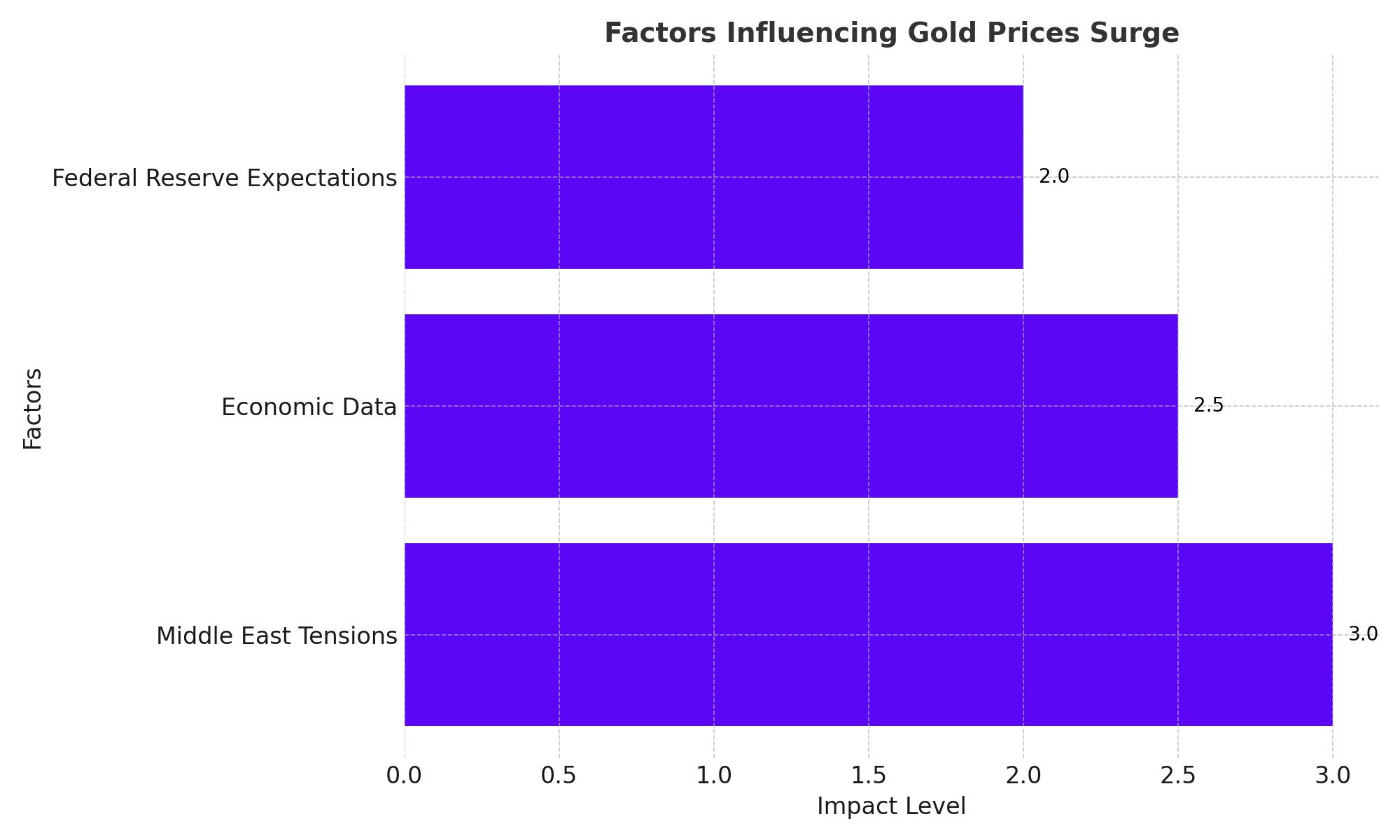

Conclusion

Gold's current bullish trend is propelled by several key factors. The Federal Reserve's dovish stance on interest rates, combined with a significant drop in US bond yields, has made non-yielding assets like gold more attractive. The 10-year US Treasury yield dipping below 4% for the first time in six months has particularly boosted gold's appeal. Additionally, escalating geopolitical tensions in the Middle East, such as Iran's vow to retaliate against Israel, have heightened demand for gold as a safe-haven asset. This combination of lower opportunity costs and increased geopolitical risk has pushed gold prices to a fresh two-week high of $2,462.30. With these drivers in play, gold's upward momentum is likely to continue, making it a key component for investors seeking stability and growth in uncertain times..

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex