Gold's Price Steady Value in Uncertain Times

Unraveling Gold's Stability Amid Fluctuating Monetary Policies and Rising Global Conflicts | That's TradingNEWS

Gold's Resilience Amid Economic Uncertainties and Geopolitical Tensions

Global Dynamics and Gold's Allure

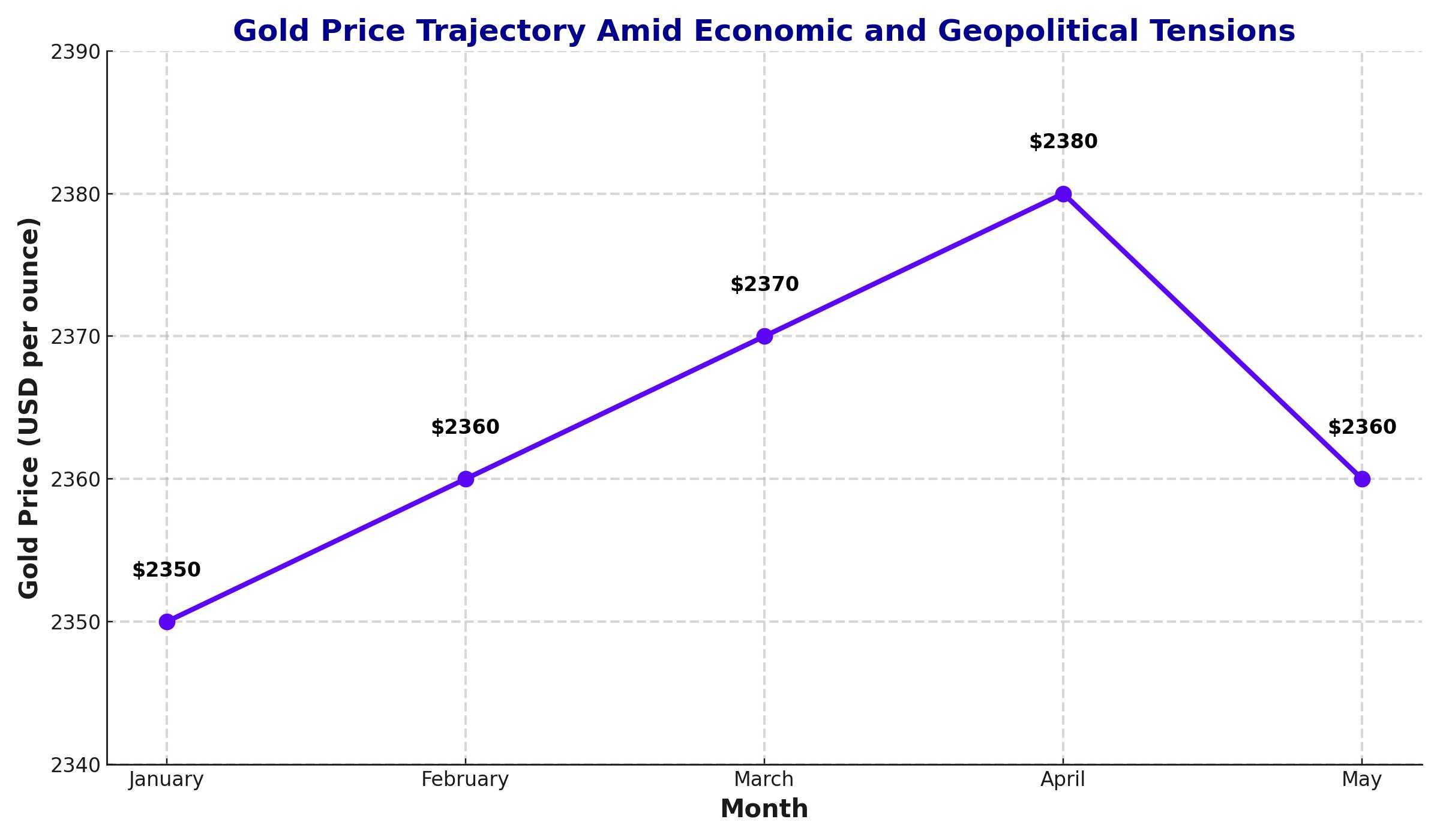

As we enter a new week, gold's resilience is more apparent than ever, with prices consistently above $2,360 per ounce. Despite a rebound in the U.S. Dollar driven by hawkish Federal Reserve signals, gold has maintained its luster, thanks largely to its status as a safe-haven asset amid escalating Middle East tensions and uncertain global economic forecasts.

Monetary Policies and Gold's Trajectory

Recent declarations from U.S. Federal Reserve officials have provided mixed signals, with some, like Atlanta Fed President Raphael Bostic, suggesting no rate cuts in 2024 due to persistent inflation concerns. Such statements typically would pressure gold prices; however, the precious metal's value has been buoyed by broader economic indicators suggesting a slowing economy, as evidenced by the rise in jobless claims to 231,000 and a stark drop in consumer sentiment to a six-month low of 67.4 in May.

Impending Economic Indicators

This week, significant attention is being paid to key economic reports such as the U.S. Consumer Price Index (CPI), Producer Price Index (PPI), and Retail Sales. These indicators are expected to shed light on the inflation trajectory and consumer spending, crucial factors that could influence the Federal Reserve's upcoming decisions and, consequently, gold's price movements.

Geopolitical Developments Enhancing Gold's Value

In addition to economic factors, geopolitical risks continue to elevate gold's appeal. The ongoing military engagements in Gaza, coupled with general geopolitical instability, have prompted investors to turn to gold as a hedge against potential market volatility. This dynamic is reflected in the robust performance of gold, which often thrives in times of uncertainty.

Technical Analysis and Market Sentiment

From a technical standpoint, gold is showing strong bullish signals. It is currently trading well above key moving averages, with the 100-day EMA providing solid support that underscores the metal’s upward momentum. Additionally, the breach of a descending trend channel suggests potential for further gains, with the next significant resistance poised at $2,400, beyond which lies the psychological $2,500 level.

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex