Intel Stock Price Forecast — INTC Shares Soar 100% to $39.99: Why It’s a Buy Now

NASDAQ:INTC surges to $39.99 with $13.65B in quarterly revenue, 124% net income growth, and a $190B market cap | That's TradingNEWS

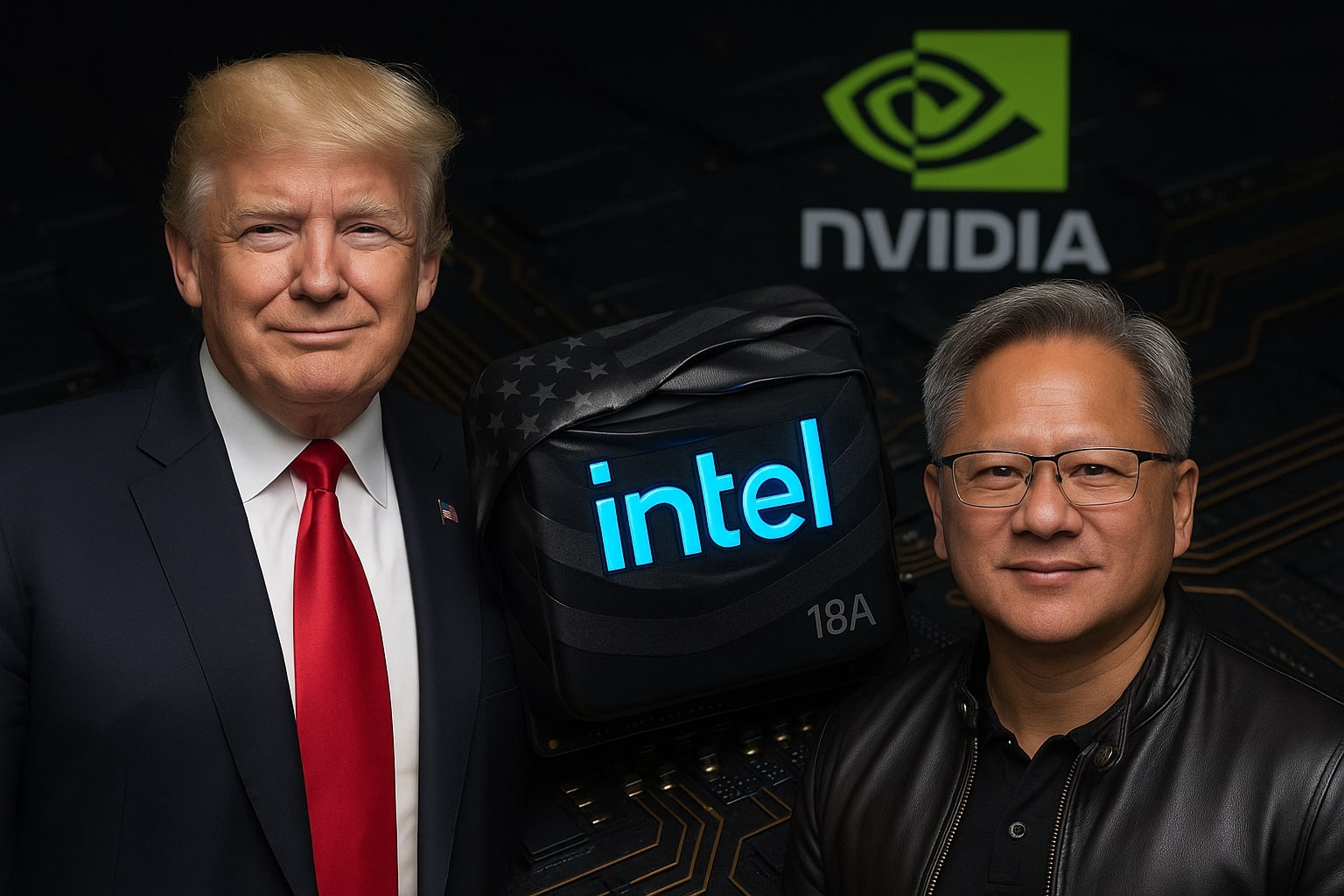

Intel Stock Price Forecast - INTC Surges 100% in 2025 as Nvidia and U.S. Government Stake Spark a Historic Turnaround

Intel Real-Time Chart — Intel Corporation trades at $39.99, slightly off its October 31 close of $40.16, after a year that has redefined its market standing. The company’s stock has soared more than 100% year-to-date, powered by a $5 billion investment from Nvidia, a strategic U.S. government stake worth nearly $8.9 billion, and a corporate restructuring that split off subsidiary Altera for $4.46 billion. Once dismissed as a fading semiconductor relic, Intel has regained relevance amid America’s push to secure domestic chip production, bringing its market capitalization back to nearly $190 billion and lifting its one-year trading range from $17.67 to $42.47.

Nvidia Partnership Injects $5 Billion and AI Momentum

The Nvidia-Intel alliance, announced in September, was a game-changer. Nvidia CEO Jensen Huang described it as “a fusion of two world-class platforms,” confirming a $5 billion equity investment at $23.28 per share, marking the largest single-day Intel stock gain in 38 years with a 23% spike. The deal allows Intel to supply custom CPUs for Nvidia’s AI data center infrastructure, while Nvidia integrates its GPUs into Intel’s PC systems. Though TSMC remains Nvidia’s main fabricator, this partnership grants Intel critical access to the booming AI chip segment and provides leverage in the U.S. government’s semiconductor reshoring strategy. Nvidia’s entry as a shareholder—alongside the federal government’s 9.9% ownership—cements Intel’s national importance as an “AI manufacturing anchor” within American borders.

Government Investment Anchors Intel as a National Semiconductor Champion

In August, the U.S. government finalized an $8.9 billion investment for a 9.9% equity stake in Intel, supporting its role in securing the American chip supply chain. The investment was drawn from previously authorized federal semiconductor grants, signaling a long-term partnership to rebuild domestic manufacturing capacity. The backing not only stabilized Intel’s balance sheet but also opened the door for massive factory expansions in Arizona, Ohio, and Oregon. The company’s cash reserves rose 28% to $30.94 billion, while total liabilities dropped slightly to $87.78 billion, underlining stronger liquidity ahead of its manufacturing ramp-up.

Financial Rebound: $13.65B Revenue and 124% Net Income Growth

Intel’s September 2025 quarter marked a crucial recovery milestone. The company generated $13.65 billion in revenue, up 2.78% year-over-year, while net income surged 124% to $4.06 billion, and EPS hit $0.23, up 150%. Operating expenses fell nearly 20% to $4.36 billion, signaling improved cost discipline under CEO Lip-Bu Tan, who assumed leadership earlier this year. Intel’s net profit margin climbed to 29.76%, one of its strongest since 2018, while EBITDA reached $3.87 billion, up 11.46%. Although the company’s cash from operations dropped 37% to $2.55 billion, its free cash flow surged 258% to $4.59 billion, reflecting successful restructuring and divestments.

Restructuring Strategy: Altera Spin-Off and Foundry Separation

Intel’s sale of a minority stake in Altera for $4.46 billion marked the start of a larger strategic shift. The company now operates two core entities: its legacy computing business (PCs and data centers) and its Intel Foundry Services (IFS) division, which manufactures chips for third parties. The legacy segment remains profitable, posting $12.6 billion in revenue and $3.7 billion in segment operating income, while the foundry business—generating $4.2 billion in sales—still runs at a $2.3 billion loss due to scaling costs. Analysts believe Intel may eventually split these units entirely, freeing the foundry from customer conflicts and accelerating growth in contract chip manufacturing.

Institutional Investors and Analyst Outlook

Institutional investors hold 64.53% of Intel shares, underscoring renewed confidence. iA Global Asset Management Inc., despite reducing its stake by 37.3% to 483,079 shares worth $10.82 million, remains one of many funds repositioning in anticipation of Intel’s foundry revival. Meanwhile, Y Intercept Hong Kong Ltd. expanded its holdings by 6,865% in Q2, acquiring over 1.15 million shares. On Wall Street, consensus sentiment is mixed: 1 Buy, 23 Hold, and 8 Sell ratings, with an average target price of $34.18. Benchmark recently upgraded Intel to “Buy,” lifting its target to $50, while Barclays raised its fair value to $35, citing “meaningful operational stabilization.”

CEO Lip-Bu Tan’s Vision: From Survival to Supercomputing Relevance

Under Lip-Bu Tan, formerly of Cadence Design Systems, Intel has shifted from survival mode to a proactive innovation cycle. Tan’s leadership has refocused the company on high-performance computing, AI acceleration, and foundry partnerships that challenge Taiwan Semiconductor’s dominance. His approach blends design expertise with capital discipline, targeting U.S. onshore capacity as a strategic differentiator in the AI age. Tan’s cost control efforts reduced Intel’s operating expenses by nearly $1 billion and revived its return on capital to 1.34%, the first positive print since 2022.

Valuation and P/E Distortion: A Misleading 3,769 Ratio

Intel’s reported P/E ratio of 3,769.09 misrepresents its real valuation due to one-time adjustments and deferred tax impacts. Excluding foundry losses and restructuring charges, Intel trades closer to 15× adjusted earnings, making it undervalued relative to peers like AMD (NASDAQ:AMD) at 35× and Nvidia (NASDAQ:NVDA) at 40× forward earnings. The stock’s price-to-book ratio of 1.8 also underscores fair value for a capital-heavy firm in transition.

Foundry Business Remains Intel’s Biggest Risk and Opportunity

Intel’s foundry arm, though currently unprofitable, holds the key to long-term growth. Losses of $2.3 billion in Q3 reflect early-stage scaling costs, yet government subsidies and Nvidia’s manufacturing demand could narrow deficits in 2026. Analysts project that by 2028, the foundry could generate $25–30 billion in revenue, rivaling TSMC’s early growth stages if Intel successfully separates its chip design division.

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex

Trading Action and Technical View

At $39.99, NASDAQ:INTC trades slightly below its 52-week high of $42.47, with strong support near $38.50 and resistance around $41.25. The stock’s average volume of 139.7 million shares shows strong retail and institutional interest. Technically, the 50-day moving average sits at $32.01, and the 200-day at $25.09, both showing bullish slope alignment. A breakout above $42.50 could target $46–$48 in the next leg, driven by institutional reaccumulation.

Cash Flow and Capital Allocation

Intel’s net change in cash of $1.45 billion (+157%) and cash from financing up 235% highlight effective capital restructuring. While cash from investing fell 126% due to foundry expansion, Intel’s liquidity buffer—now $30.94 billion in short-term assets—ensures it can sustain multiyear capex projects without additional dilution. The company’s debt-to-equity ratio of 0.38 remains conservative relative to industry averages, providing flexibility for further U.S.-based capacity growth.

Verdict: Intel’s Reindustrialization Era Signals a Buy for Strategic Investors

After years of decline, Intel (NASDAQ:INTC) has reasserted itself as America’s semiconductor cornerstone. The combined effects of the $5 billion Nvidia stake, U.S. government ownership, rising net income (+124%), and free cash flow up 259% confirm a turnaround with structural support. While foundry losses pose short-term drag, the company’s balance sheet and strategic partnerships suggest a durable recovery trajectory.

Decision: BUY — Target Range $46–$50 (12-Month), Long-Term Potential $60+ as AI Manufacturing Expands and Foundry Scaling Matures.