NVIDIA (NASDAQ:NVDA): Undervalued Stock With $144 Today, a Future AI Powerhouse!

With Insider Buys and Explosive AI Demand, NVIDIA is Poised to Shatter Expectations! | That's TradingNEWS

NVIDIA Corporation (NASDAQ:NVDA): Dominance, Growth, and Undervaluation

NVIDIA Corporation (NASDAQ:NVDA) continues to showcase unparalleled leadership in the tech industry, dominating sectors such as artificial intelligence (AI), accelerated computing, and data center technologies. With record-breaking financials in Q3 FY 2025, the company demonstrates its capacity to expand its market share and maintain strong margins while addressing growing global demand for AI infrastructure. Despite its meteoric rise in valuation and share price, NVIDIA’s growth prospects suggest that the stock remains undervalued, presenting a compelling opportunity for investors.

Exceptional Q3 FY 2025 Performance and Financial Growth

NVIDIA's Q3 FY 2025 earnings exceeded market expectations, delivering total revenue of $35.08 billion, reflecting a staggering 94% year-over-year growth. The Data Center segment emerged as the primary driver, contributing $30.8 billion, a 112% YoY increase. Gaming revenues also rose significantly, reaching $3.3 billion, while the Automotive segment grew by 72% YoY to $449 million, showcasing the company's diversified revenue streams.

Profitability reached extraordinary levels, with gross margins at 74.6% and operating margins at 62.34%. Net income soared by 109% YoY to $19.309 billion, supported by NVIDIA's effective cost management and rapid adoption of its next-generation GPU, Blackwell. Free cash flow hit $56.55 billion TTM, further underscoring its robust financial position.

The Role of Blackwell GPUs in Driving Demand

NVIDIA's Blackwell GPUs have solidified the company's dominance in the AI chip market. Blackwell offers a 4x cost reduction compared to its predecessor, H100, enhancing the efficiency and scalability of AI infrastructure. CFO Colette Kress highlighted the staggering demand for Blackwell chips, which has exceeded supply, with production ramping to meet customer needs through FY 2026.

CEO Jensen Huang emphasized the transformative impact of Blackwell on AI scalability, citing its advanced capabilities in pretraining and inference scaling. With the increasing need for physical AI and generative AI applications, NVIDIA remains at the forefront of innovation, securing a competitive edge that competitors, including AMD and Intel, struggle to match.

NVIDIA's Expanding Addressable Market

NVIDIA's total addressable market (TAM) is estimated at $2.4 trillion, spanning AI, cloud services, and semiconductors. Despite its dominance, the company holds only a 4.7% market share, leaving ample room for growth. With the AI market projected to grow at a 38% CAGR from $214 billion in 2024 to $1.4 trillion by 2030, NVIDIA is well-positioned to capture significant opportunities.

Partnerships with leading technology firms like Meta Platforms, which invested $100 billion in NVIDIA GPUs, and T-Mobile, leveraging NVIDIA's AI Aerial platform, exemplify the company's ability to integrate its technology across various industries, further expanding its TAM.

Financial Health and Shareholder Returns

NVIDIA boasts a strong balance sheet, with $38.49 billion in cash and short-term investments and a low debt-to-equity ratio of 0.16. In Q3 FY 2025, the company returned $11.2 billion to shareholders through buybacks and dividends, reflecting its commitment to enhancing shareholder value.

Research and development (R&D) investments also reached $3.4 billion, a 48% YoY increase, underscoring NVIDIA's dedication to innovation. This strategic focus ensures the company maintains its technological leadership in the face of rising competition.

Competitive Landscape and Risks

While NVIDIA holds an 80% market share in AI hardware, competition remains a potential threat. AMD, with only 10% market share, aims to increase its presence, but NVIDIA's full-stack solutions and established ecosystem make it difficult for competitors to erode its dominance. The company's CUDA platform, NVLink networking, and comprehensive AI software suite create high switching costs for customers, securing its market position.

Potential risks include geopolitical tensions, particularly tariffs on Taiwan-manufactured chips, and customer concentration risks, as a significant portion of revenue comes from major tech companies. Despite these challenges, NVIDIA's proactive measures, such as exploring alternative manufacturing sites, mitigate long-term risks.

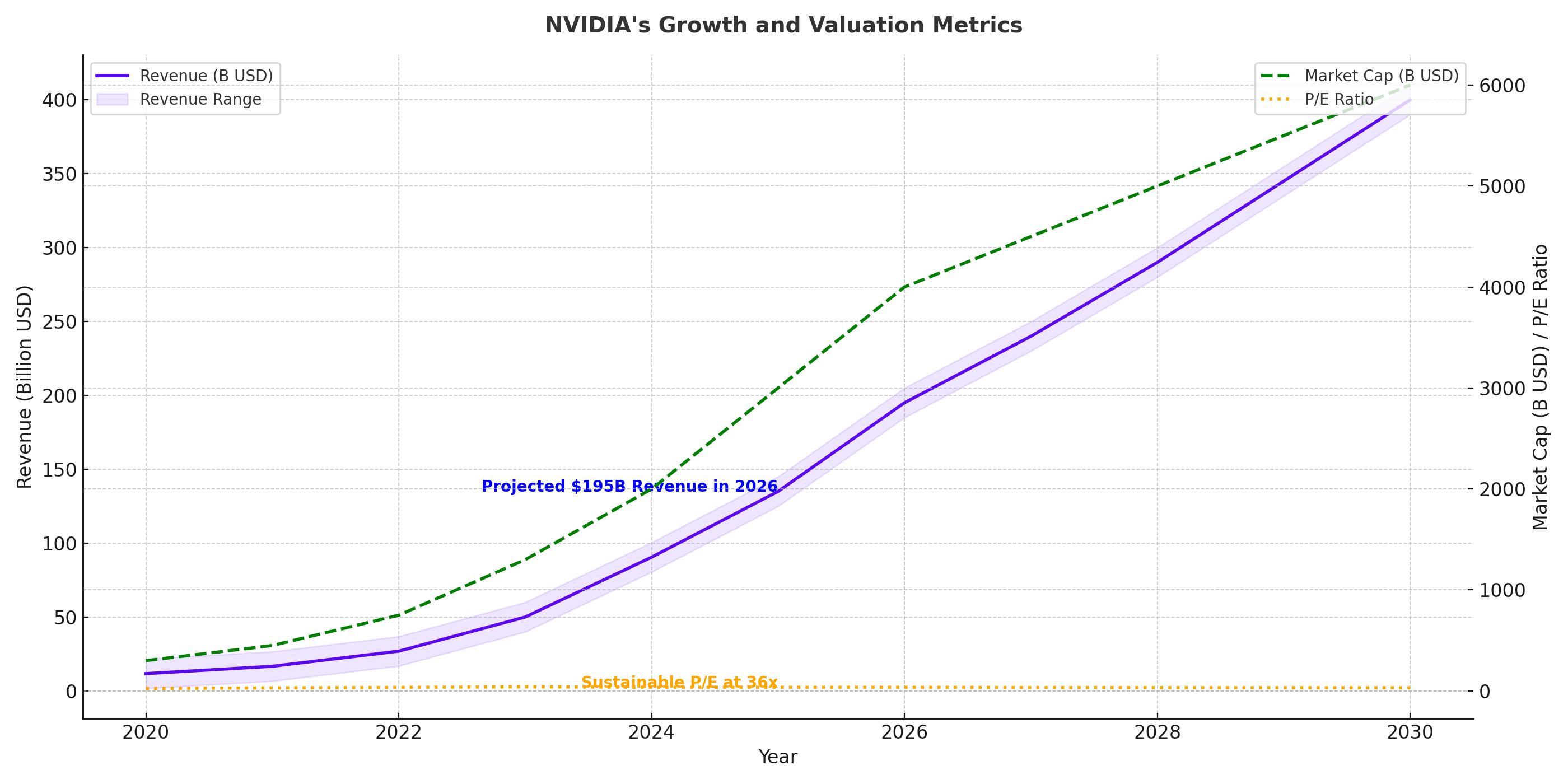

Valuation and Growth Prospects

NVIDIA trades at a forward P/E ratio of 36x, slightly above its historical average but justified by its extraordinary growth trajectory. Analysts project a 50% revenue increase in FY 2026, reaching $195 billion, with EPS growth of 89% over the next two years. A reverse DCF analysis reveals that NVIDIA could sustain annual revenue growth of 20% while maintaining aggressive FCF margins of 40-50%, supporting its current valuation.

Comparing NVIDIA's valuation to peers like Apple and Microsoft, its forward P/E is reasonable given its higher growth rate and profitability. The potential to achieve $5 trillion in market capitalization by 2030 further underscores its long-term investment appeal.

Final Assessment: NVIDIA is Undervalued and Poised for Long-Term Growth

NVIDIA Corporation (NASDAQ:NVDA) isn’t just a strong buy—it’s a market leader poised to redefine the tech landscape. With its dominance in AI hardware, robust financials, and groundbreaking products like the Blackwell GPU, NVIDIA continues to outperform expectations while maintaining high profitability margins. The company's undervalued stock, considering its projected EPS growth of 89% over the next two years, presents a compelling investment case. The recent insider purchases further solidify confidence in NVIDIA's trajectory, indicating a substantial runway for future growth.

For growth-focused investors, NVIDIA offers more than just exposure to the AI revolution; it provides a stake in a company that is actively shaping the future of technology. Don’t miss out—track its real-time performance at NVIDIA Stock Chart and secure your position in one of the most transformative tech companies of our time.

That's TradingNEWS

Read More

-

GPIX ETF At $52.52: 8% Yield And Dynamic S&P 500 Income Upside

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Surge Toward $1B As XRPI Hits $11.64 And XRPR $16.48 With XRP Near $2

13.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovers Near $4.07 Support After 22% Weekly Slide

13.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen at 154–158 Range as BoJ 0.75% Hike and Fed Cut Debate

13.12.2025 · TradingNEWS ArchiveForex