Nvidia Stock Price Forecast - Can NVDA Turn Its AI Rack Dominance Into a Run Toward $275?

With $51B quarterly data-center revenue, 50%+ market share, rich 64–65% EBITDA margins and limited H200 China upside in the base case, NVDA still screens as a core AI Buy with 50%+ re-rating potential | That's TradingNEWS

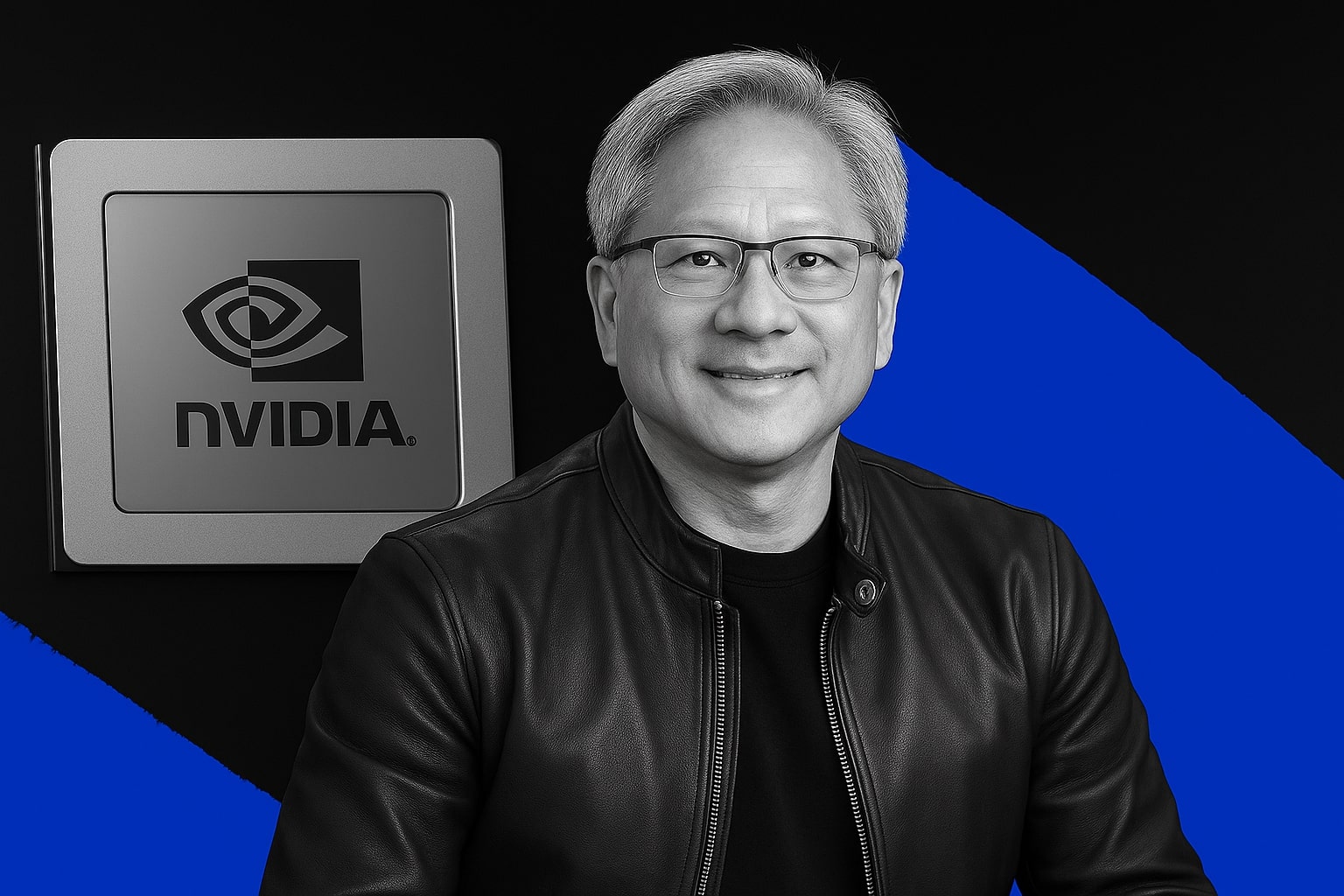

NVIDIA’s AI Engine: Is NASDAQ:NVDA Still a Buy at $177.91?

Data Center Dominance: 50%+ Market Share And $51 Billion in One Quarter

At $177.91, NASDAQ:NVDA is pricing in leadership, not dreams. In fiscal 2026 Q3, NVIDIA’s Data Center segment delivered over $51 billion in revenue, a 66% year-on-year jump, with roughly $10 billion of incremental revenue added in a single quarter. That quarterly delta alone is larger than AMD’s entire revenue for the same period. As a result, NVIDIA’s share of the overall data center software and equipment market moved above 50% for the first time, gaining about 5 percentage points of share in one shot. This step-up wasn’t driven by a few extra GPUs; it came from selling full AI racks and platforms instead of isolated chips. The ramp in demand has been strong enough that the limiting factor is now TSMC wafer capacity and networking hardware, not appetite from hyperscalers or sovereign buyers. That is why the revenue trend since fiscal 2024 Q2 has looked like a straight line higher rather than a cycle top.

Rack-Scale AI And NVLink: Why Scale-Up Keeps NVIDIA Ahead

The core edge of NASDAQ:NVDA now sits at rack scale, not at the individual GPU level. Modern training and inference workloads for large language models require thousands of GPUs acting as one logical engine. NVIDIA’s NVL72 rack – with 72 Blackwell GPUs – is wired with fifth-generation NVLink Switch fabric that delivers around 1,800 GB/s between any two GPUs in the system. That design makes the entire rack behave like a single, massive accelerator. The real moat is that performance scaling holds up as more racks are linked. In real deployments, using multiple NVL72 racks, NVIDIA systems typically achieve 60–70% of ideal scaling, which is extremely high at those sizes. By contrast, competing accelerators are still operating at much smaller practical scales. Benchmarks show NVIDIA configurations ranging from small 8-GPU systems up to 5,120 Blackwell GPUs, while AMD’s largest tested clusters in comparable public training tests sit around 16 GPUs. The UA Link consortium is trying to close that gap, but they are still working toward their first fully competitive scale-up switch while NVIDIA is already on NVLink generation five and preparing generation six. That time advantage at rack scale is exactly what sustains NVIDIA’s pricing power.

Growth Pipeline: $1.52 Trillion Data Center Revenue And 64–65% EBITDA Margins

Forward projections for NASDAQ:NVDA are aggressive and still look conservative relative to what the platform is already delivering. A five-year modeling window from fiscal 2026 to fiscal 2030 implies cumulative Data Center revenue of roughly $1.522 trillion, with annual Data Center revenue climbing toward about $374 billion by fiscal 2030. Under those assumptions, the broader data center software and equipment market sits in a more realistic $600–800 billion per year range instead of the “trillions” that get thrown around in promotional AI narratives. On profitability, the same framework supports EBITDA margins around 64–65%, a sales CAGR near 37.7%, and free cash flow growth around 43.8% annually. Feeding those numbers into a discounted cash-flow model yields a fair value in the $241–$258 band per share, which is roughly 35–45% above the current $177.91 quote. When longer-dated estimates for 2027–2028 are pulled in and blended EV/EBITDA multiples are used, fair value estimates cluster around $276.50 for the medium term and stretch into the $355–$487 range under full execution, implying 50–100% upside from today’s level.

Risk-Adjusted Profile: Why NASDAQ:NVDA Screens as the Core AI Exposure

When the returns of NASDAQ:NVDA are regressed over about a decade against sector risk, macro rates, and company-specific revenue growth, the stock behaves like a premium compounder rather than a pure momentum trade. The ordinary least squares model produces an R² of roughly 0.72, meaning around 72% of the monthly return variance can be explained by the chosen drivers. The intercept sits near 0.018, versus around 0.009 for AMD, which translates into approximately 24% annualized excess return for NVIDIA versus about 11% for AMD once sector and macro factors are stripped out. Revenue elasticity in the model is about 0.28 for NVIDIA, so every 10% upside surprise in revenue has historically driven roughly a 2.8% move in the stock, compared with about 1.9% for AMD. On sensitivity to the semiconductor sector index, NVIDIA’s beta comes out close to 1.42, while AMD’s is around 1.68, meaning AMD amplifies sector drawdowns more sharply. On interest-rate risk, the coefficient versus the 10-year Treasury yield is about –0.45 for NVIDIA and roughly –0.65 for AMD, so rising yields hit AMD harder. The real-world result was visible in 2022: AMD slid by roughly 55%, NVIDIA by about 50%, while the broader semiconductor index dropped near 35%. Over a longer arc, the total return gap is decisive: NVIDIA’s cumulative return sits around 21,682%, versus roughly 8,503% for AMD. Paying a richer ~22.99x price-to-sales multiple for NVIDIA versus about 10.75x for AMD is therefore not random overvaluation; it reflects materially stronger alpha and more stable risk-adjusted performance.

China, H200 And The 25% Revenue Share: Optional Upside, Not Core Fuel

The recent headlines around H200 exports to China sound dramatic but do not drive the base case for NASDAQ:NVDA. Before US restrictions tightened, NVIDIA shipped around $4.6 billion of H20 chips into China and had roughly $2.5 billion per quarter of additional demand that it could not serve once exports were halted, a notional $7.1 billion quarterly opportunity. Under the current US framework, approved shipments of H200 or H20 variants to China carry a 25% revenue share back to the US government, which would have meant close to $1.8 billion in a single quarter if the old volume had continued. On paper, the green light for H200 looks like a major win. In practice, Beijing has not softened its own stance. Chinese authorities have warned domestic firms away from NVIDIA and AMD where local solutions from Huawei or Alibaba exist, and any firm wanting US chips must justify why domestic accelerators are insufficient. That political filter sharply caps realistic H200 volume. NVIDIA itself has told investors that its guidance and consensus numbers do not assume material data center sales to China, and analyst estimate revisions since the policy news have been marginal. The rational approach is simple: assume zero China contribution, treat any licensed H200 shipments as a bonus, and value the stock on the rest of the world. Strategically, the real benefit of H200 approval is that it keeps the door open for a future China-specific Blackwell product if geopolitics thaw, but that is a multi-year option, not something that belongs in today’s price.

Competition: AMD, Custom ASICs And TPUs Versus NVIDIA’s Full-Stack Platform

The competitive field around NASDAQ:NVDA is loud, but the numbers show a clear hierarchy. AMD is growing, with trailing revenue around $32 billion and 31.82% growth, and its data center segment posting about 22% year-on-year gains in a recent quarter. However, that is still dwarfed by NVIDIA’s 114.2% revenue growth to $130.5 billion and the Data Center jump to $51 billion in one quarter. AMD’s higher beta to the sector and to interest rates makes it attractive for investors comfortable with sharp drawdowns and upside convexity but less suitable as the main AI anchor position. Custom accelerators and TPUs remain important at specific hyperscalers, but they do not yet provide the same flexibility. NVIDIA’s management correctly frames the advantage as a programmable platform rather than a single generation of silicon. CUDA, its software stack, the networking layer, and its system reference designs are all tuned to handle today’s transformer-heavy workloads and tomorrow’s models without having to rip out infrastructure. Even where raw FLOPs on paper look comparable, TPU-style solutions are heavily optimized for narrow classes of model architectures. That makes it harder to convince third-party cloud providers to standardize around TPUs instead of NASDAQ:NVDA hardware that already anchors most of their existing AI fleets. Combined with the scale-up moat at the rack level, that platform effect is what protects NVIDIA’s margins even as new entrants show up.

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex

Valuation, Targets And Verdict For NASDAQ:NVDA At $177.91

At $177.91, with a P/E around 44.06, dividend yield near 0.02%, market cap around $4.30 trillion, and a 52-week range of $86.63 to $212.19, the question is not whether NASDAQ:NVDA is cheap on traditional metrics but whether the current price fully discounts its AI dominance and cash flow trajectory. Discounted cash-flow work that assumes slowing but still strong Data Center growth, EBITDA margins around 64–65%, and free cash flow compounding near 43–44% annually points to fair value in the $241–$276 zone based on the next few years of earnings, with outer targets in the $350–$480 band if the 2028–2030 ramp plays out as projected. Those levels imply 50%+ upside on a medium-term horizon even after a massive multi-year run. Layer on top of that the structural advantages in rack-scale AI systems, the persistent software lock-in, better risk-adjusted return statistics versus AMD, and the fact that China is essentially not in the base case, and the conclusion is straightforward. On the data you have, NASDAQ:NVDA is a Buy with a bullish bias, and it still deserves to be treated as the core AI semiconductor exposure in a long-term portfolio rather than a trade you fade just because the headline market cap is large.