Oil Market Dynamics: June Volatility and Anticipating July Prospects

Analyzing the Impact of Economic Factors, OPEC Strategies, Geopolitical Tensions, and Seasonal Demand on Oil Prices | That's TradingNEWS

Oil Market Dynamics: June Volatility and July Prospects

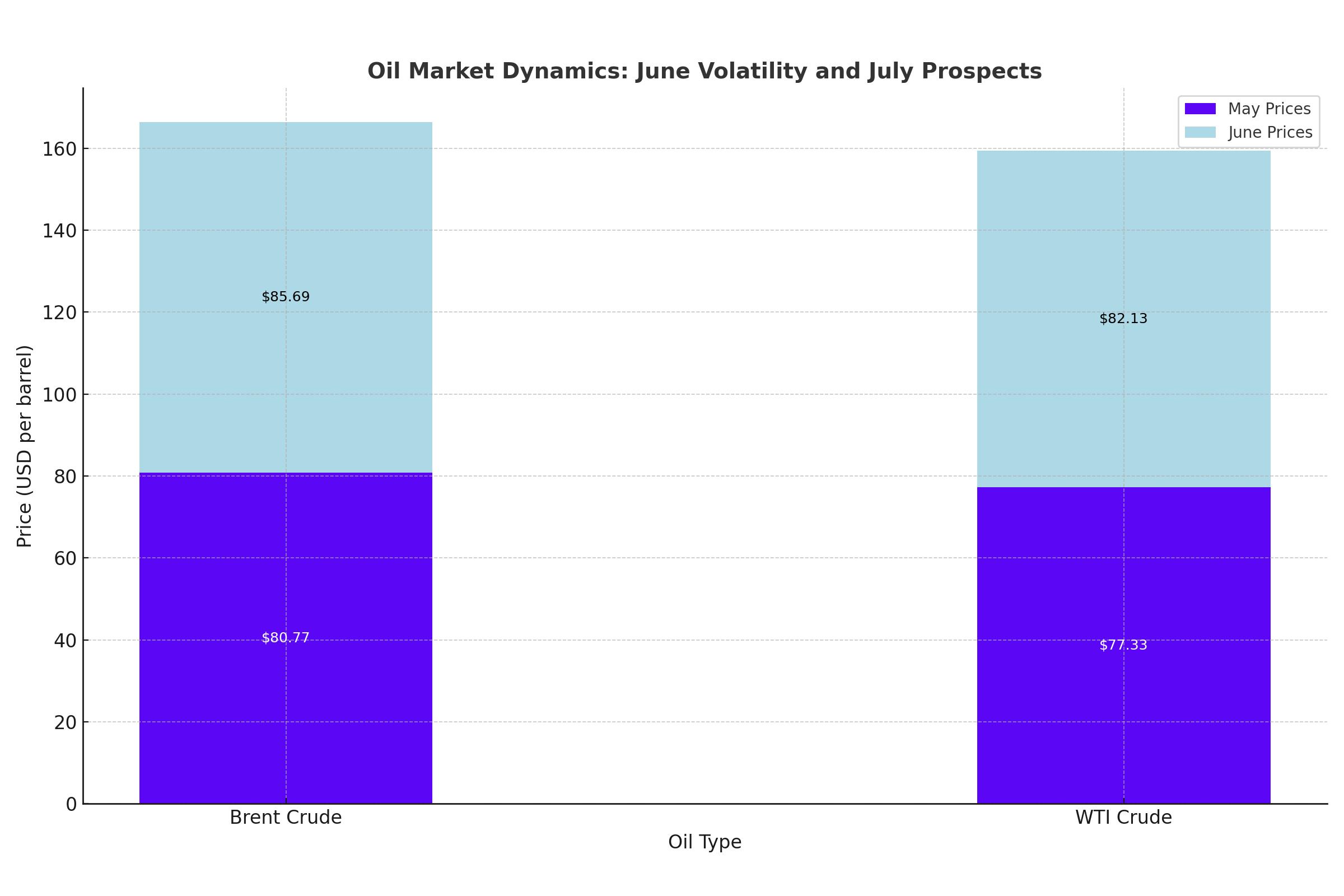

The month of June was marked by significant volatility in the oil market, driven by various economic and geopolitical factors. Brent crude futures increased by 6% in June, settling at $85.69 per barrel, while U.S. West Texas Intermediate (WTI) crude futures rose to $82.13. This price movement was influenced by OPEC+ production cuts, which have been extended through 2025, and the expected peak summer consumption.

OPEC’s Perspective on Energy Transition

OPEC Secretary General Haitham Al Ghais emphasized the critical role of hydrocarbons in the global energy mix, highlighting the unrealistic expectations of a swift transition to renewable energy. Al Ghais pointed out that critical minerals essential for renewable energy and EVs are heavily reliant on hydrocarbons for their extraction and processing. He noted that over $9.5 trillion has been invested in the energy transition over the past two decades, yet wind and solar power only supply just under 4% of the world’s energy, with EVs having a global penetration rate of between 2% and 3%.

US Senate Investigation into Oil Producers

The US Senate's budget committee has initiated an investigation into potential collusion between domestic oil producers and OPEC regarding price adjustments and production coordination. This inquiry, led by Senator Sheldon Whitehouse, seeks to examine communications between nearly 20 oil and gas producers and OPEC from January 2020 to the present. The investigation follows allegations against major energy companies like ExxonMobil, Chevron, and ConocoPhillips, and includes a request for detailed communications concerning oil production output and pricing.

Market Influences and Geopolitical Tensions

Oil prices have been bolstered by expected peak summer demand and production cuts by OPEC+. However, rising output from other producers and geopolitical tensions have added layers of complexity. Analysts forecast supply deficits in the third quarter due to increased demand for transportation and air-conditioning fuel. The Energy Information Administration (EIA) reported that oil production and demand hit a four-month high in April, supporting the upward price trend.

Investor focus is also on remarks from U.S. Federal Reserve Chair Jerome Powell, with market participants watching closely for signals on potential interest rate cuts. Additionally, political concerns in Europe and tensions between Israel and Lebanon's Hezbollah are contributing to market volatility.

Technical Analysis and Price Projections

Brent crude oil prices are approaching a two-month high, with the potential to surpass the mid-March peak of $87.11. The support line at $84.81 and the 84.72-to-83.25 zone are critical levels to watch. On the upside, Brent could target the minor psychological $90.00 region. For WTI, the critical levels are slightly lower but follow a similar upward trajectory.

If oil prices manage to break and sustain above these resistance levels, further gains are likely. However, any failure to hold these levels could result in a pullback to previous support zones.

Impact of Summer Consumption and Refinery Demand

The summer season typically drives higher oil consumption due to increased transportation and air-conditioning use. JPMorgan analysts noted that demand indicators are solid, particularly in the U.S. market, with peak refinery demand for crude expected to last through August. This seasonal demand is likely to keep prices elevated, barring significant changes in supply dynamics or unexpected geopolitical events.

Future Market Outlook and Strategic Insights

Looking ahead, the oil market is poised for continued volatility, influenced by OPEC+ production strategies, geopolitical tensions, and seasonal demand patterns. Analysts, including those from Barclays, forecast that Brent crude prices could remain around $90 per barrel in the coming months, reflecting strong underlying fundamentals.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex