Oil Prices Soar Past $81 as Middle East Tensions Escalate

Geopolitical Instability Sparks Significant Increase in Brent Crude Prices | That's TradingNEWS

Oil Prices Surge Amid Middle East Tensions and Market Dynamics

Current Price Movements and Market Sentiment

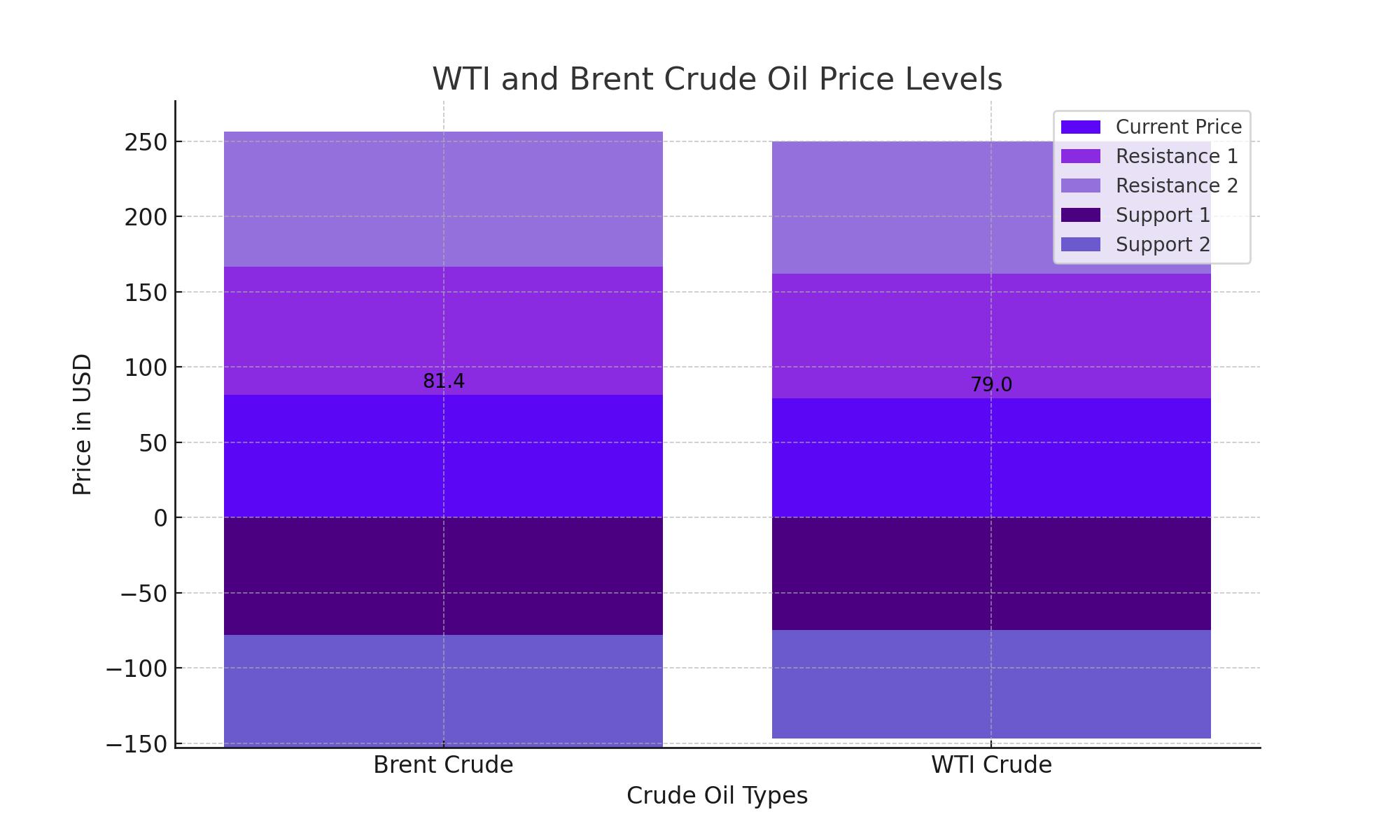

Oil prices have surged this week, driven by escalating tensions between Israel and Iran. Brent crude prices broke past $81 per barrel, reflecting a significant increase due to geopolitical instability in the Middle East. As of the latest trading, Brent crude is priced at $81.40 per barrel, while West Texas Intermediate (WTI) crude is trading near $79 per barrel. This spike follows the assassination of Hamas’s political leader Ismail Haniyeh in Iran and a senior Hezbollah official in Lebanon, which has heightened fears of a broader regional conflict.

Federal Reserve and OPEC+ Decisions

The Federal Reserve's recent decisions have also played a role in influencing oil prices. The Fed maintained interest rates at 5.25%-5.50% but hinted at potential rate cuts in September if inflation remains controlled. This dovish outlook has contributed to market optimism and has indirectly supported oil prices by potentially easing borrowing costs and boosting economic activity.

OPEC+ has decided to keep its output policy unchanged, continuing with the plan to start unwinding some output cuts from October. The group's policy calls for gradually phasing out cuts of 2.2 million barrels per day (bpd) from October 2024 to September 2025, while extending earlier cuts of 3.66 million bpd until the end of 2025. This decision comes as the Joint Ministerial Monitoring Committee (JMMC) meets to assess market conditions.

Impact of Geopolitical Tensions

The assassination of key political figures in Iran and Lebanon has significantly impacted the oil market. The incident has prompted Tehran to threaten retaliation, raising concerns about potential disruptions to oil supply from the region. The Strait of Hormuz, a critical chokepoint for global oil transit, could be affected, with about a fifth of the world's oil supply passing through it daily. This has led to a heightened geopolitical risk premium in oil prices.

Market Reactions and Trading Activities

Traders have been actively buying call options, betting on oil prices reaching $110-$130 per barrel in November. On Wednesday alone, more than 300,000 call options in Brent were traded, the highest volume since April. These call options give traders the right to buy assets at a certain price by a specified date, indicating bullish sentiment in the market.

U.S. Crude Oil Stockpiles and Demand

The U.S. Energy Information Administration (EIA) reported a decrease in U.S. crude oil stockpiles by 3.4 million barrels in the week ending July 26, driven by robust export demand. This decline in stockpiles has provided additional support to oil prices. Furthermore, oil demand in the United States reached a seasonal record in May, at 20.80 million barrels daily, significantly revised from previous estimates of 20 million barrels daily.

European Energy Crisis and Its Implications

High energy costs and uncertainty about energy supply have prompted four out of ten German manufacturing firms to consider relocating production abroad or limiting it in Germany. This trend reflects the broader impact of energy price shocks following the Russian invasion of Ukraine. The German economy, particularly its energy-intensive industries, continues to struggle with high energy costs, leading to weak manufacturing and industrial activity.

Future Outlook for Oil Prices

The outlook for oil prices remains bullish amid ongoing geopolitical tensions and supply constraints. The recent surge in prices underscores the potential for further increases, with market participants closely monitoring developments in the Middle East. Analysts are optimistic that continued supply disruptions from geopolitical events, coupled with robust demand, will sustain upward pressure on oil prices.

In conclusion, the combination of geopolitical instability, Federal Reserve policies, and market dynamics are key drivers of the current bullish trend in oil prices. Investors will continue to monitor these factors closely, as they significantly impact the oil market's future direction. The situation remains fluid, and the market's response to geopolitical developments will be critical in determining the trajectory of oil prices in the coming months.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex