Oil TradingNEWS - Australia's Natural Gas Expansion

Emphasizing Sustainability and Economic Growth, Australia's Future Gas Strategy Aims to Balance Environmental Goals with Robust Energy Production | That's TradingNEWS

Expanding Australia's Energy Horizons: The Strategic Role of Natural Gas

Reinforcing Energy Stability with Natural Gas

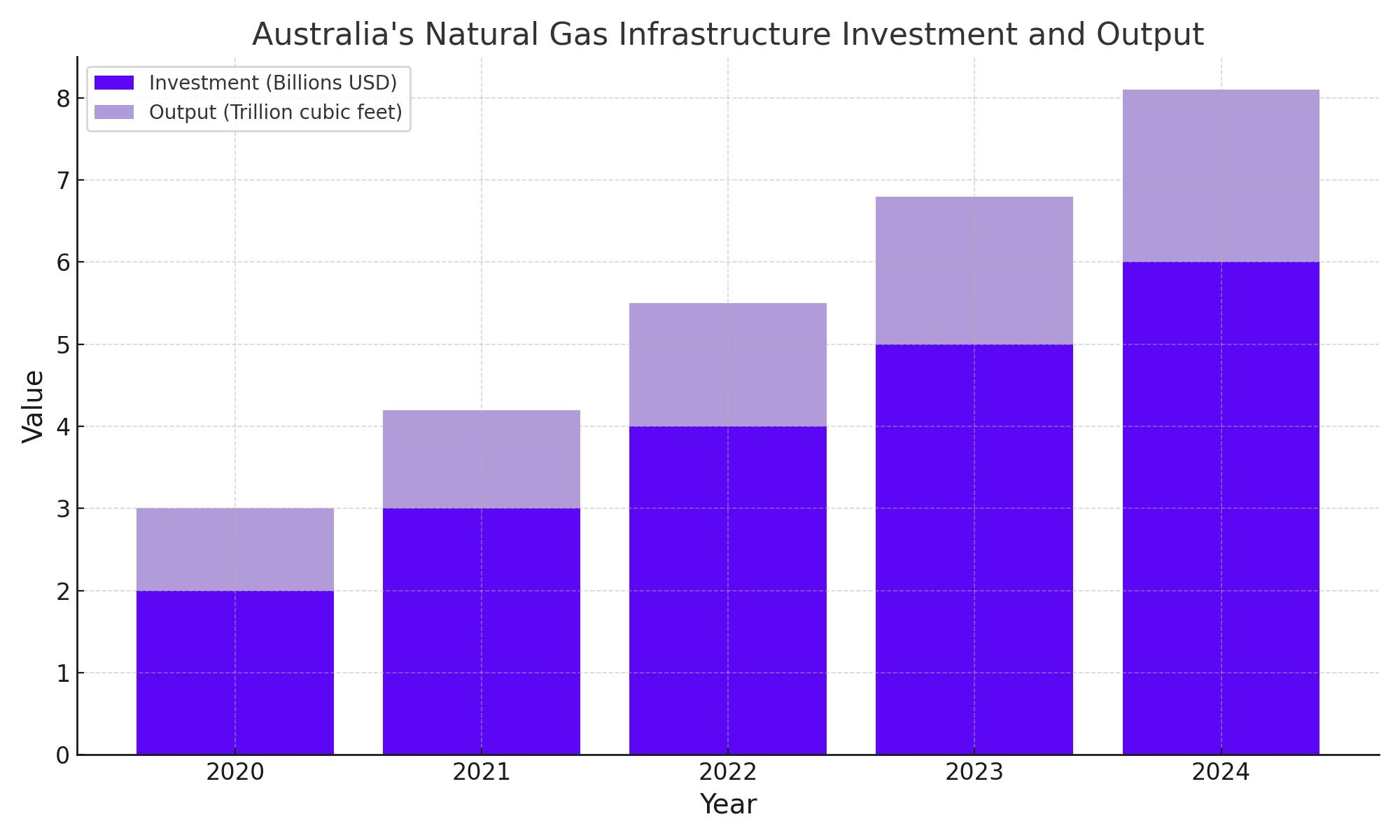

Australia is actively enhancing its natural gas infrastructure, aiming to meet its ambitious goal of achieving a net-zero economy by 2050. This strategic push, spearheaded by Minister for Resources and Northern Australia Madeleine King, is articulated in the "Future Gas Strategy." This comprehensive plan underscores natural gas as a linchpin in Australia’s transition to renewable energy sources while ensuring energy affordability. As a response to the pressing need for sustainable energy solutions, Australia is focusing on the expansion of natural gas exploration and production, viewing it as crucial to both economic growth and environmental stewardship.

Australia's Global Energy Strategy and Market Integration

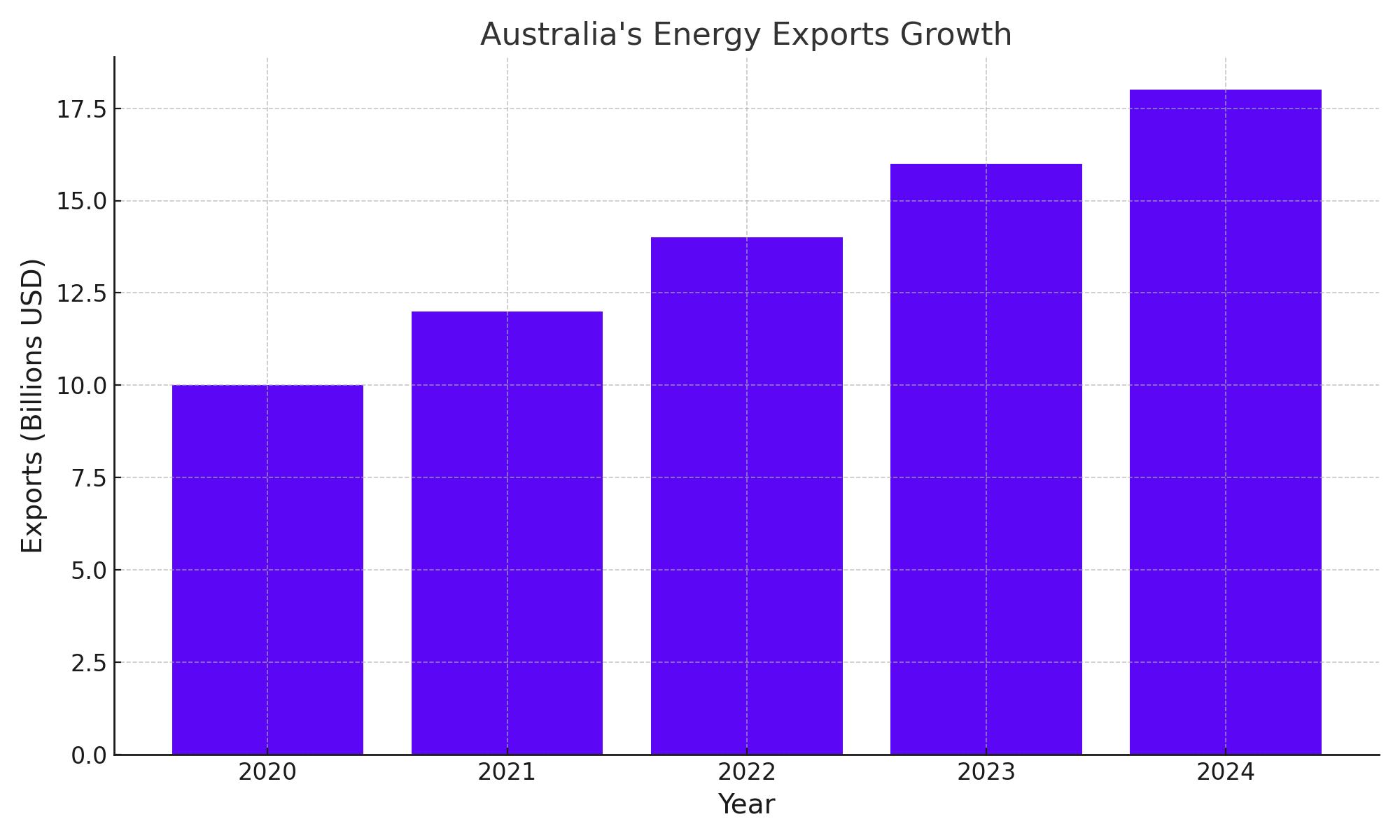

Contributing 27% to the nation’s energy matrix and 14% to its export revenues, natural gas stands as a key player in Australia's energy strategy. The government's commitment is demonstrated through initiatives aimed at averting potential gas shortages by fostering timely development of existing gas reserves, particularly in prolific gas-producing regions. This proactive approach not only aims to satisfy domestic energy demands but also to secure a stable energy supply for international markets, reinforcing Australia’s role as a reliable energy partner globally.

Navigating Economic and Environmental Paradigms

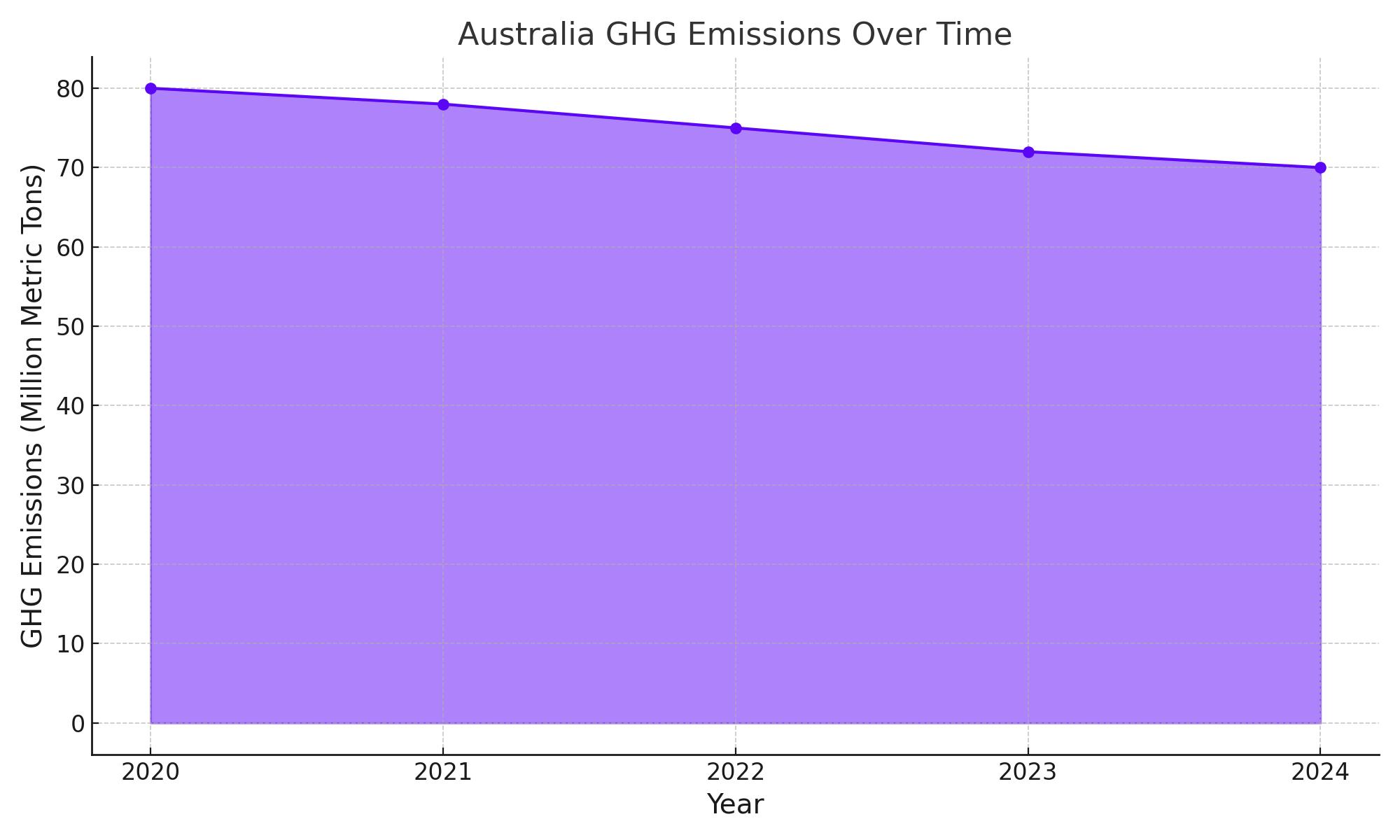

While championing natural gas, the Australian government is equally committed to cutting global greenhouse gas emissions, maintaining a delicate balance between environmental responsibilities and energy needs. This dual approach ensures that natural gas is not only a bridge in the transitional energy landscape but also remains affordable as the nation shifts towards more sustainable energy sources. This strategy positions natural gas as an essential, yet transitional fuel that supports both economic stability and environmental sustainability.

Influencing Global Oil Markets through Strategic Policy

The interplay between Australia’s energy strategies and global oil markets is evident, especially given recent shifts in economic indicators and inventory adjustments in the U.S. Recent data highlighted a reduction in U.S. crude inventories, which slightly lifted oil prices with West Texas Intermediate (WTI) crude reaching $78.99 per barrel and Brent crude peaking at $83.58 per barrel. These price adjustments reflect broader market reactions to geopolitical developments and economic data, emphasizing the sensitivity of global oil markets to policy changes and supply dynamics.

Strategic Petroleum Reserve Adjustments and Market Stability

In response to market fluctuations, the U.S. has revised its approach to managing the Strategic Petroleum Reserve (SPR). By setting a clear price ceiling of $79.99 per barrel for purchasing oil, the U.S. government aims to introduce more market-driven dynamics into its reserve management practices. This shift is designed to mitigate the impacts of market volatility and to facilitate more effective risk management strategies among traders, thereby contributing to overall market stability.

Global Impact and Strategic Alliances in Energy

Australia's commitment to bolstering its natural gas production is not merely a domestic agenda but a strategic move within the global energy market. As the world's largest liquefied natural gas (LNG) exporter after Qatar, Australia's enhanced natural gas capabilities are poised to strengthen its economic ties with energy-hungry Asian economies like China, Japan, and South Korea. These countries, reliant on stable and secure energy imports to drive their economies, view Australia as a key partner. This relationship offers Australia leverage in broader geopolitical discussions, facilitating enhanced cooperation on technology, climate change mitigation, and economic development initiatives.

Innovation and Sustainability in the Energy Sector

Transitioning to a net-zero future, Australia is focusing on incorporating cutting-edge technologies that align with its increased natural gas output. Technologies such as Carbon Capture and Storage (CCS) and the enhancement of gas-fired plants are pivotal. These innovations aim to maintain the relevance of natural gas in a decarbonizing world by minimizing its environmental impact. For instance, projects like Chevron's Gorgon CCS facility aim to sequester up to 4 million tons of CO2 annually, illustrating significant progress in clean technology applications within the sector.

Navigating Economic Shifts and Market Dynamics

The volatile nature of global energy markets requires that Australia strategically manages the economic implications of its energy policies. Natural gas prices, which can fluctuate based on international market trends, geopolitical stability, and supply-demand dynamics, directly influence the profitability of Australia's gas exports. For example, the Asian LNG spot price surged to record highs over $50 per million British thermal units (MMBtu) in late 2021 due to cold snaps and tight supplies. Such fluctuations necessitate agile fiscal policies and market adaptations to sustain economic growth and ensure domestic energy affordability.

Adhering to Regulatory Standards and Global Expectations

Australia's energy strategy also involves stringent adherence to international environmental and safety standards, ensuring that its natural gas projects align with global best practices. This compliance is crucial not only for maintaining market access but also for appealing to international partners and investors who prioritize sustainability. The alignment with standards such as those set by the International Energy Agency (IEA) ensures that Australian natural gas remains a competitive, clean, and reliable energy source on the global stage.

Pricing Dynamics and Market Opportunities

Current oil pricing dynamics offer compelling entry points for investors. With Brent crude trading at approximately $83.86 a barrel and West Texas Intermediate (WTI) at around $79.39 a barrel, the market is poised above significant support levels. The U.S. government's proactive measures, such as setting a strategic purchase price cap of $79.99 for oil, signal a floor in pricing strategies that could stabilize market fluctuations. This governmental support, coupled with strategic reserve adjustments, is aimed at mitigating extreme volatilities and fostering a stable investment environment.

Geopolitical Factors and Economic Recovery

Geopolitical developments and economic recovery efforts continue to play crucial roles in shaping the oil market's trajectory. The ongoing ceasefire talks in the Gaza Strip and strategic dialogues among global leaders reflect a geopolitical landscape that investors must navigate carefully. However, these factors also present unique opportunities for market gains when strategically managed.

Long-Term Outlook and Investment Considerations

Looking forward, the oil market's fundamentals are strengthened by OPEC+'s management of production cuts, which are likely to extend into the year-end, supporting a deficit that could push Brent prices towards the $90 mark over the summer. This forecasted deficit, alongside the anticipated increase in seasonal demand, provides a fertile ground for bullish investments.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex