Oil (WTI): Bullish Momentum Amid Geopolitical Tensions and Market Dynamics

Oil Price Movements with Brent Crude at $80.67 and WTI at $77.50 Amid Middle East Tensions and Economic Indicators | That's TradingNEWS

Oil (WTI): Bullish Momentum Amid Geopolitical Tensions and Market Dynamics

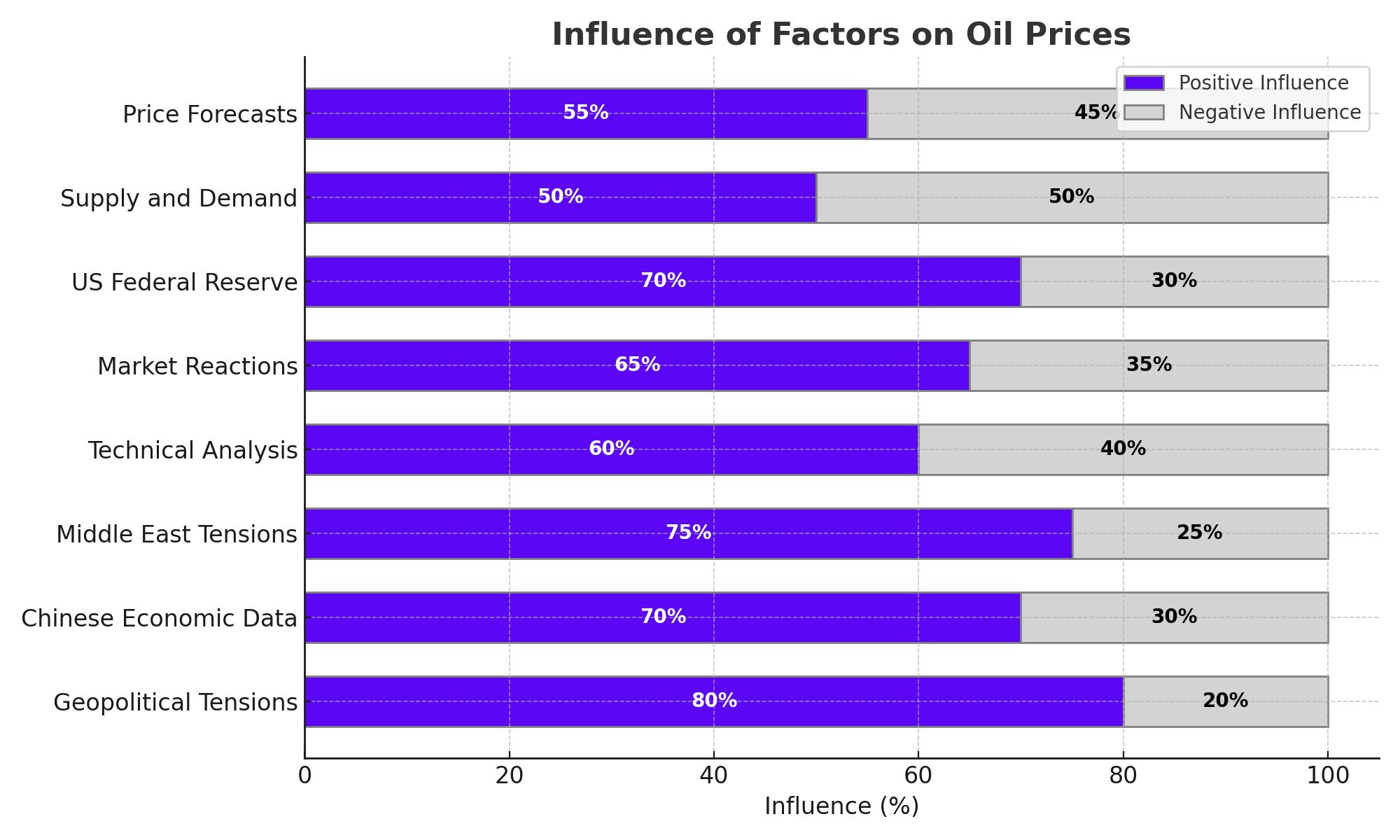

Geopolitical Tensions Influence Oil Prices

Crude oil prices began this week on a positive note due to heightened geopolitical tensions in the Middle East. A rocket strike on the Golan Heights over the weekend has rekindled fears of an escalation in conflict, significantly impacting oil markets. Brent crude traded at $80.67 per barrel, while West Texas Intermediate (WTI) crude was at $77.50 per barrel on Monday morning, reflecting increases of 0.49% and 0.44%, respectively.

Chinese Economic Data and Market Sentiment

Concerns about demand from China, the world’s largest oil importer, have weighed heavily on the market. Recent data indicated a monthly acceleration in industrial profits for June, somewhat alleviating these worries. Vivek Dhar, an analyst at Commonwealth Bank of Australia, noted that "Concerns around China’s economy have broadly weighed on energy commodity prices," but rising geopolitical risks are now likely to take precedence.

Impact of Middle East Tensions

On Saturday, a missile attack in the Israeli-occupied Golan Heights killed 12 people, intensifying fears of a broader conflict. Israel has blamed Hezbollah for the attack and has threatened retaliation. These developments have supported oil prices, although gains were limited by ongoing concerns about Chinese demand.

Technical Analysis and Key Price Levels

WTI crude opened higher on Monday, recovering from last week’s lows. Prices retraced approximately 50% of Friday’s 2.4% drop but remained within a narrow range. Key resistance levels for WTI are at $78.31 and $78.39, with support at $77.06 and $76.02. Brent crude faces resistance at $82.67, $83.41, and $84.45, with support at $79.24, $78.32, and $77.21.

Price Forecasts and Projections

WTI crude oil is projected to remain bearish below the $77.07 pivot point. A firm break above this level could shift sentiment to bullish. Brent crude oil is currently trading above its pivot point of $81.64, with a bullish outlook if this level is maintained. Failure to do so could trigger a sharp selling trend.

Conclusion

Oil prices have been significantly impacted by recent geopolitical tensions in the Middle East, notably the rocket strike on the Golan Heights, which has led to a rise in Brent crude to $80.67 per barrel and WTI crude to $77.50 per barrel. These prices are supported by concerns over potential conflict escalation, balanced against worries about weakened demand from China, which saw a 11% drop in fuel oil imports in the first half of 2024. Technical resistance for WTI is at $78.31 and $78.39, while support is found at $77.06 and $76.02. For Brent, resistance lies at $82.67, $83.41, and $84.45, with support levels at $79.24, $78.32, and $77.21. Investors should focus on geopolitical developments and key economic indicators, such as the U.S. Federal Reserve's policy decisions and China's economic data, to gauge future price movements and market stability.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex