Rise in Gold Prices Amid Global Economic Fluctuations

Analyzing the Impact of Federal Reserve Policies and Geopolitical Developments on Gold's Market Dynamics | That's TradingNEWs

Exploring the Surge in Gold Prices Amid Economic Uncertainties

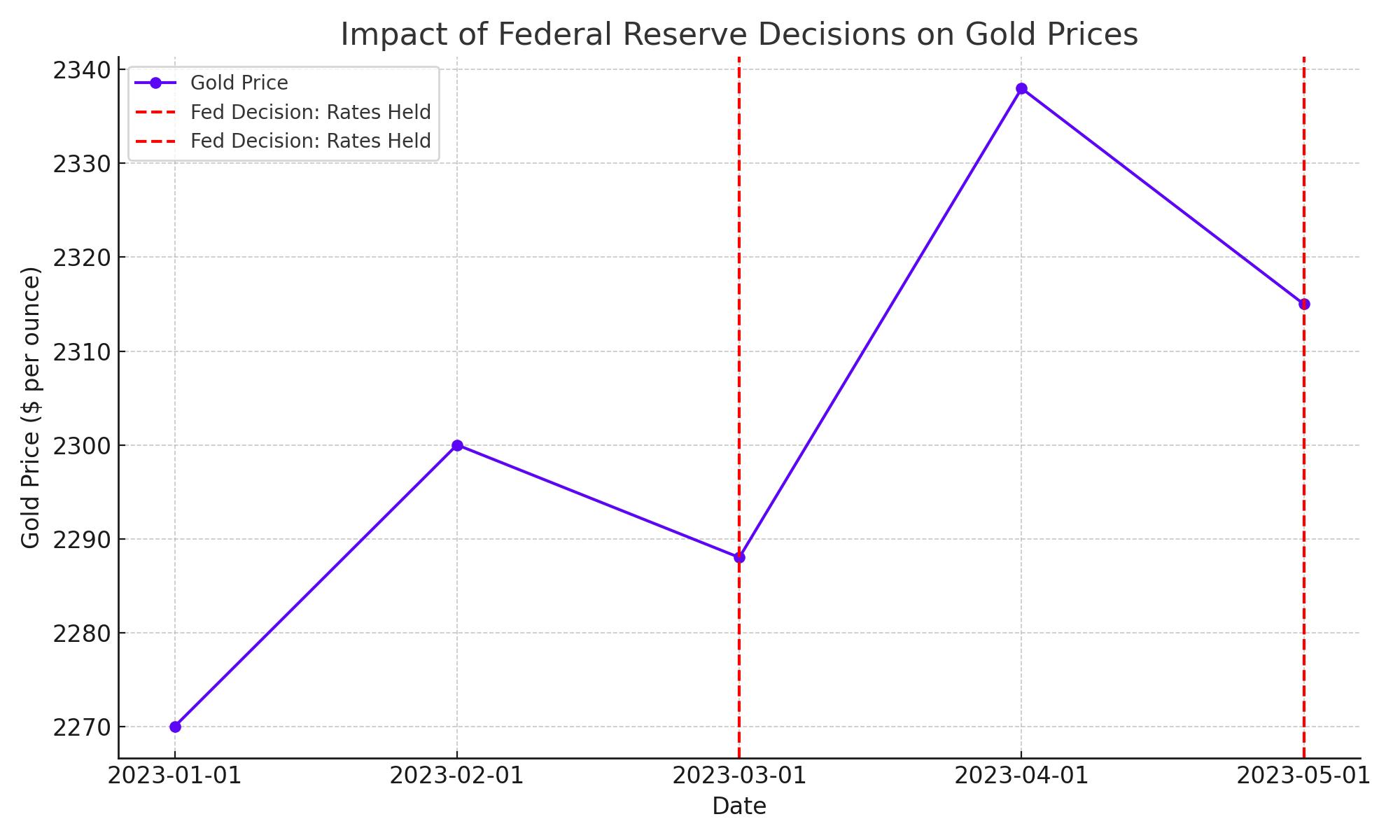

Anticipating the Federal Reserve's Impact on Gold Prices

The gold market has recently seen a slight upswing, with prices hovering around $2,288. This movement comes as the financial community keenly anticipates the Federal Reserve's upcoming decision on interest rates, expected to maintain a hawkish stance. Historically, the Fed’s monetary policy significantly influences gold prices due to its impact on the U.S. dollar's strength and yield dynamics. Currently, the market predicts the Federal Reserve will maintain rates, potentially sustaining high-yield investments' appeal over non-yielding assets like gold.

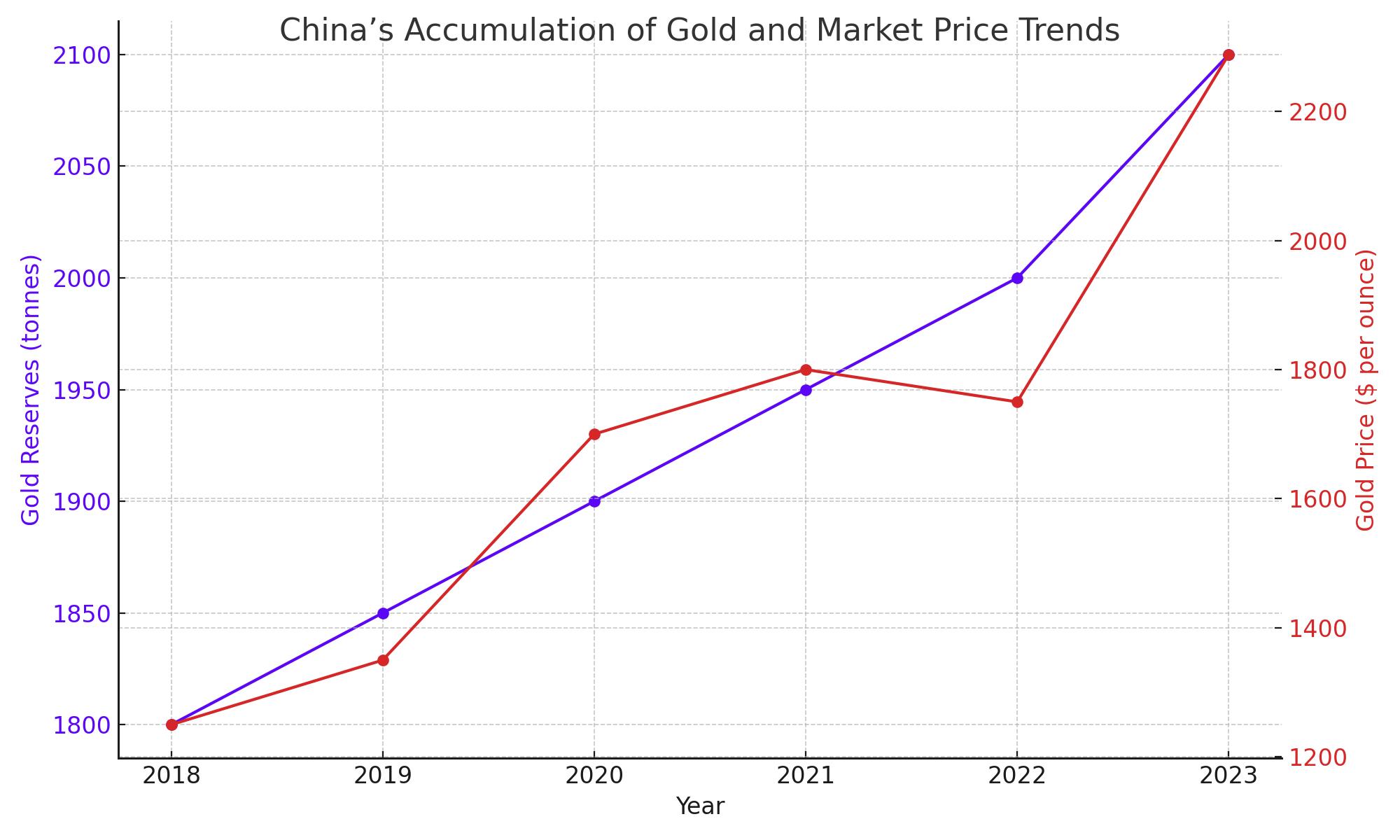

China's Influence on Gold’s Market Dynamics

A significant factor buoying gold prices is China’s continued accumulation of the metal, marking its longest buildup phase since 2000. This strategic accumulation not only strengthens the Chinese yuan but also potentially lays the groundwork for broader geopolitical maneuvers, reflecting on gold's price stability. Amidst increasing tensions in regions like Taiwan and the Middle East, gold's role as a safe-haven asset becomes more pronounced. Traders and investors alike are closely monitoring these developments, as any escalation could further spur safe-haven investments, pushing gold prices higher.

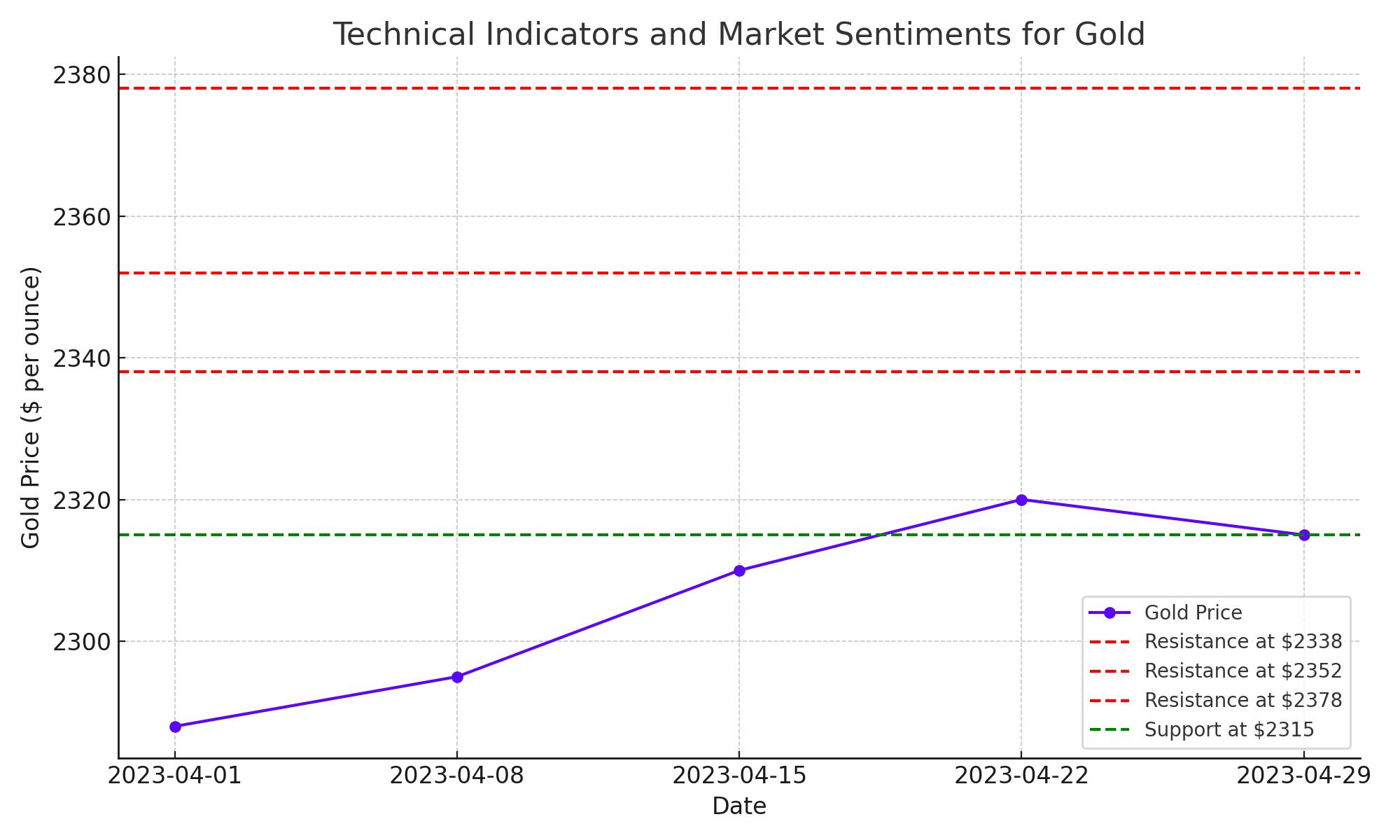

Technical Indicators and Market Sentiments

From a technical perspective, gold has shown resilience by staying above critical support levels despite fluctuating near four-week lows. Key resistance is observed at $2,338, with further hurdles at $2,352 and $2,378, which could limit upward movements. Conversely, if the price breaks below the pivotal $2,315 mark, it could see further declines towards $2,250, testing subsequent support levels.

Market Reactions to Economic Indicators

The market's reaction to U.S. economic indicators, such as the ISM Manufacturing PMI and ADP Employment Change, will provide further clues about the economic landscape and its implications for gold. Strong economic data might bolster the case for sustained higher rates, which traditionally dampens gold's appeal. However, any signs of economic softening could tilt the balance, enhancing gold's attractiveness as a hedge against economic uncertainty.

Strategic Outlook for Gold Investors

Investors are advised to monitor the Federal Reserve's statements closely, as the central bank's tone will likely dictate short-term market sentiments and influence gold's price trajectory. The ongoing geopolitical risks and economic indicators present a complex backdrop that could either challenge or bolster gold's position as a traditional refuge in times of financial uncertainty.

That's TradingNEWs

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex