Spot Gold Surges Past $2,530 as Investors Flock to Safe Havens

Amid Fed Rate Cut Expectations and Global Unrest, Gold Shines as the Ultimate Safe-Haven Investment | That's TradingNEWS

Gold Soars to New Heights Amid Rate Cut Speculation and Geopolitical Tensions

Market Overview: Gold Reaches Record Highs as Investors Flee to Safety

Gold prices have surged to unprecedented levels, with spot gold hitting a record $2,531.60 per ounce, driven by growing expectations of U.S. Federal Reserve interest rate cuts and rising geopolitical tensions. The allure of gold as a safe-haven asset has been magnified by these factors, pushing the value of a standard 400-ounce gold bar above $1 million for the first time.

Fed Rate Cut Expectations Fuel Gold Rally

The anticipation of a rate cut by the Federal Reserve in September has been a key driver behind the recent surge in gold prices. Markets are currently pricing in a 73.5% chance of a 25 basis point cut, according to the CME FedWatch Tool. This sentiment is further supported by dovish remarks from several Fed officials, including Minneapolis Fed President Neel Kashkari and Chicago Fed President Austan Goolsbee, who have both indicated a shift in focus towards supporting the labor market.

Geopolitical Risks Add to Gold's Appeal

In addition to the monetary policy outlook, geopolitical uncertainties continue to underpin the bullish trend in gold. The ongoing conflicts in Ukraine and Gaza, coupled with rising tensions in the Middle East, have reinforced gold's status as a safe-haven asset. The market's reaction to these risks has been swift, with substantial inflows into gold-backed exchange-traded funds (ETFs) like the SPDR Gold Trust, which saw holdings jump to a seven-month high.

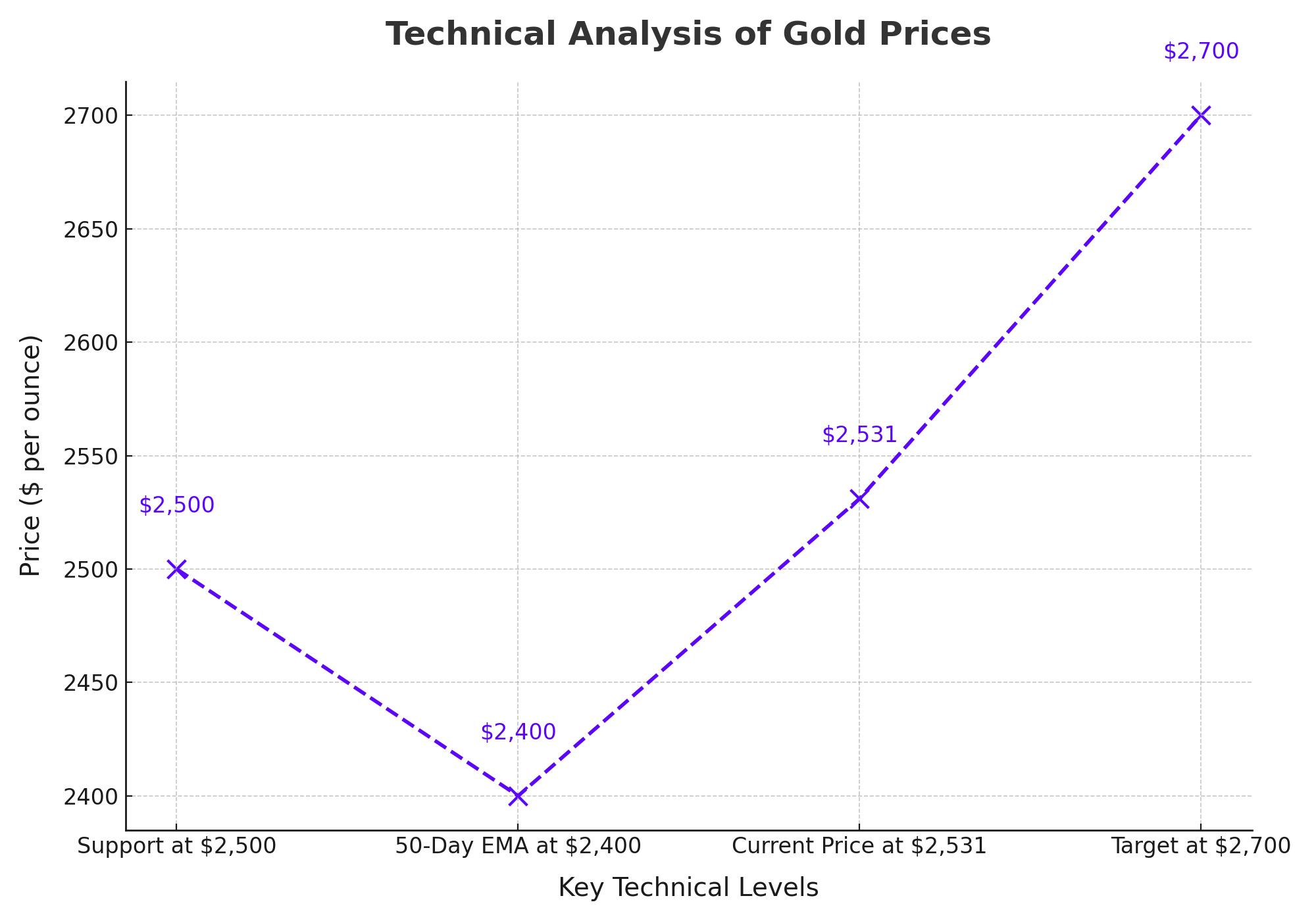

Technical Analysis: Gold Eyes $2,700 as Bulls Maintain Control

From a technical perspective, gold's breakout above the $2,500 level signals a strong bullish momentum, with the next target potentially being the $2,700 mark. The current market setup shows robust support around the $2,500 level, which could act as a significant barrier on any pullbacks. The 50-day EMA, currently near $2,400, also provides a solid foundation for further gains.

Market Sentiment: Investors Anticipate Further Upside

Investor sentiment remains firmly bullish, with many viewing gold as a hedge against both inflation and geopolitical instability. The combination of dovish Fed expectations, coupled with ongoing global tensions, suggests that gold may continue to attract buyers looking for safety. Analysts are now speculating that gold could reach as high as $2,600 by the end of 2024, as central banks worldwide continue to accumulate the precious metal.

Conclusion: A Bullish Outlook for Gold

With the Federal Reserve poised to potentially lower rates and global uncertainties showing no sign of abating, gold's appeal as a safe haven remains strong. The recent price action indicates that the path of least resistance is upward, with technical indicators pointing to further gains. Investors and analysts alike will be closely watching upcoming Fed decisions and geopolitical developments, which will likely dictate the next move in gold prices. For now, the market consensus leans towards a continued rally, with gold possibly setting new records in the near future.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex