TradingNEWS Gold's Market Dynamics and Future Prospects

Exploring Gold's Resilience and Growth Amid Global Economic Fluctuations and Central Bank Strategies | That's TradingNEWS

In-Depth Analysis: Gold's Market Dynamics and Future Prospects

Gold's Current Market Position

As of now, gold prices (XAU/USD) have showcased resilience, trading with a slight positive bias around $2,312, despite the backdrop of a strengthening U.S. dollar and assertive statements from the U.S. Federal Reserve hinting at a steadfast approach to monetary policy. This firm stance may limit gold's upside in the immediate future.

Global Demand Fuels Market Optimism

Contrasting the domestic pressures, gold's global appeal has intensified, primarily fueled by robust investment from over-the-counter markets and consistent acquisitions by central banks, particularly in Asia. The World Gold Council highlights a surge in demand from nations like China and India, which bolsters the metal's standing as a safe-haven asset amidst ongoing geopolitical tensions in regions like the Middle East.

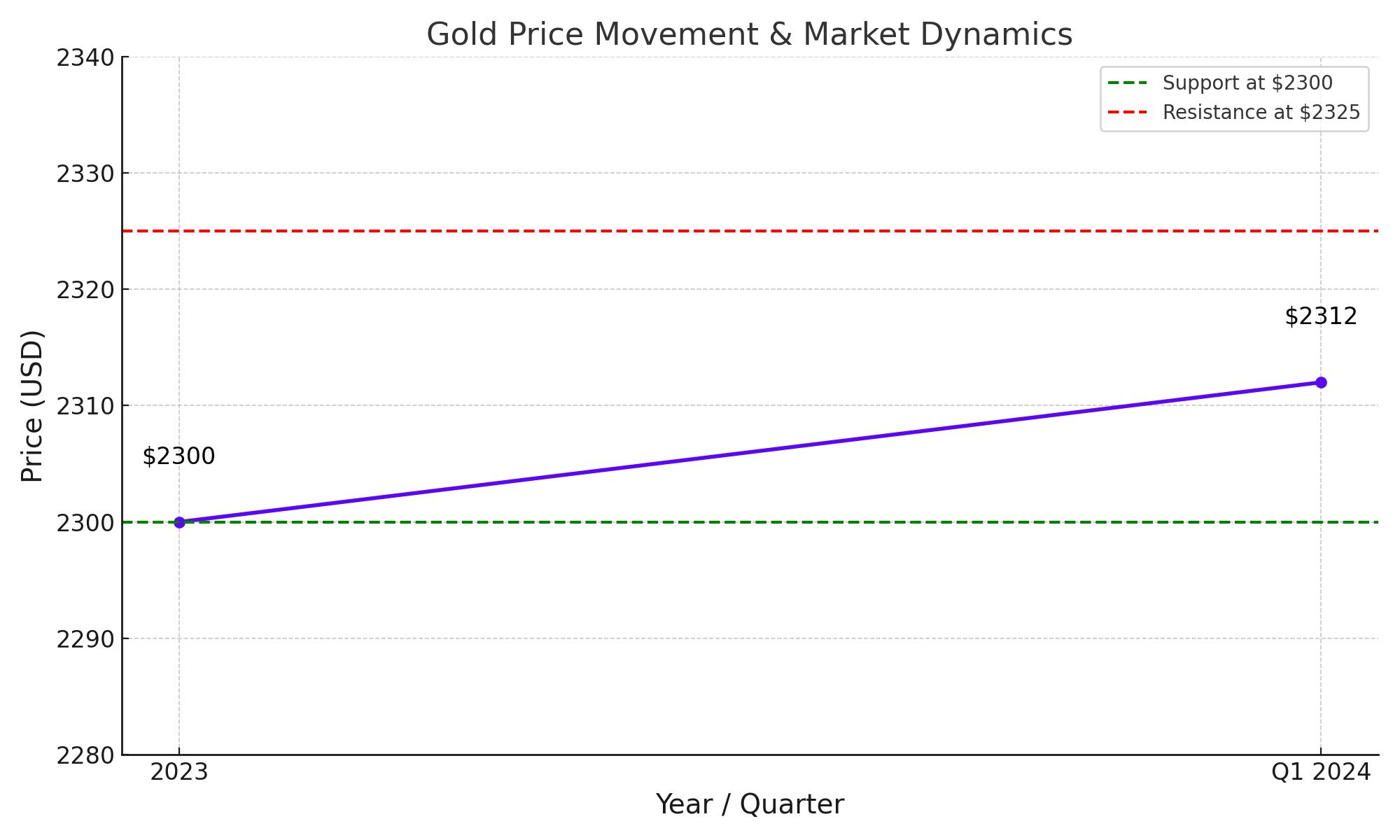

Technical Outlook: Signals and Support

Technical analysis reveals that gold maintains a bullish undertone over the long term, buoyed above the critical 100-day Exponential Moving Average (EMA). However, short-term indicators, such as the 14-day Relative Strength Index (RSI) lingering around the 50-midline, suggest a potential consolidation phase could be underway. Support levels are currently pegged near the $2,300 mark, with resistance around $2,325.

The Fed's Impact and Economic Indicators

Upcoming economic indicators, including U.S. Initial Jobless Claims and updates from Federal Reserve officials, could provide fresh catalysts for the market. Notably, any dovish shifts in Fed rhetoric could temper downside risks and enhance gold's investment appeal as a non-yielding asset, especially if rate cut expectations, currently at a 55% probability for September, begin to rise again.

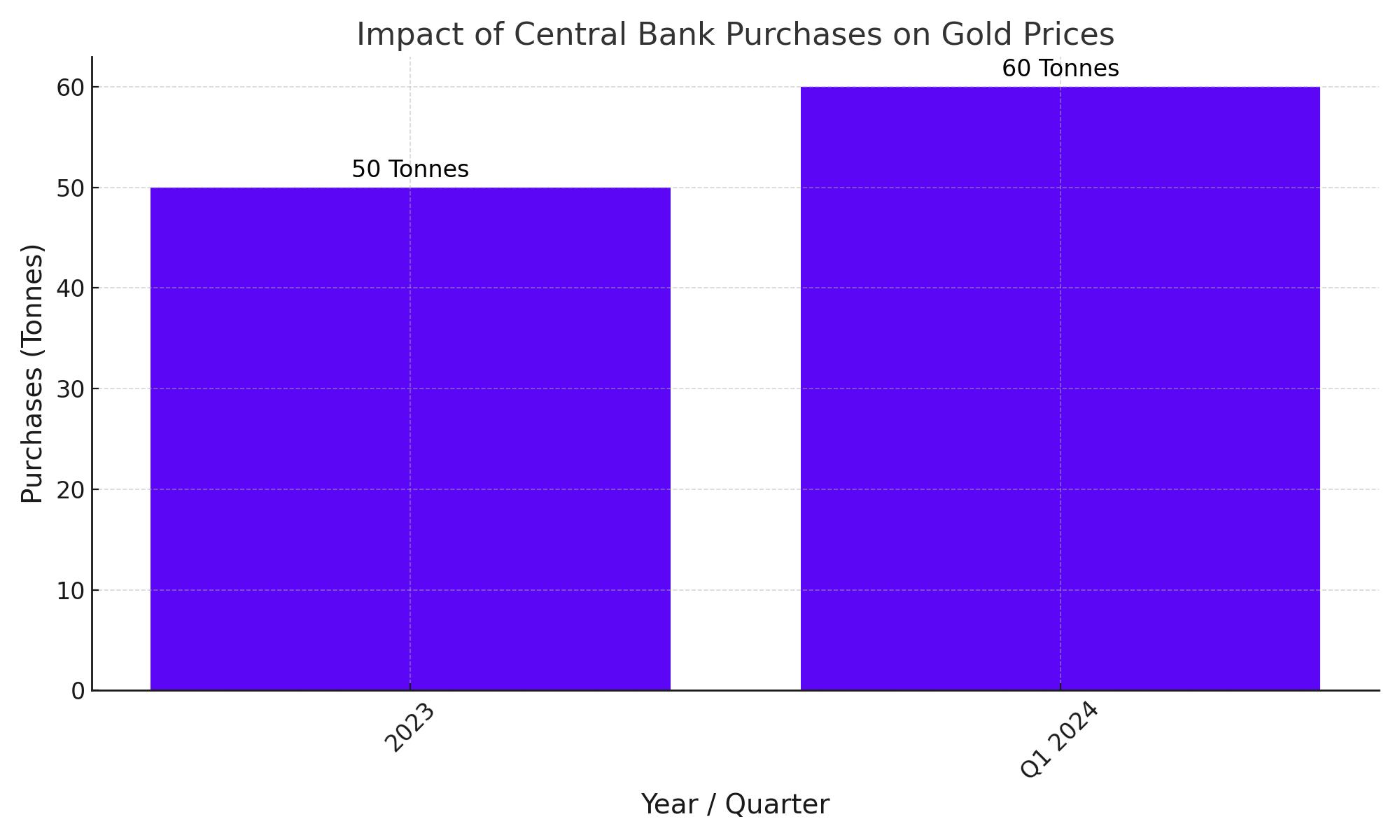

Impact of Central Banks on Gold Prices

The People's Bank of China has been notably consistent in bolstering its gold reserves, marking an 18-month streak of purchases. This sustained acquisition, adding 60,000 troy ounces to its reserves in April alone, highlights central banks' trust in gold as a stable store of value. Such actions by major central banks globally provide a solid foundation for the positive sentiment pervading the gold market.

Influences on Investor Sentiment and Gold Market Dynamics

Investor sentiment towards gold remains cautiously optimistic, a reflection of its resilience in price, which as of now hovers around $2,312 per ounce. Market participants are keenly observing the U.S. Federal Reserve for any shifts in monetary policy that could influence gold's valuation. Additionally, factors like rising U.S. Treasury yields and a strengthening U.S. dollar contribute to ongoing price volatility, demanding investor vigilance.

Future Outlook and Investment Strategies for Gold

The outlook for gold is cautiously optimistic despite potential challenges from U.S. monetary policy. With global demand robust and central banks actively participating in the market, gold's price trajectory is expected to remain upward. Investors should remain alert to geopolitical shifts and central bank decisions, which are likely to influence gold prices in the short term, providing both challenges and opportunities for strategic investments.

Comprehensive View on Gold's Market Prospects

Amidst ongoing fluctuations and uncertainties, particularly concerning future U.S. Federal Reserve rate decisions, gold's market fundamentals are strong, supported by global demand and consistent central bank investments. These elements suggest a positive long-term outlook for gold. As financial markets navigate through these variables, gold continues to be an indispensable asset for investors, offering a combination of stability and potential for appreciation in a volatile global economic landscape.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex