TradingNEWS Weekly Analysis of WTI Crude Oil Market Dynamics

Exploring Price Trends, Technical Sentiments, and Strategic Market Outlook for WTI Crude Oil | That's TradingNEWS

In-Depth Analysis of WTI Crude Oil's Weekly Market Dynamics

Detailed Price Fluctuations Over the Week

WTI Crude Oil began trading last week slightly below the $82.00 threshold, experiencing a significant dip to a weekly low of $80.70 amidst ongoing geopolitical tensions. Despite these challenges, the commodity managed a steady recovery, ascending to close the week at approximately $83.64, with a weekly high reaching $84.45. This upward trend, which has positioned the prices within the mid-range of the past month, introduces potential inflationary concerns if the trajectory continues to rise.

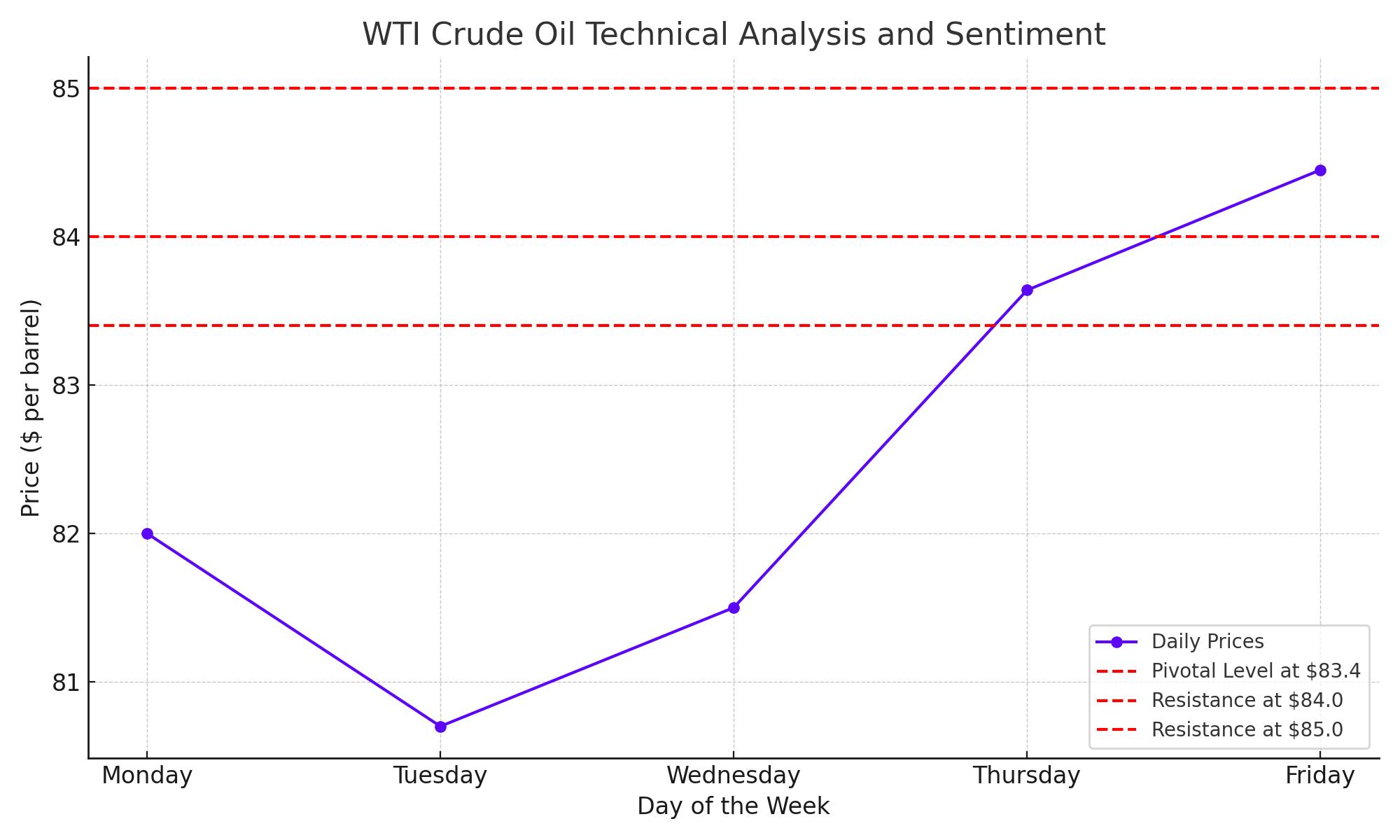

Technical Analysis and Sentiment Evaluation

The resilience of WTI Crude Oil was notably evident last week, with the commodity securing its highest weekly close since the middle of April. The price momentarily surged to $85.60 during heightened tensions between Israel and Iran, subsequently stabilizing. The upcoming trading week will scrutinize WTI's ability to maintain above the pivotal $83.40 level amidst a strengthening U.S. dollar in Forex markets. Market participants are particularly focused on the $84.00 resistance level, with potential aims to test the $85.00 mark.

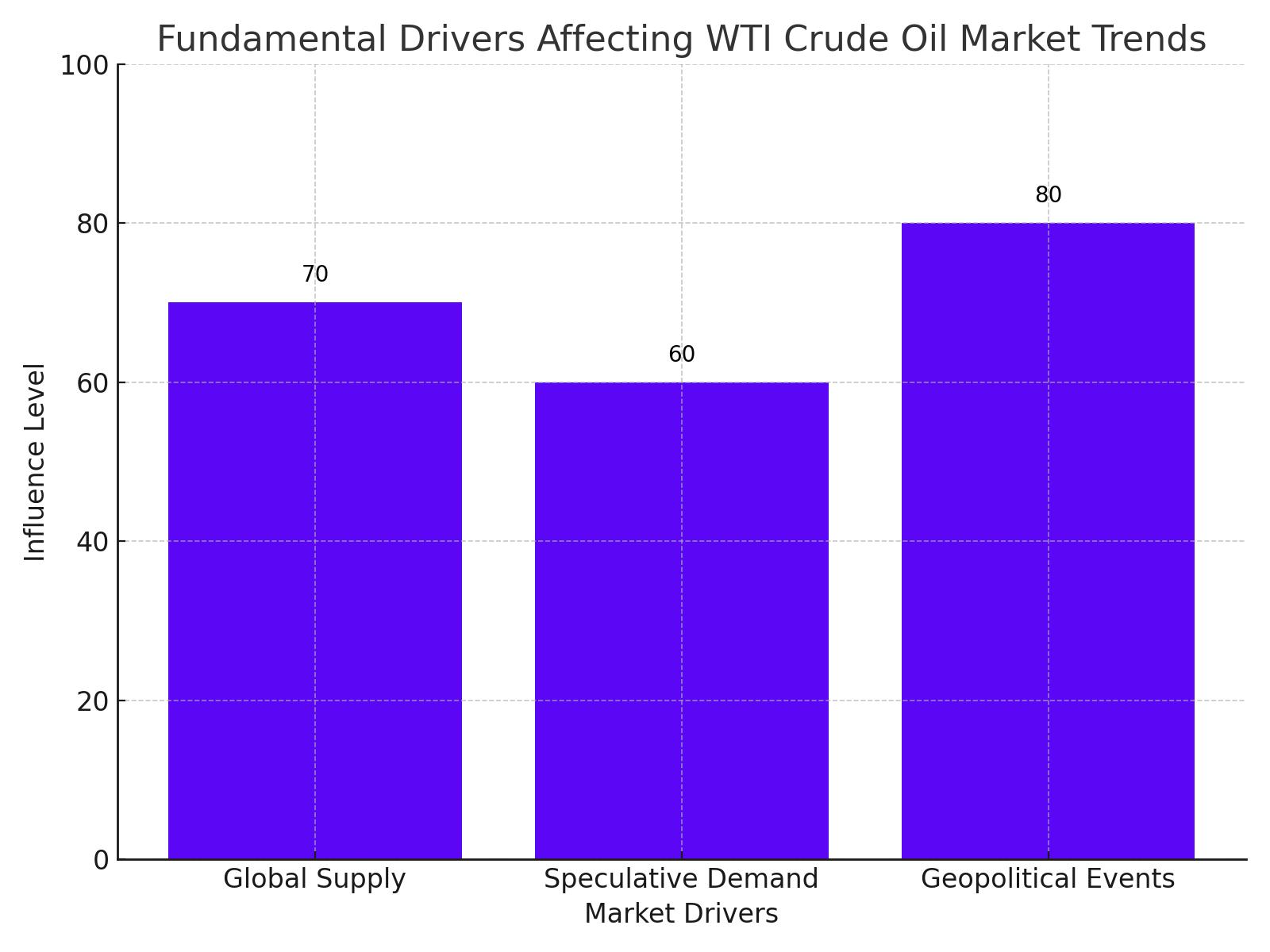

Fundamental Drivers Influencing WTI Crude Oil Market Trends

Last week's trading in the WTI Crude Oil market reflected a nuanced shift in investor focus, emphasizing the foundational role of global supply and demand factors over transient geopolitical events. Despite ongoing tensions in the Middle East, which traditionally introduce volatility into commodity markets, these were overshadowed by more systemic supply concerns and demand forecasts.

Global Supply Issues

The supply side of the crude oil equation remains tight, influenced by several factors including OPEC+ production decisions, U.S. shale output responses to price signals, and the operational status of key pipelines and shipping routes. For instance, OPEC+ adherence to production cuts has been a critical stabilizer for oil prices, and any deviation from this can introduce significant volatility into the market.

Demand Expectations

On the demand front, global economic recovery trajectories—post-pandemic—are vital in shaping oil consumption patterns. Industrial activity and energy usage in major economies such as China and the United States directly impact crude oil demand. Additionally, seasonal fluctuations in energy use, particularly in the transportation and heating sectors, play a crucial role in shaping market expectations and price movements.

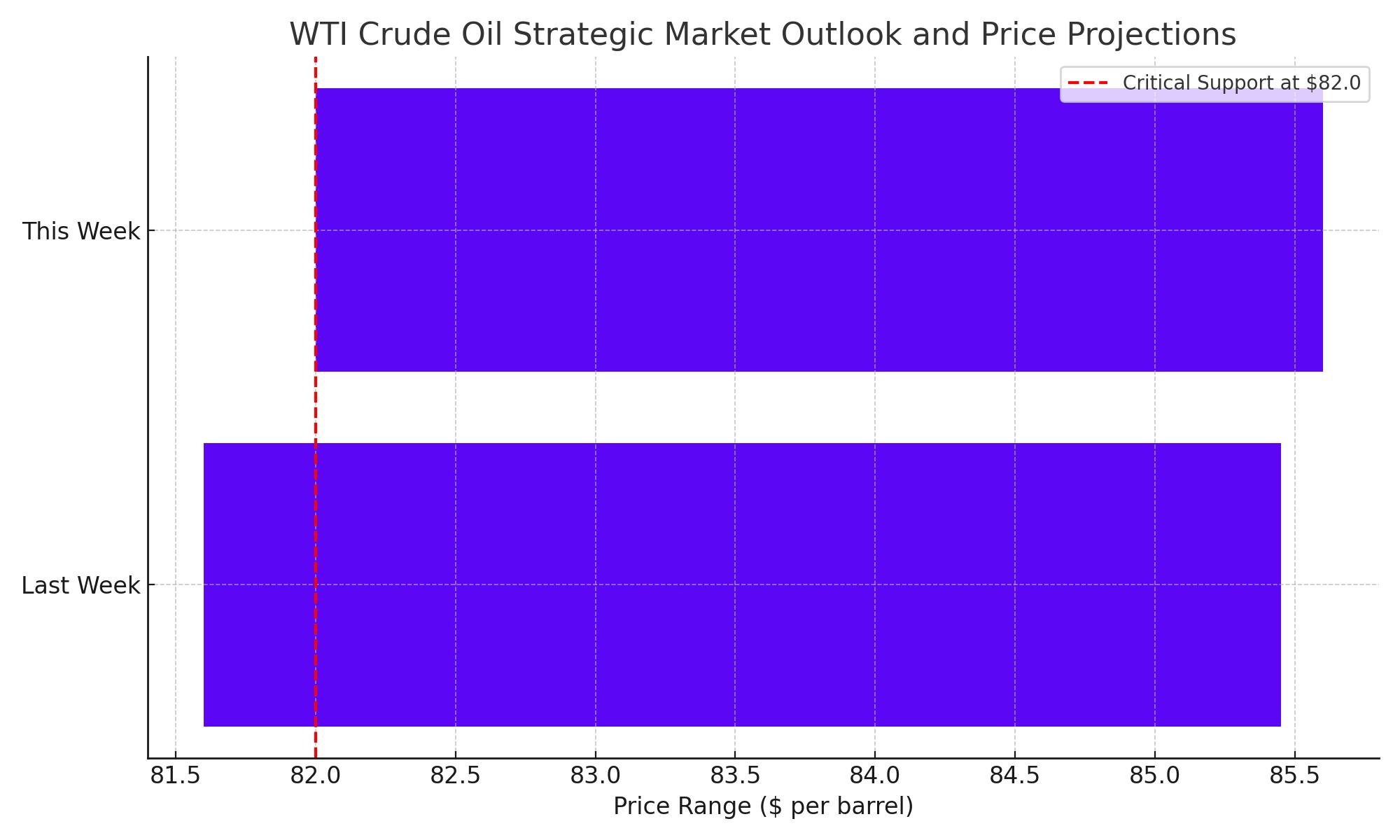

Strategic Market Outlook and Price Projections

The speculative price range for WTI Crude Oil is currently set between $81.60 and $85.45. With the forthcoming Federal Open Market Committee (FOMC) meeting, no major policy shifts are expected; however, the outcomes could influence speculative market positions, potentially affecting oil price movements. Investors and traders should brace for possible volatility, with the $82.00 level emerging as a critical support point last week. A break below this could suggest a bearish market sentiment, while sustained levels above could indicate bullish confidence.

Global Economic Indicators and Their Influence on Oil Prices

The interconnection between crude oil prices and global economic indicators cannot be overstated. Key economic data, such as the U.S. GDP growth rate and inflation metrics, play pivotal roles in shaping market expectations and oil price movements. Last week’s U.S. GDP growth rate reported at 1.6%, significantly below the anticipated 2.4%, signals potential economic cooling which might reduce oil demand forecasts. Additionally, the persistently high U.S. inflation rate, which remains above the Federal Reserve’s target, continues to exert upward pressure on the dollar, thereby impacting commodity prices, including oil.

Weekly Inventory Data as a Price Catalyst

The weekly U.S. crude inventory levels serve as a critical catalyst for oil prices. Last week, the Energy Information Administration (EIA) reported a significant drawdown of 6.4 million barrels, contrary to the expectations of an 825,000-barrel increase. This unexpected decrease is typically viewed as an indicator of robust demand or dwindling supply, which can lead to bullish behavior in commodity markets. Traders should closely monitor these inventory reports as they provide key insights into supply-demand dynamics and are often a driver of short-term price movements in the oil market.

Geopolitical Tensions and Supply Concerns

Geopolitical risks are perennial factors influencing the volatility in crude oil markets. Last week’s escalation of military actions in the Middle East, particularly the increased airstrikes by Israel in Gaza, reintroduced a risk premium into the oil market. These geopolitical events can disrupt supply chains and heighten concerns about stable supply, pushing prices upward. Traders must remain acutely aware of such developments, as the oil market is highly sensitive to supply disruptions caused by political instability in key oil-producing regions.

Currency Strength and Its Impact on Commodities

The strength of the U.S. dollar is a crucial external factor impacting crude oil prices. A stronger dollar, as seen with its recent rise to a 34-year high against the yen, makes dollar-denominated commodities like oil more expensive for foreign buyers, potentially dampening demand. This dynamic was evident last week and remains a critical consideration for traders. The relationship between the dollar and commodity prices should be a key component of any comprehensive trading strategy in the oil markets.

Anticipated Market Movements and Trader Sentiment

Looking ahead, the oil market’s trajectory appears cautiously optimistic but is riddled with potential volatility triggers. The upcoming FOMC meeting, although not expected to result in major policy shifts, will still be closely watched by traders for any indications that could sway the market sentiment. Moreover, the ongoing robust demand, as suggested by recent inventory drawdowns, supports a bullish outlook, but this must be balanced against the potential dampening effects of a strong dollar and economic slowdown concerns.

Strategic Recommendations for Market Participants

Given the complex landscape, traders should consider a strategy that includes hedging against significant price swings, especially in the face of geopolitical and economic uncertainties. Staying informed through continuous monitoring of market news, inventory levels, and economic indicators will be essential for navigating the expected market fluctuations. Engaging in technical analysis can also provide traders with insights into trend reversals and momentum, which could be crucial for making timely decisions in such a dynamic market environment.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex