Why CrowdStrike (NASDAQ:CRWD) Could Surge 28% Amid Rising Cybersecurity Demands

Unveiling CrowdStrike’s AI-powered Falcon platform, growing ARR, and its path to $484 as cybersecurity becomes a global priority | That's TradingNEWS

CrowdStrike Holdings (NASDAQ:CRWD): Positioned for Growth Amid Rising Cybersecurity Needs

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) has solidified itself as a leader in the cybersecurity industry, leveraging its cutting-edge AI-powered Falcon platform. With the growing importance of cybersecurity driven by increased threats, regulatory scrutiny, and the rapid adoption of cloud computing, CrowdStrike is poised to capture significant market share. Despite challenges like the July 2024 incident, CrowdStrike’s growth metrics, product adoption, and forward-looking strategy highlight its robust investment potential.

CrowdStrike’s Leadership in Cybersecurity

As a cloud-native cybersecurity solutions provider, CrowdStrike's flagship Falcon platform plays a pivotal role in its growth. The platform processes over 2 trillion events daily, applying machine learning to detect and neutralize cyber threats, including zero-day attacks. This ability to self-learn and scale makes Falcon one of the most powerful tools in the industry. Its recognition as a leader in the Gartner Magic Quadrant for Endpoint Protection Platforms further validates its technical superiority.

Cybersecurity has never been more critical, with the global market projected to grow from $190 billion in 2023 to $298.5 billion by 2028 at a CAGR of 9.4%. CrowdStrike’s competitive advantage lies in its ability to scale and continuously improve through its flywheel effect. As more customers adopt the Falcon platform, the system analyzes more data, improving its ability to detect threats, which in turn attracts more customers—a virtuous cycle that strengthens its market position.

Strong Financial Momentum and Growth Metrics

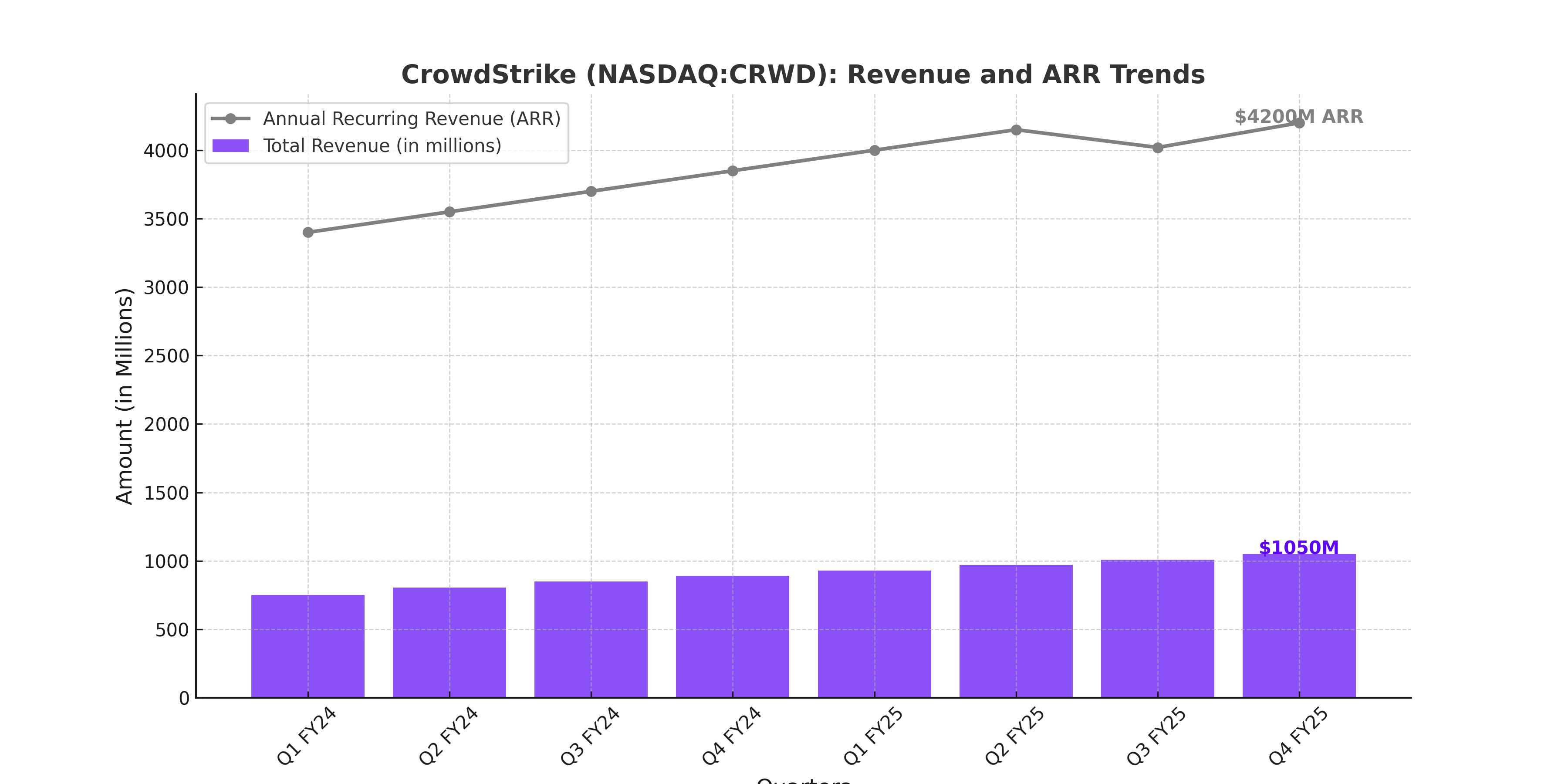

Despite the lingering effects of its July 2024 incident, CrowdStrike reported robust financial results for Q3 FY25. The company’s annual recurring revenue (ARR) grew 27% year-over-year to $4.02 billion, while total revenue for the quarter increased 29% year-over-year to $1.01 billion. Its gross retention rate of 97% and a net retention rate of 115% underscore strong customer loyalty and expanding product adoption.

The introduction of the Falcon Flex subscription model has been a key driver of growth. This model incentivizes customers to adopt more modules from CrowdStrike’s portfolio, resulting in higher average contract values. During Q3 FY25, over 150 Falcon Flex deals were closed, with these customers representing $1.3 billion in total deal value. The average Falcon Flex customer adopts nine modules, significantly above the typical contract value.

Navigating Challenges Post-July Incident

The July 2024 incident, which involved a misconfiguration update that disrupted millions of devices, led to a 15% increase in the sales cycle within enterprise accounts. This directly impacted CrowdStrike’s Net New ARR, which declined 31% year-over-year in Q3 to $153 million. Despite these headwinds, CrowdStrike has demonstrated resilience by focusing on improving customer trust and scaling operations.

The company expects these headwinds to persist in the short term, projecting a $30 million impact on Net New ARR in Q4. However, the management is confident about recovering in the latter half of FY26, driven by the growing adoption of Falcon Flex and accelerating module uptake.

Valuation and Upside Potential

CrowdStrike’s current valuation reflects its growth trajectory and potential. The stock trades at a forward price-to-earnings multiple of 86, with a projected revenue growth rate of 28.6% for FY25. As the company scales, it aims to achieve its long-term operating model, targeting a non-GAAP operating margin of 30%. If achieved, this would translate to a non-GAAP operating income of $2.96 billion by FY29, supporting its ambitious $10 billion ARR target.

Based on these growth assumptions, CrowdStrike’s fair value is estimated at $484 per share, representing a 28% upside from its current price. This valuation is supported by its leadership in cybersecurity, increasing enterprise penetration, and expanding module adoption.

Risks to Consider

While CrowdStrike’s growth prospects are promising, risks remain. Reputation is critical in the cybersecurity industry, and another incident like the one in July could significantly impact customer trust. Additionally, as competition in the sector intensifies, maintaining its technological edge will require continued investment in research and development. Regulatory changes or macroeconomic headwinds could also slow enterprise spending on cybersecurity solutions.

CrowdStrike’s Competitive Edge

What sets CrowdStrike apart is its ability to adapt and innovate. Its Falcon platform's rapid threat detection capabilities, bolstered by AI, make it indispensable in an environment of growing cyber threats. The Falcon Flex model also positions the company to benefit from enterprise vendor consolidation, as businesses seek to reduce inefficiencies from multiple cybersecurity vendors.

The company’s ability to expand its product offerings across Endpoint Security, Cloud Security, Identity Protection, and Next-Gen SIEM solutions ensures that it remains a one-stop shop for enterprise cybersecurity needs. Its growing partner ecosystem, including hyperscalers and technology integrators, further enhances its market reach.

Conclusion

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is well-positioned to achieve its $10 billion ARR target within the next five years, driven by its Falcon platform’s scalability and its growing enterprise customer base. Despite short-term challenges, the company’s strong financial performance, high customer retention rates, and innovative subscription model underscore its long-term growth potential. With a path to $484 per share, CrowdStrike offers a compelling investment opportunity in the rapidly expanding cybersecurity market. As organizations continue to prioritize cybersecurity in an increasingly digital world, CrowdStrike’s leadership and innovation make it a standout performer in the industry.

That's TradingNEWS

Read More

-

GPIQ ETF Rises on 10% Yield and AI Boom as Investors Brace for Tech Volatility

14.10.2025 · TradingNEWS ArchiveStocks

-

Ripple (XRP-USD) Stabilizes at $2.51 as Whales Buy $5.5B and ETF Outflows Shake Crypto

14.10.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Falls to $3.07 as Supply Glut and Weak Heating Outlook Hit Demand

14.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Slides to 151.80 as Trade Tensions Boost Yen Strength

14.10.2025 · TradingNEWS ArchiveForex