Why to Buy Baidu Stock (NASDAQ:BIDU) ?

Key Insights into Baidu's Growth Potential, AI Innovations, and Financial Strength | That's TradingNEWS

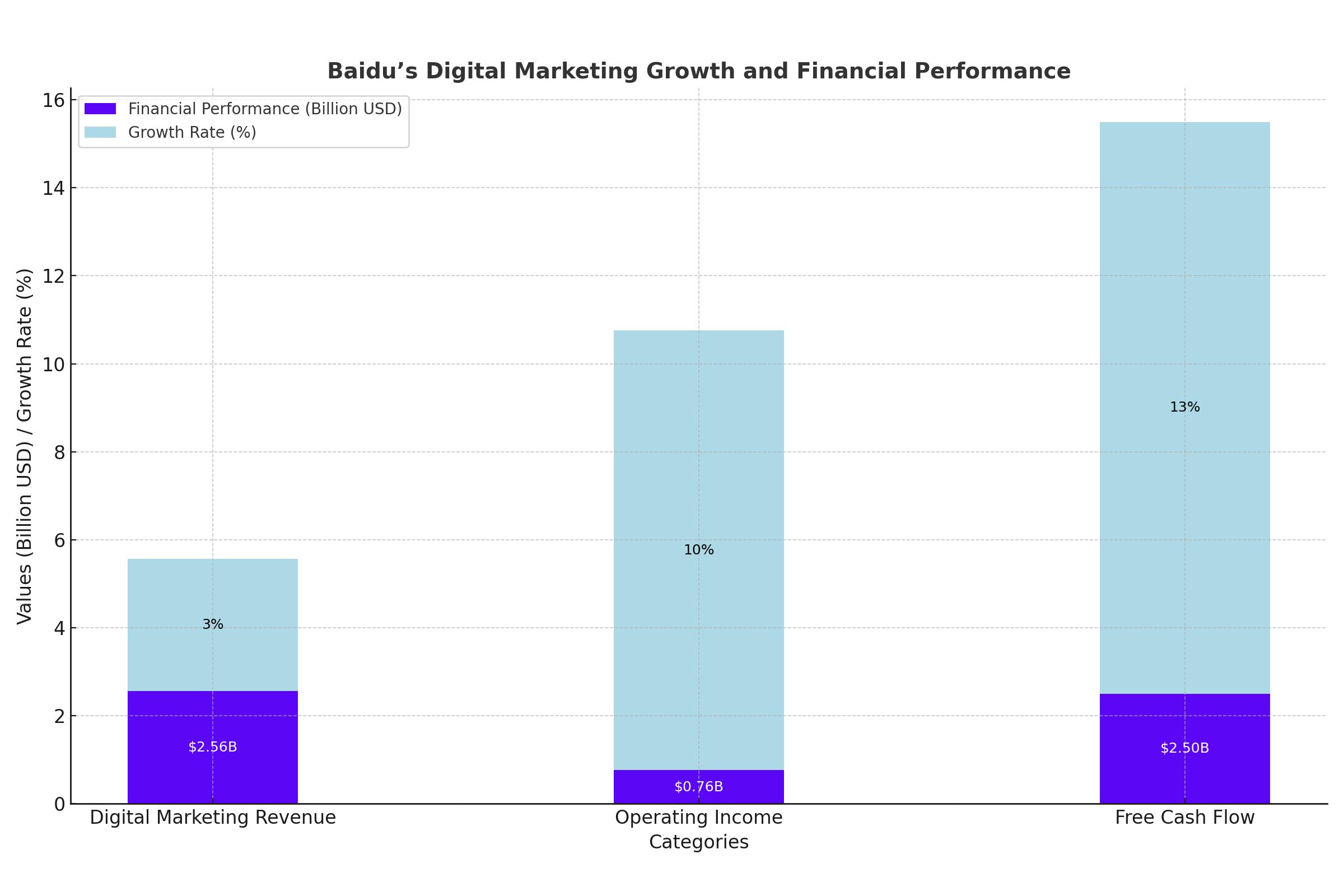

Baidu’s Digital Marketing Growth

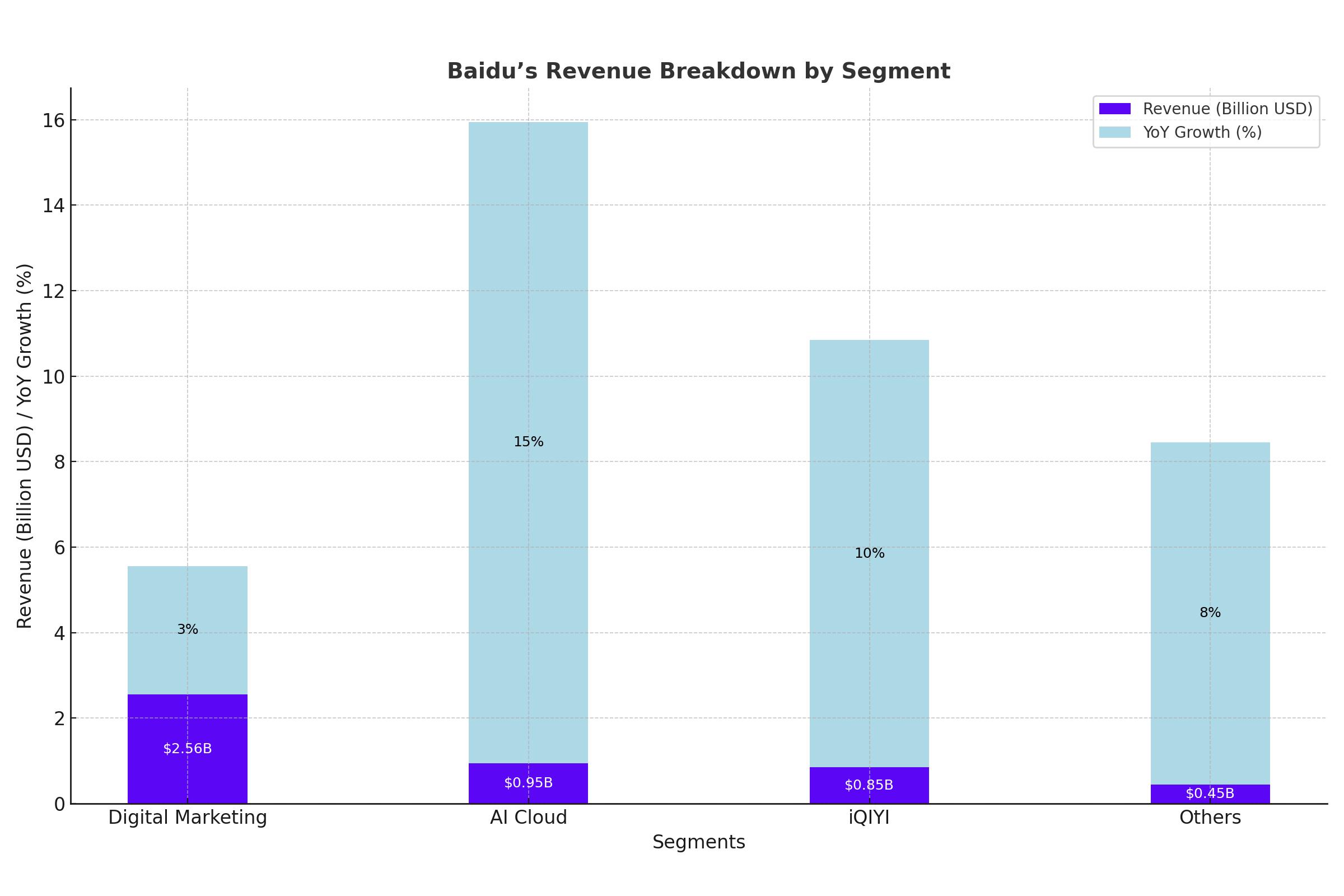

Baidu's (NASDAQ:BIDU) digital marketing business remains a cornerstone of its revenue, generating 18.5B Chinese Yuan ($2.56B) in Q1'24. This represents a year-over-year growth rate of 3%, indicating steady progress despite a challenging macroeconomic environment. The company's operating income from this segment was 5.48B Chinese Yuan ($760M), showcasing a 10% Y/Y growth rate. This robust performance underscores Baidu's dominant position in China's search engine market, which continues to benefit from increased digital advertising spend.

AI Innovations and Autonomous Driving

Baidu's transition to an AI-first company is marked by significant investments in its large language model, ERNIE. This model enhances Baidu’s consumer and business segments, improving user experience and advertiser ROI. Additionally, Baidu's autonomous driving technology, Apollo Go, reported 826,000 rides in Q1 2024, reflecting a 25% Y/Y growth. The robotaxi service is approaching unit economics breakeven, particularly in Wuhan, where it operates 24/7.

Financial Performance and Free Cash Flow

Baidu’s free cash flow remains strong, with significant contributions from its video streaming platform iQIYI, which has over 500M monthly active users. iQIYI contributed $127M to Baidu's consolidated free cash flow in the latest quarter. Overall, Baidu achieved a free cash flow margin of 13% in Q1, aligning with its goal of approximately $2.5B in free cash flow for the year. This financial strength supports the potential for increased stock buybacks and capital returns to shareholders.

Valuation and Market Sentiment

Despite Baidu’s strong financial performance and strategic initiatives, the stock trades at a relatively low valuation. With a current P/E ratio of 7.4X, Baidu offers an earnings yield of 14%, significantly lower than its historical average P/E of 14.8X. This undervaluation is largely due to persistent investor skepticism towards Chinese tech companies. However, this presents a potential upside for long-term investors if the market re-evaluates Baidu's intrinsic value.

Insider Transactions and Institutional Holdings

Insider ownership in Baidu is significant, with CEO Yanhong Li holding 19% of shares outstanding. This aligns management’s interests with those of shareholders. Institutional investors own 42% of Baidu’s shares, indicating confidence among professional investors. Major institutions include The Vanguard Group, Inc., and BlackRock, Inc., which hold 3.2% and 3.1% of shares, respectively.

Risks and Challenges

Investing in Baidu comes with several risks, primarily related to its operations in China. Geopolitical tensions between China and the U.S., regulatory scrutiny, and currency risks are key factors that could impact Baidu’s performance. Additionally, the company's reliance on its online marketing business, which accounted for 59% of total revenues in Q1'24, poses a risk if growth in this segment stalls.

Read More

-

Stock Market Today: 4.3% GDP Beat Pins SPX at 6,880 as Gold (XAU/USD) Blasts Above $4,500

23.12.2025 · TradingNEWS ArchiveStocks

-

Bitcoin Price Forecast (BTC-USD): $85K Support Line Before a Push Toward $105K

23.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Stays Pinned Near $4 as LNG Pull Beats Warm Weather

22.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Pulls Back to 156.95 After 157.75 Spike as BoJ Hike Triggers Intervention Alarm

22.12.2025 · TradingNEWS ArchiveForex