Will Microsoft (NASDAQ:MSFT) Surge to $530? AI Expansion, Azure Growth, and Earnings Outlook

Microsoft’s AI Strategy, Cloud Dominance, and Copilot Growth—How High Can MSFT Go? | That's TradingNEWS

Microsoft (NASDAQ:MSFT): Can It Surpass $530 in 2025? A Deep Dive into AI, Cloud, and Market Strategy

Microsoft’s AI Evolution: Is It Leaving OpenAI Behind?

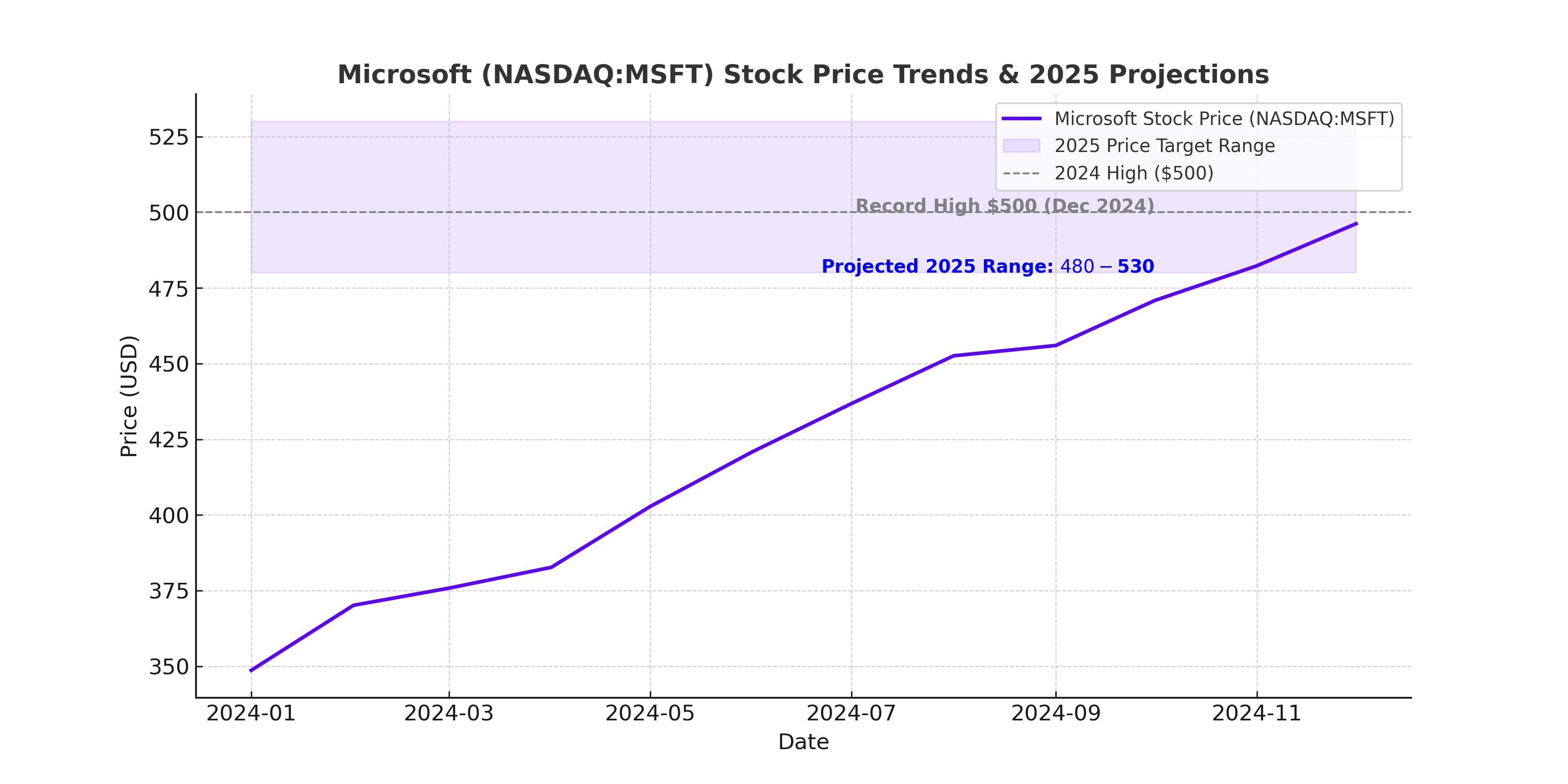

Microsoft (NASDAQ:MSFT) has been a dominant force in tech for decades, but in 2025, the company faces a critical inflection point. With AI driving its future, Microsoft's reliance on OpenAI is now under scrutiny. Is MSFT shifting gears to develop its own AI ecosystem, or is it doubling down on its partnership with OpenAI? This question is central to the stock's potential upside, with analysts eyeing a price target of $530—a 20% upside from current levels.

Microsoft’s AI Ambitions: A Threat to OpenAI?

Microsoft’s strategic moves in artificial intelligence indicate a shift. In 2024, the company hired key Inflection AI talent, signaling that it wants control over its own AI capabilities rather than solely depending on OpenAI. More recently, Microsoft unveiled Phi-3-mini, a small but powerful AI model that outperformed OpenAI’s o1 in mathematics benchmarks.

This shift matters because it reduces Microsoft’s dependence on OpenAI’s expensive models. OpenAI’s latest o1 model costs 12 times more to run than its predecessor, making it costly for widespread enterprise adoption. By optimizing AI costs, Microsoft can integrate AI deeper into its Office 365 and Azure products, making AI adoption more practical and profitable.

Azure’s Dominance: Can Microsoft Keep Outpacing AWS?

Microsoft’s cloud revenue surged 33% in Q1 2025, outpacing AWS and almost matching Google Cloud's 35% growth. Azure’s aggressive push into AI-driven enterprise services has solidified its position as the leader in AI cloud adoption.

CEO Satya Nadella has emphasized that Azure is not just a cloud platform but an AI deployment ecosystem. Microsoft’s unique edge lies in its seamless integration of AI with enterprise workflows, from Azure AI services to Copilot integrations in Microsoft 365.

The growth potential is enormous. If Azure maintains this pace, analysts predict it will surpass AWS in market share by 2026. Given that cloud computing and AI are Microsoft’s biggest growth drivers, this could be the stock’s most significant long-term catalyst.

Microsoft 365 Copilot: The Next Billion-Dollar AI Play?

Microsoft 365 Copilot has already been adopted by 70% of Fortune 500 companies, but its growth potential is just getting started. The pricing structure suggests an enormous revenue opportunity:

- Every $1 increase in Microsoft 365 subscriptions translates to $4.5 billion in additional annual revenue.

- A $30 annual Copilot price increase on consumer users alone adds $2.5 billion in revenue.

The issue? AI costs are still high, making Copilot’s full-scale rollout expensive. But if Microsoft continues developing cheaper, smaller AI models, Copilot adoption could skyrocket.

Is Microsoft’s AI Spending Too Aggressive?

Microsoft’s AI investments are massive, with $80 billion in planned capital expenditures for 2025. This spending is outpacing AWS and Google Cloud, raising concerns about the stock’s near-term valuation.

However, unlike Amazon and Google, Microsoft isn’t just building AI models—it’s creating a comprehensive AI ecosystem. The company integrates AI across Azure, Office, LinkedIn, and Dynamics, ensuring that AI adoption translates into recurring, high-margin revenue streams.

Financials: Can Microsoft Justify Its Valuation?

Microsoft currently trades at 32.5x forward earnings and 28x 2026 earnings estimates. Historically, MSFT has commanded a mid-30s multiple, meaning the current valuation is actually slightly discounted.

- Q1 2025 Revenue: $65.6 billion (+16%)

- Azure Growth: +33%

- Operating Income: $30.5 billion (+10%)

- EPS Growth: +10%

With free cash flow impacted by high capital expenditures, some investors are cautious. However, if AI investments start yielding higher efficiency and monetization, expect margin expansion and multiple rerating.

Microsoft Stock Forecast: Is It a Buy at $444?

With Azure’s continued growth, Copilot monetization, and AI cost optimizations, Microsoft is positioned for significant upside. If Microsoft’s AI investments pay off faster than expected, the stock could surge to $530 by the end of 2025.

Investors should watch:

- Azure market share vs. AWS and Google Cloud

- AI adoption rates in Microsoft 365 and Copilot revenue trends

- The evolution of Microsoft’s in-house AI models

Final Verdict: Should You Buy, Hold, or Sell NASDAQ:MSFT?

Microsoft remains a dominant force in AI and cloud computing, with a clear path to long-term revenue expansion. With analysts predicting at least 20% upside, MSFT is a strong buy for long-term investors looking to capitalize on the next AI-driven market cycle.

Stock Rating: Strong Buy

Price Target: $530 (20% upside)

AI Disruption Risk: Low

Growth Catalysts: AI monetization, Azure expansion, Copilot revenue

With AI reshaping the tech landscape, Microsoft’s strategic positioning makes it one of the best long-term investments in the market today.

That's TradingNEWS

Read More

-

GPIQ ETF Rises on 10% Yield and AI Boom as Investors Brace for Tech Volatility

14.10.2025 · TradingNEWS ArchiveStocks

-

Ripple (XRP-USD) Stabilizes at $2.51 as Whales Buy $5.5B and ETF Outflows Shake Crypto

14.10.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Falls to $3.07 as Supply Glut and Weak Heating Outlook Hit Demand

14.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Slides to 151.80 as Trade Tensions Boost Yen Strength

14.10.2025 · TradingNEWS ArchiveForex