The broader context reveals a market caught between the European Central Bank’s potential rate cuts and similar moves from the Federal Reserve. This uncertainty is leading to choppy, range-bound trading, with the EUR/USD oscillating within a tight range.

Political Influences on EUR/USD

The US dollar’s retreat appears to be influenced by political factors, particularly as the Democratic National Convention (DNC) begins. Democratic Presidential Candidate Kamala Harris has gained a lead in the polls, and her proposed economic agenda, which includes inflationary measures, is creating headwinds for the dollar. This political backdrop could explain part of the recent weakness in the greenback, providing support to the EUR/USD pair.

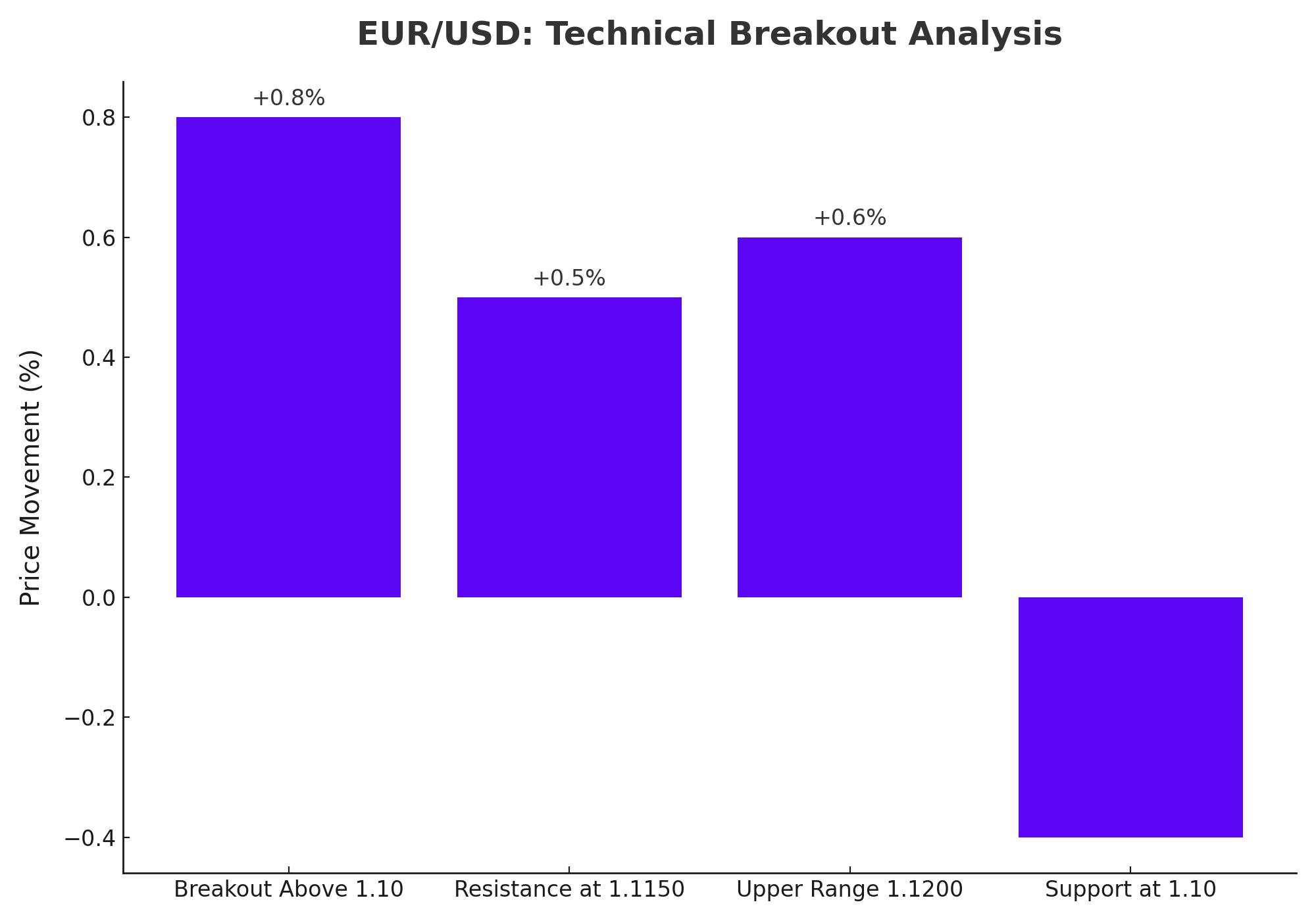

Breakout or Fakeout? EUR/USD Technical Analysis

Last week, EUR/USD broke out of a long-term consolidation pattern, moving above the key psychological resistance at 1.10. This breakout, following a period of lower highs and higher lows, could signal further bullish momentum. The next resistance levels to watch are 1.1150 and the upper 1.1200s, which correspond to the highs from July and December 2023. However, a break below 1.10 would cast doubt on the near-term bullish outlook.

Economic Factors at Play

Despite a relatively barren economic calendar, EUR/USD has continued its advance, reaching new 2024 highs of 1.1049. The market’s optimism is driven by expectations of a Federal Reserve rate cut in September, following easing inflationary pressures and resilient US economic data. This optimism has bolstered risk appetite, keeping the EUR/USD near its highs.

However, the absence of significant macroeconomic data this week could limit further gains. Fed Board members, including Neel Kashkari, have indicated that while inflation is moderating, the labor market remains a concern. Kashkari’s remarks suggest that the balance of risks is shifting away from inflation and towards labor market stability, which could influence future monetary policy decisions.

EUR/USD: Short-Term Technical Outlook

From a technical perspective, the EUR/USD pair remains under bullish control, albeit with some caution. The daily chart shows that technical indicators have turned flat near overbought levels, but the pair continues to trade well above its moving averages. The 20-day Simple Moving Average (SMA) is gaining bullish traction around 1.0900, reinforcing the upward trend.

In the short term, the 4-hour chart reflects a similar picture, with technical indicators flattening but remaining in positive territory. The Relative Strength Index (RSI) hovers near overbought levels, while the Momentum indicator remains neutral. All moving averages are trending higher, suggesting that bulls still dominate the market.

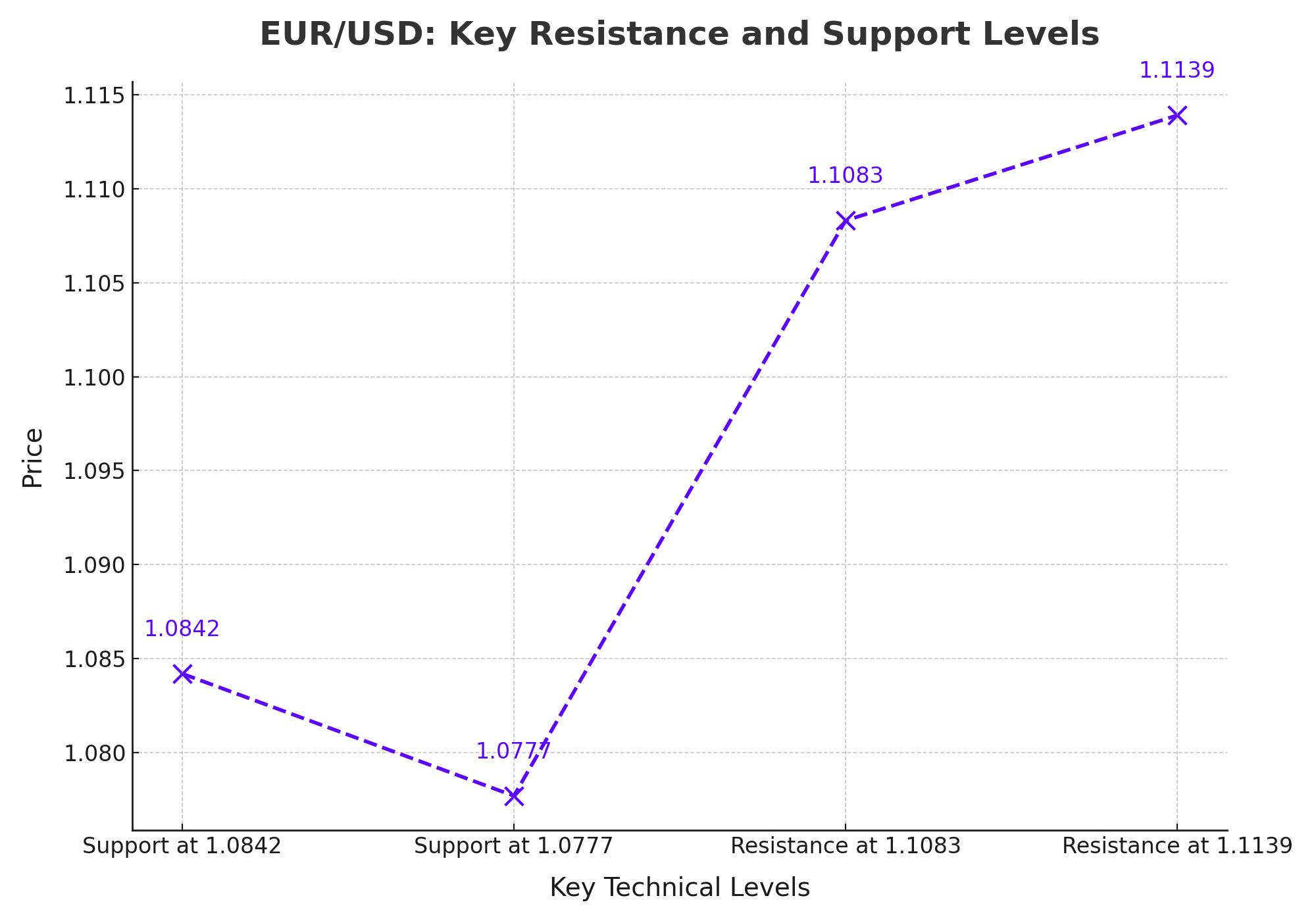

Key Resistance and Support Levels

The EUR/USD pair extended its gains to reach a new 2024 high around 1.1080 on Monday, driven by the weakening US dollar. The next resistance levels to watch are 1.1083 (the August 19 high) and 1.1139 (the December 2023 high). On the downside, support is seen at the 200-day SMA at 1.0842, followed by the weekly low of 1.0777 and the June low of 1.0666. The pair's upward trend is likely to continue as long as it remains above the 200-day SMA.

Market Sentiment and Future Outlook

The market’s focus will shift to the upcoming Federal Open Market Committee (FOMC) Minutes and Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium. These events could provide crucial insights into the Federal Reserve's monetary policy direction, influencing the EUR/USD pair's future trajectory.

Overall, the EUR/USD is navigating a complex landscape of political, economic, and technical factors. While the pair remains in a bullish trend, caution is warranted as the market awaits further clarity on the direction of US and European monetary policies.