EUR/USD Faces Resistance at 1.0535 – Will the Fed Trigger a Breakout or a Pullback?

Can EUR/USD Hold Above 1.0480 and Rally Higher, or Will Weak Eurozone Data Drag It Down? | That's TradingNEWS

EUR/USD Faces Key Resistance Levels as Dollar Weakens – Can the Euro Hold Its Ground?

EUR/USD Gains as US Dollar Weakens Amid Economic Concerns

The EUR/USD pair is trading near 1.0480, gaining traction as the US dollar remains under pressure following weak economic data. The US Dollar Index (DXY) has fallen below 106.70, reflecting growing uncertainty about US economic strength. Soft US PMI data showed that the service sector is contracting, with the Flash Services PMI dropping to 49.7, below the expected 53.0. Consumer confidence is also showing signs of weakness, as the University of Michigan’s Consumer Sentiment Index fell to 64.7, well below the market forecast of 67.8. These figures have fueled speculation that the Federal Reserve may be forced to adjust its monetary policy sooner than anticipated, putting further pressure on the US dollar.

Political Uncertainty in Germany Adds to Euro Volatility

Political uncertainty in Germany is also playing a role in EUR/USD price movements. The German elections have created market volatility, with the unexpected strong performance of the AfD party, which secured 20.8% of the vote. This result has added uncertainty about the future direction of German fiscal policy, particularly regarding the debt brake policy, which limits government spending. The CDU/CSU alliance, which won 28.5% of the vote, is likely to push for strict fiscal discipline, which could support the euro in the long term. However, uncertainty surrounding the formation of a coalition government could create short-term volatility.

Eurozone Inflation Data in Focus

The Eurozone CPI print remains a key factor for traders. The final inflation reading will determine whether the European Central Bank (ECB) remains on track with its current stance or if adjustments are needed. If inflation remains elevated, the ECB may signal a more hawkish policy, supporting EUR/USD. However, a weaker inflation figure could renew concerns about slowing economic growth in the Eurozone, limiting upside potential for the euro.

US Tariffs and Fed Rate Policy Remain Key Risks for EUR/USD

Another factor impacting EUR/USD is the looming risk of additional US trade tariffs. The Biden administration is considering new tariffs on European goods, which could weigh on the euro if implemented. At the same time, the Federal Reserve’s cautious stance on rate cuts has led to increased speculation in the market. If the Fed signals a delay in cutting interest rates, the US dollar could regain strength, limiting EUR/USD gains.

Technical Analysis: Can EUR/USD Break Above 1.0535?

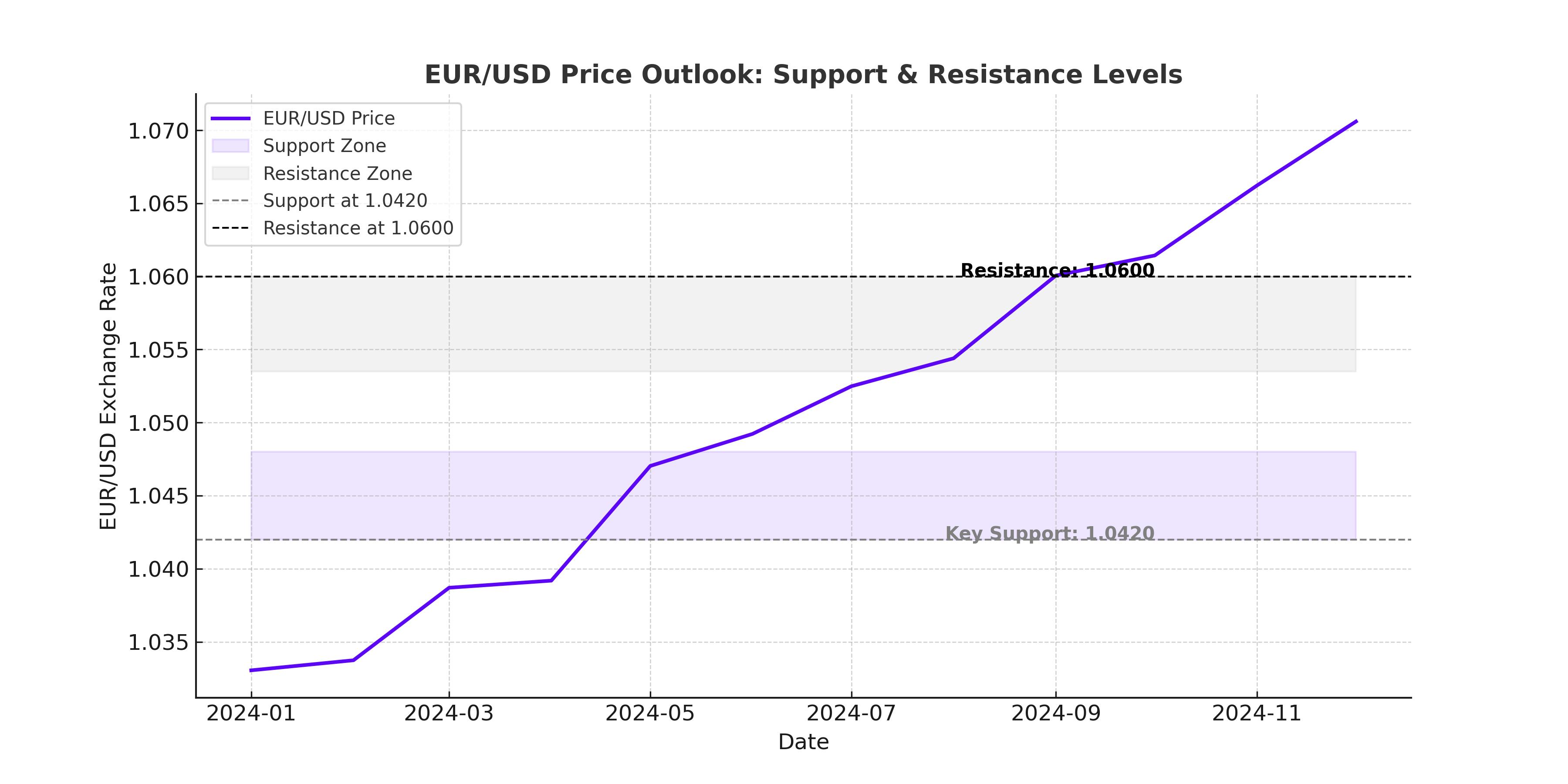

The EUR/USD pair is currently testing resistance near 1.0530, just below the 100-day Simple Moving Average (SMA). A break above 1.0535-1.0540 could trigger further upside momentum, with the next key resistance at 1.0600, followed by 1.0620. Beyond this level, a sustained move higher could push EUR/USD toward the 1.0700 mark, aligning with the 50% Fibonacci retracement level. Further gains could take the pair to 1.0750, with the final upside target near 1.0815 (the 61.8% Fibonacci retracement level).

On the downside, EUR/USD needs to hold support at 1.0500 to maintain its current momentum. A break below this level could see the pair testing 1.0460, followed by 1.0420. If selling pressure intensifies, EUR/USD could decline further toward 1.0340 before potentially dropping to the key psychological support at 1.0300.

The Relative Strength Index (RSI) remains in positive territory but is starting to flatten, suggesting that bullish momentum may be fading. The MACD indicator is also showing signs of consolidation, reinforcing the idea that EUR/USD may struggle to break higher without a fresh catalyst.

US Economic Data Could Determine EUR/USD's Next Move

Looking ahead, key US economic data releases this week could determine EUR/USD direction. The CB Consumer Confidence Index, due on Tuesday, is expected to decline slightly to 103.3, down from the previous 104.1 reading. If consumer confidence drops more than expected, the US dollar could face renewed selling pressure.

The Preliminary US GDP report on Thursday will also be closely watched, with expectations for a 2.3% growth rate. A weaker-than-expected GDP figure could reinforce concerns about slowing economic activity in the US, boosting EUR/USD.

The Core PCE Price Index, the Federal Reserve's preferred inflation measure, is due on Friday. A hotter-than-expected reading (above the 0.3% forecast) could force the Fed to remain hawkish, potentially strengthening the dollar and weighing on EUR/USD.

Can EUR/USD Hold Above 1.0480 and Extend Its Rally?

The EUR/USD pair has seen mild gains, but bullish momentum is being tested as it struggles to break past key resistance levels. The 100-day SMA remains a major hurdle, and unless the pair clears 1.0535-1.0540, upside potential remains limited.

If the euro can hold above 1.0480 and break higher, EUR/USD could extend its rally toward 1.0600 and beyond. However, failure to maintain support could see the pair slipping back toward 1.0450, reinforcing a more cautious outlook.

With the US dollar under pressure due to weaker economic data, and political uncertainty in Germany adding another layer of volatility, traders should remain cautious. EUR/USD remains at a critical juncture, and the next few trading sessions will be key in determining its near-term direction.

That's TradingNEWS

Read More

-

GPIX ETF Climbs to $52.54 as 8% Yield Turns S&P 500 Volatility Into Income

02.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI $11.54, XRPR $16.35 And XRP-USD At $1.99 Aim For A $5–$8 Cycle

02.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Tests $3.50–$3.60 Floor Before LNG Wave

02.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds Near 157 as BoJ Caution and Fed Cut Bets Drive the Move

02.01.2026 · TradingNEWS ArchiveForex