EUR/USD Trends: Bearish Momentum Strengthens Amid Economic Shifts

The EUR/USD pair has continued to face downward pressure in recent sessions, with a clear decline from the recent high of 1.1213. As of the latest analysis, the pair has fallen below the 1.0990 mark, forming a potential double-top pattern that suggests further downside risk. This bearish outlook is reinforced by broader macroeconomic factors, including the Federal Reserve's strong stance on interest rates and ongoing geopolitical tensions, which have favored the U.S. dollar (USD) over the euro (EUR).

Key Support Levels and Technical Outlook

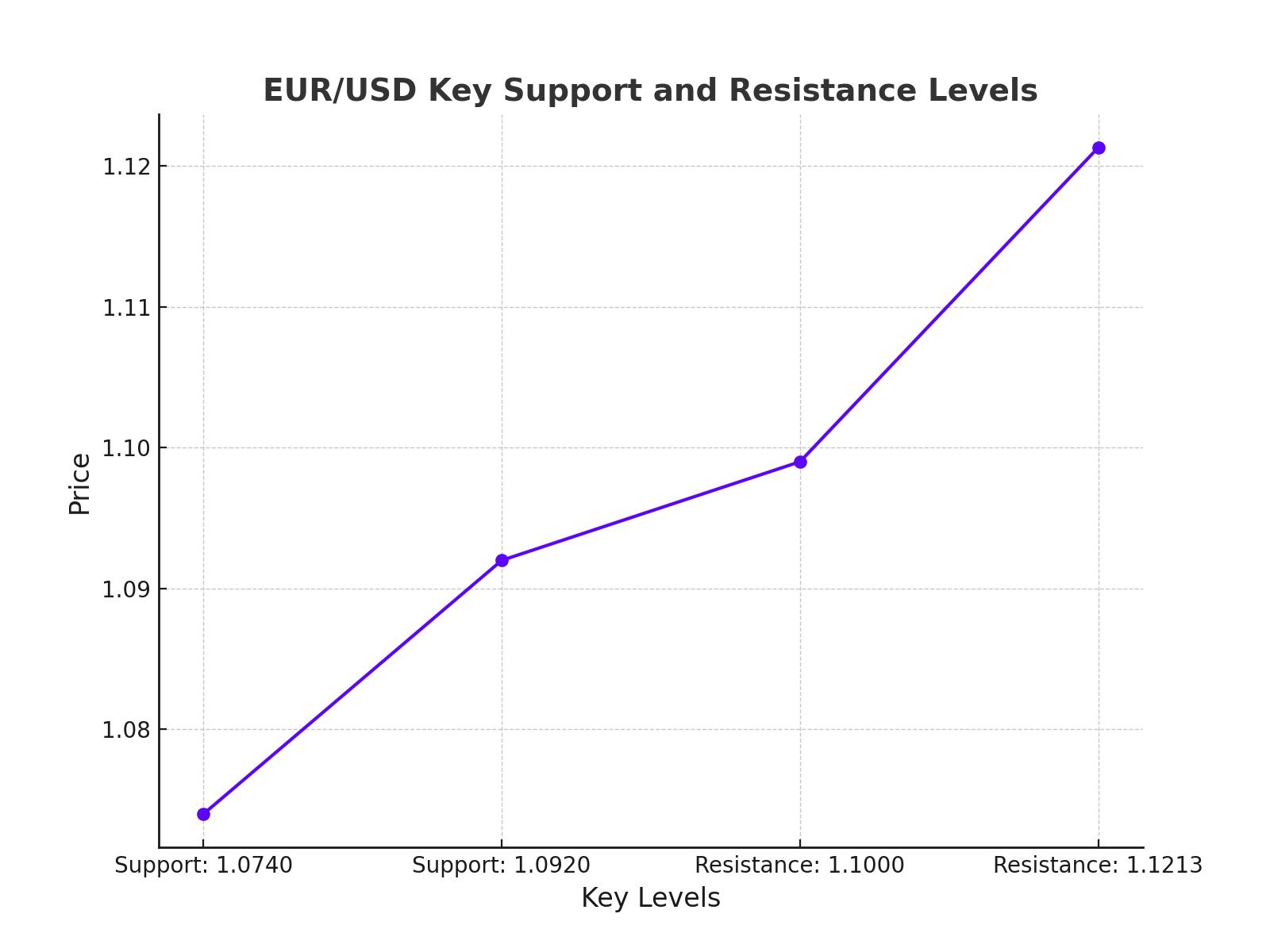

The technical outlook for EUR/USD indicates a deepening bearish trend. The pair has already tested the 38.2% retracement level of the uptrend from 1.0447 to 1.1213, with the next critical support level at 1.0920. A sustained break below this point could lead to further declines towards the 61.8% retracement level at 1.0740.

Additionally, the pair failed to maintain the psychological support level at 1.1000, further solidifying the bearish sentiment. The Relative Strength Index (RSI) has fallen below the neutral 50 level, indicating growing downside momentum. If the 1.0920 support fails, a deeper correction could see the pair testing lows near 1.0840, potentially even challenging the yearly low at 1.0740.

Impact of U.S. Economic Data and Federal Reserve Policy

The strong U.S. economic performance, as highlighted by recent jobs data, has been a significant factor driving the dollar higher. The U.S. added 254,000 jobs in September, surpassing expectations and pushing the unemployment rate down to 4.1%. These figures suggest that the U.S. economy remains resilient, despite global uncertainties, making it less likely that the Federal Reserve will aggressively cut rates in the short term.

Market expectations now suggest a 95% chance of a 25 basis points (bps) cut by the Fed in November, down from 50 bps as was previously anticipated. The shift in sentiment has favored the USD, driving the EUR/USD pair lower as investors anticipate a slower pace of rate cuts, which has supported the dollar.

Geopolitical Tensions and the Safe-Haven Dollar

Ongoing geopolitical instability, particularly in the Middle East, has added to the EUR/USD pair's downside pressure. With conflict escalating between Israel and Iran, the demand for safe-haven assets like the U.S. dollar has increased. This shift towards the dollar is exacerbating the euro’s weakness, especially given the eurozone’s economic fragility.

In response to the latest tensions, the Brent crude oil price surged by 8% last week, the largest weekly gain since early January 2023, further highlighting the risk-off sentiment in the market. Meanwhile, the Dollar Index (DXY), which measures the greenback against a basket of major currencies, gained more than 2%, hitting a seven-week high.

Eurozone Economic Weakness: Inflation and ECB Rate Cuts

The euro's struggles are not solely due to the dollar's strength; weaknesses within the eurozone are also contributing. Eurozone inflation has been falling steadily, with the latest data showing a drop to 1.8% in September from 2.2% in August. This has bolstered expectations that the European Central Bank (ECB) will continue cutting rates, further weighing on the EUR/USD pair.

Weak economic data across core eurozone economies, especially Germany and France, have also fueled speculation of a more aggressive monetary policy shift by the ECB. With markets pricing in an additional rate cut by the ECB in October, the outlook for the euro remains bleak.

Long-Term Outlook: Is There Room for Recovery?

Despite the prevailing bearish sentiment, some technical indicators suggest that the euro could find support at key levels in the medium term. For instance, if the pair can hold above the 1.0920 support, there could be an opportunity for a corrective rebound towards the 1.1039 resistance level. However, this recovery is highly dependent on broader market sentiment and economic data, particularly from the U.S. and eurozone.

The 50-day simple moving average (SMA) at 1.1050 remains a key level to watch. If EUR/USD can reclaim this level, the bulls may attempt to push the pair back towards the 1.1200 region, though this seems unlikely given the current macroeconomic backdrop.

Bank of England and Euro Sterling Cross

While much of the focus is on the EUR/USD pair, the EUR/GBP cross is also experiencing notable moves. The British pound (GBP) has been relatively resilient despite dovish comments from Bank of England (BoE) Governor Andrew Bailey, who indicated that the central bank may cut rates cautiously. In contrast, the ECB is expected to cut rates more aggressively, leading to a stronger pound relative to the euro. This has added further downside pressure to the euro, both against the dollar and sterling.

Conclusion: Bearish Bias Dominates EUR/USD

In conclusion, the EUR/USD pair remains firmly entrenched in a bearish trend, with little sign of an immediate recovery. Key factors, including a resilient U.S. economy, Federal Reserve policy, and eurozone economic weakness, are all aligning to favor the dollar over the euro.

Investors should closely watch the 1.0920 support level, as a break below could signal deeper declines towards 1.0740. Conversely, any bullish attempts will face significant resistance at 1.1039, with only a sustained move above this level potentially altering the bearish outlook. However, given the broader macroeconomic conditions, the EUR/USD pair is likely to remain under pressure in the near term.