EUR/USD Market Analysis: U.S. Recession Signals and Economic Data

Key Support and Resistance Levels, Recession Indicators, and Economic Data Shape EUR/USD Outlook | That's TradingNEWS

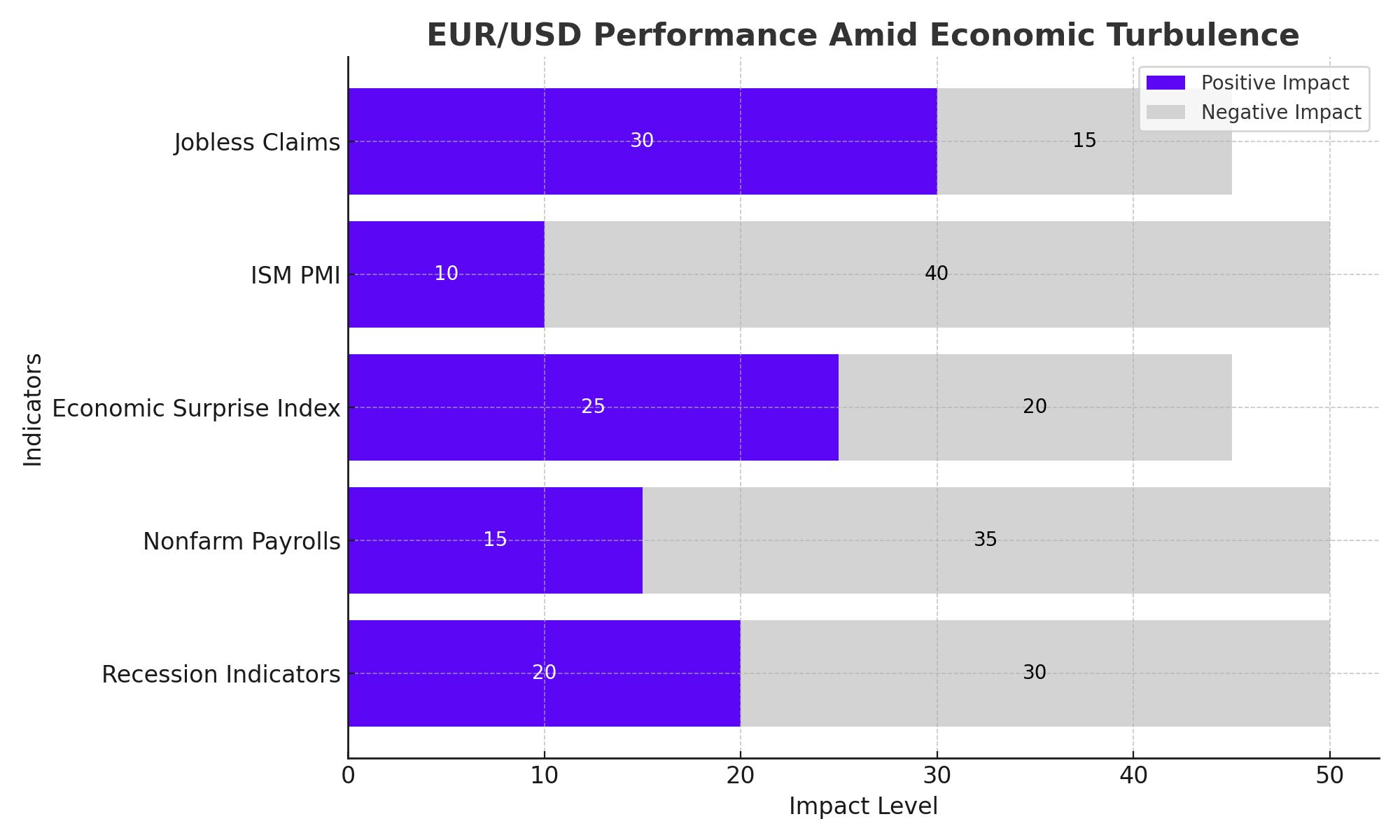

EUR/USD Performance Amid Economic Turbulence

Recession Indicators Flashing Red

Current economic data suggests the U.S. may be approaching a recession, significantly impacting EUR/USD movements. The ‘Sahm rule,’ triggered by the recent nonfarm payrolls report, indicates a rising unemployment rate, predicting economic downturns effectively. Furthermore, the 2s-10s yield curve is nearing disinversion, reflecting market expectations of Fed rate cuts. Traders now expect 200 basis points in cuts by June 2025, up from 50 basis points a few months ago, reflecting rapid market sentiment shifts.

Economic Data and Market Sentiment

Aggregate U.S. economic data, as measured by Citi’s economic surprise index, has consistently undershot expectations, indicating persistent economic weakness. This deterioration has narrowed the U.S. yield advantage over German bonds, affecting EUR/USD dynamics. The EUR/USD pair tends to react inversely to U.S. economic data and sentiment, with a weak labor market and lower-than-expected economic performance boosting the euro.

Impact of ISM Non-Manufacturing PMI

The upcoming ISM non-manufacturing PMI is pivotal for EUR/USD. Last week's manufacturing PMI exacerbated downturn fears, making this release crucial for sentiment. A PMI confirming recessionary signals could extend recent market moves, while a more robust reading might trigger a reversal. Additionally, jobless claims data on Thursday will likely influence market reactions, further impacting EUR/USD.

Technical Analysis of EUR/USD

Technically, EUR/USD shows potential for bullish movements following a sharp reversal on Friday. RSI breaking its downtrend and a potential bullish MACD signal suggest a retest of the July high at 1.0948. If this level breaks, further upside targets include 1.1000 and 1.1140. Conversely, strong horizontal support at 1.0800 has consistently thwarted bearish attempts, supported by proximity to the 50 and 200-day moving averages.

Broader Market Movements and Currency Crosses

Recent events like the dovish Federal Reserve stance and lower-than-expected U.S. economic data have weakened the U.S. dollar, benefitting the euro. The Fed's indication of possible rate cuts by September and poor labor market data have driven yields down, significantly affecting currency dynamics. This dovish outlook on the dollar, combined with weaker U.S. economic indicators, supports a stronger EUR/USD.

Comparative Analysis with Other Currency Pairs

EUR/USD’s performance is also seen against movements in other currency pairs. For instance, the USD/CHF pair showed significant bearish movements, while JPY pairs, particularly those involving the Australian and Canadian dollars, demonstrated notable volatility. These comparisons highlight the broader impact of U.S. economic data on global currency markets.

Economic Outlook and Strategic Positioning

The Federal Reserve's recent policy decisions and economic data point towards potential rate cuts, influencing EUR/USD positively. Lower interest rates reduce borrowing costs, stimulate economic activity, and typically weaken the U.S. dollar. However, investors must remain vigilant of inflation, employment data, and geopolitical tensions, which can introduce volatility and impact EUR/USD dynamics.

Conclusion

The EUR/USD pair's future is closely tied to specific U.S. economic indicators and Federal Reserve decisions. Recent weak economic data, such as the nonfarm payrolls report showing only 114,000 jobs added in July against expectations of 175,000, increases the likelihood of upcoming rate cuts. This scenario supports a bullish outlook for EUR/USD. However, traders should keep an eye on critical resistance levels, particularly around 1.0948 and 1.1000, as well as broader economic factors like inflation and geopolitical tensions, to successfully navigate this trading environment.

That's TradingNEWS

Read More

-

GPIX ETF Climbs to $52.54 as 8% Yield Turns S&P 500 Volatility Into Income

02.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI $11.54, XRPR $16.35 And XRP-USD At $1.99 Aim For A $5–$8 Cycle

02.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Tests $3.50–$3.60 Floor Before LNG Wave

02.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds Near 157 as BoJ Caution and Fed Cut Bets Drive the Move

02.01.2026 · TradingNEWS ArchiveForex