EUR/USD Price Outlook – Can the Euro Hold Above Key Levels or Is a Reversal Coming?

Is EUR/USD Gaining Momentum or Setting Up for Another Breakdown?

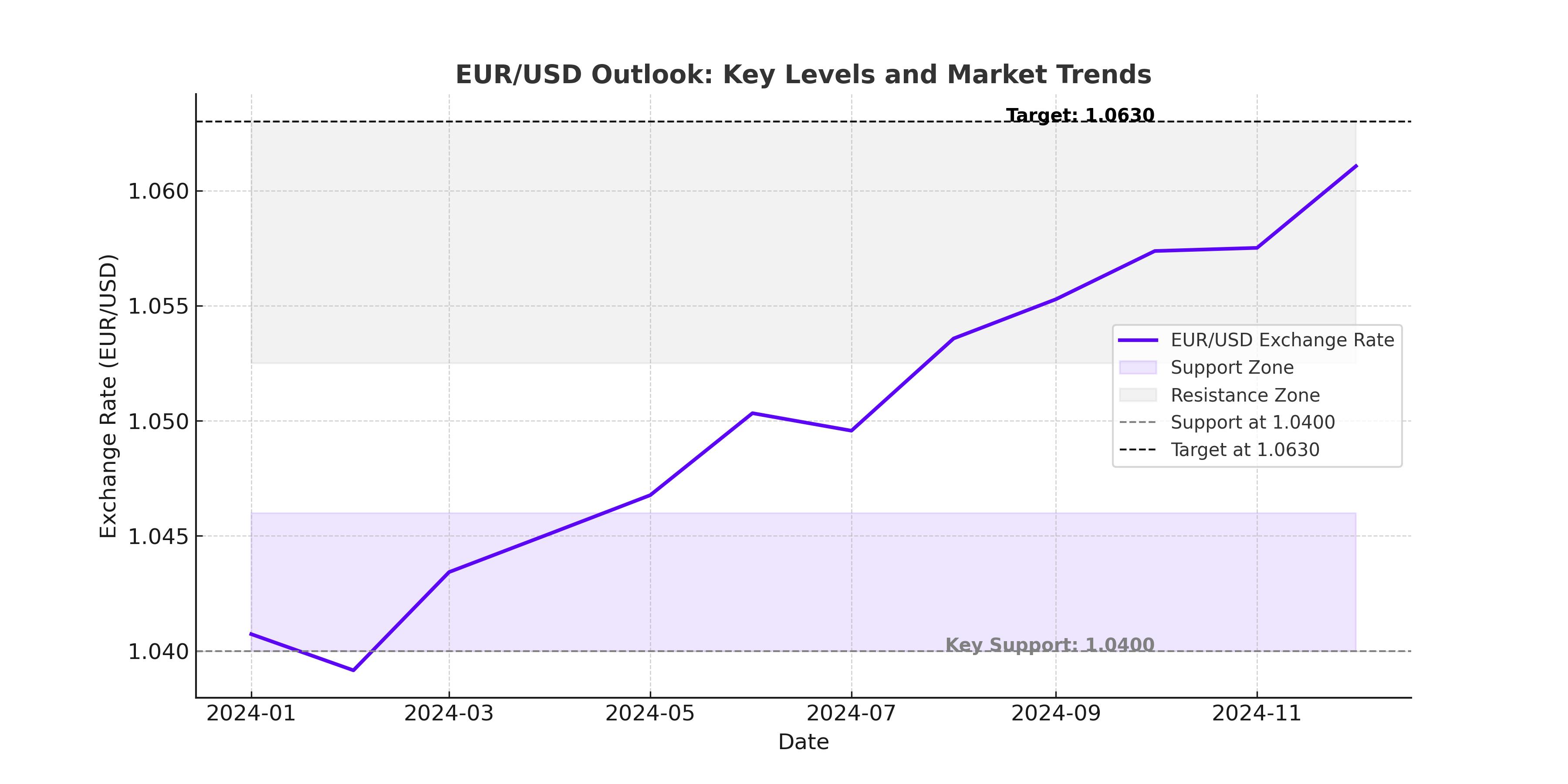

The EUR/USD currency pair has been navigating a volatile trading range, with price action reflecting shifting sentiment in the U.S. dollar and eurozone economic conditions. Currently, EUR/USD is trading around 1.0470, showing resilience after recent weakness, yet still struggling below key resistance levels. The question now is whether the pair can sustain its recent gains or if selling pressure will once again dominate.

With the U.S. dollar showing signs of consolidation, traders are closely watching economic indicators such as the Richmond Manufacturing Index, which is expected to rise to -3 from -4, signaling a potential recovery in U.S. industrial activity. Additionally, the upcoming Core PCE Price Index release and Prelim GDP data will be crucial in shaping market sentiment.

Technical indicators suggest EUR/USD is attempting to establish bullish momentum, but strong resistance at 1.0525-1.0530, which coincides with the 100-day Exponential Moving Average (EMA), remains a significant barrier. If buyers fail to push through this level, the downtrend could resume, with downside targets at 1.0400 and 1.0295.

US Dollar Index (DXY) and Its Impact on EUR/USD Price Action

The US Dollar Index (DXY) is currently trading at 106.607, reflecting a cautious tone in the market. The index remains below its pivot point at 106.790, while also trading under its 50-day EMA at 106.904, which indicates a short-term bearish outlook for the dollar. If selling pressure continues, the next key support level sits at 106.111, with further downside risk toward 105.590.

However, if DXY finds support and reverses higher, it could quickly shift market sentiment and drive EUR/USD lower. A break above 106.790 would invalidate the bearish setup and could push the index towards 107.365 or even 107.853, creating headwinds for the euro.

EUR/USD Faces Resistance at 1.0525-1.0530 – Will Bulls Break Through?

The EUR/USD pair is currently trading around 1.0470, attempting to sustain a bullish bias. The 50 EMA is providing near-term support at 1.04516, but buyers need to clear the 1.0525-1.0530 resistance zone, where the 100-day EMA and the upper Bollinger Band converge.

If bulls manage to break and sustain price action above this zone, it could open the door for further upside, targeting the December 6, 2024, high at 1.0630, followed by 1.0777, which was last tested in August 2024.

On the downside, 1.0400 remains the key psychological support, and a break below this level could trigger a sharper decline toward 1.0295, which is the lower limit of the Bollinger Band. If sellers push further, the next downside target is 1.0210, marking the February 3 low.

German Political Stability and Its Effect on the Euro

One of the fundamental drivers behind the euro’s recent gains has been political stabilization in Germany, following the victory of the Christian Democratic Union (CDU) and Christian Social Union (CSU) alliance in the federal election. This development has helped ease concerns over policy uncertainty in Europe’s largest economy, providing modest support to the euro.

While this news adds a positive backdrop for EUR/USD, broader market focus remains on U.S. economic conditions and Federal Reserve monetary policy expectations. The eurozone’s economic outlook remains fragile, with growth concerns lingering, making it crucial to monitor incoming data for further confirmation of trends.

Upcoming U.S. Data Releases and Their Impact on EUR/USD Volatility

This week, multiple high-impact economic reports could drive significant movement in EUR/USD. The CB Consumer Confidence report is expected to show a decline from 104.1 to 102.7, reflecting a more cautious sentiment among U.S. consumers. Additionally, the S&P/CS Composite-20 HPI y/y is projected to rise slightly to 4.4%, which could influence housing market expectations and broader economic sentiment.

The Core PCE Price Index, scheduled for release later this week, remains the key inflation indicator watched by the Federal Reserve. If inflation pressures persist, expectations for higher-for-longer interest rates could strengthen, providing support for the U.S. dollar and putting downward pressure on EUR/USD.

Additionally, FOMC Member speeches from Logan, Barr, and Barkin could provide insights into the Fed’s policy direction, further influencing currency markets. Traders should watch for any hawkish signals that could indicate potential rate hikes or dovish commentary suggesting rate cuts in 2025.

EUR/USD Technical Levels to Watch – Bullish Breakout or Bearish Reversal?

Traders remain focused on key technical levels that could dictate the next major move in EUR/USD. Holding above 1.04669 keeps the bullish sentiment intact, while failure to hold this level could signal renewed selling pressure.

Immediate resistance lies at 1.0525-1.0530, marking the 100-day EMA and a critical inflection point. If price action breaks above this level, it could fuel a rally toward 1.0630, followed by 1.0777, where previous highs were established.

On the downside, the 1.0400 level is a must-hold support zone. A breakdown below this threshold could see EUR/USD accelerating lower towards 1.0295, with further selling potentially targeting 1.0210, the February 3 low.

The Relative Strength Index (RSI) remains above the midline at 55.50, indicating that bullish momentum is still present. However, the MACD histogram is showing a flat structure, signaling a potential pause in momentum. This means that while buyers have the upper hand for now, failure to break resistance could invite renewed selling pressure.

Final Take – Will EUR/USD Sustain Its Gains or Face Renewed Selling Pressure?

The EUR/USD pair has rebounded in recent sessions but remains below key resistance at 1.0525-1.0530, which could dictate the next trend direction. The euro has gained ground on the back of German political stability, but U.S. economic data and Fed policy expectations remain the primary drivers of movement.

If the dollar weakens further, EUR/USD could push higher toward 1.0630 and beyond. However, if upcoming U.S. data supports a stronger dollar outlook, a break below 1.0400 could trigger a deeper sell-off toward 1.0295 and 1.0210.

For now, traders should closely monitor DXY price action, upcoming U.S. inflation data, and Fed commentary, as these factors will likely dictate whether EUR/USD extends its gains or faces another round of selling pressure.