EUR/USD Under Pressure: US Dollar Gains Amid Mixed Eurozone Economic Signals

Stronger US Data Fuels Dollar Rally While Euro Struggles with Inflation and Unemployment Concerns | That's TradingNEWS

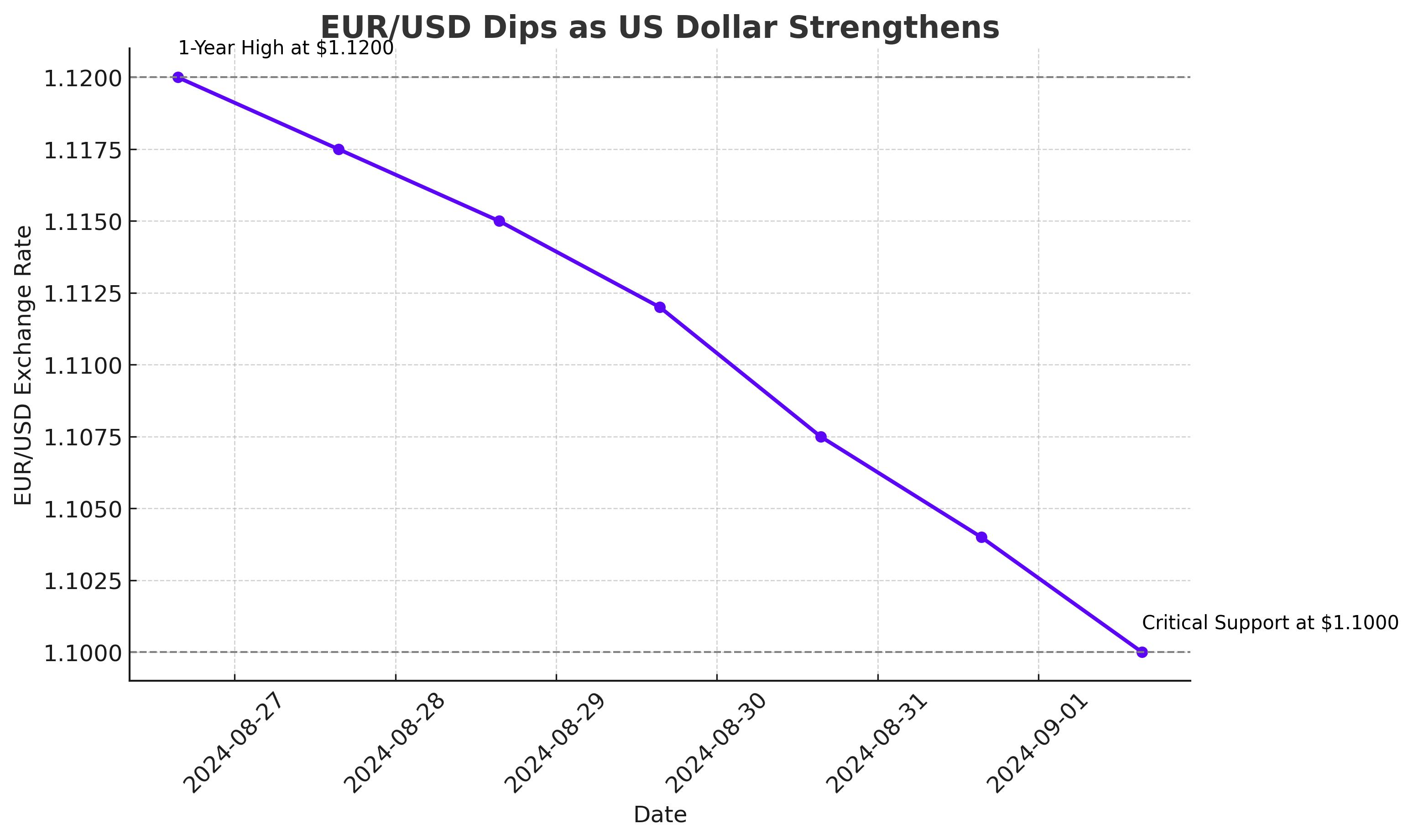

EUR/USD Dips as US Dollar Strengthens

The EUR/USD currency pair faced significant pressure this week, driven by a robust US Dollar bolstered by stronger-than-expected economic data. The pair, which had been trading near its 1-year high at $1.1200, saw a sharp reversal, closing the week near the $1.1000 mark, a critical support level that traders are closely monitoring.

US Economic Data Boosts USD

Several key economic indicators from the United States have provided a tailwind for the USD. The US Preliminary GDP data for the last quarter showed an annualized growth of 3.0%, surpassing expectations of 2.8%. This stronger-than-expected growth has eased some pressure on the Federal Reserve to implement aggressive rate cuts, leading to a more hawkish stance on the USD.

Moreover, the US Core PCE Price Index, a key inflation metric, came in as expected at a 0.2% month-on-month increase, reinforcing the Fed’s cautious approach. These data points, coupled with slightly better-than-expected US Consumer Confidence and steady Unemployment Claims, have provided solid support for the USD, pushing the EUR/USD lower.

Euro Struggles Amid Mixed Eurozone Data

In contrast, the Eurozone's economic landscape has been mixed. The German Preliminary CPI data surprised markets with a -0.1% deflation when no change was expected, indicating a potential slowdown in Europe’s largest economy. The Eurozone CPI flash estimate came in at an annualized rate of 2.2%, meeting expectations but doing little to support the Euro.

Additionally, the Eurozone unemployment rate fell unexpectedly to a record low of 6.4%, which could have been a bullish signal for the Euro. However, the stronger USD overshadowed this, leading to a broader bearish sentiment for the EUR/USD pair.

Technical Analysis: EUR/USD at a Crossroads

From a technical perspective, the EUR/USD’s recent price action suggests a potential shift in market sentiment. The pair’s failure to maintain its bullish momentum above $1.1200 and the subsequent close near $1.1000 indicate a significant bearish retracement. The 100-day ATR shows the pair moving close to 3 times its average, signaling that trend traders might be on the verge of exiting long positions.

Key levels to watch include the $1.1031 support. A break below this could signal further downside potential, while a daily close above $1.1057 might reignite bullish momentum.

USD/JPY Gains as Yen Weakens

While the EUR/USD falters, the USD/JPY pair has been on a steady climb, reaching new weekly highs around ¥146.25. This rally is largely driven by the divergence in monetary policies between the US and Japan. The Bank of Japan’s continued ultra-loose monetary stance contrasts sharply with the Fed’s more hawkish tone, providing support for the USD/JPY.

However, the Yen found some support from higher-than-expected Tokyo CPI data, which could signal a potential shift in BOJ policy down the line. Traders should watch for a break above the 148.90 resistance level, which could open the door to further gains.

GBP/USD Also Under Pressure

The GBP/USD pair mirrored the EUR/USD’s struggles, falling from a 2-year high above $1.3200 to close near $1.3000. Despite robust UK economic data, including a stable inflation rate, the pair could not withstand the broad-based strength of the USD. The upcoming UK economic data and the Bank of England’s policy decisions will be crucial in determining the pair’s next move.

Gold (XAU/USD) Faces Resistance

Gold prices, often seen as a safe-haven asset, have been grinding higher but faced strong resistance near the $2,500 mark. Despite a long-term bullish trend, the recent retracement from this level suggests that traders are taking profits, especially as the USD strengthens. However, should the price close above $2,525, we could see a renewed bullish push towards new highs.

S&P 500 Index: A Cautious Recovery

The S&P 500 Index has shown signs of recovery, closing the week on a high note. However, the index remains just shy of its all-time highs, with potential profit-taking looming as it approaches these levels. A clear break above 5,668 could set the stage for a sustained rally, but caution is advised as the market remains sensitive to broader economic developments.

Outlook: A Mixed Bag for EUR/USD

The EUR/USD’s outlook remains uncertain, with the pair caught between a strong US Dollar and mixed economic signals from the Eurozone. Traders should closely monitor upcoming economic data, particularly the US Non-Farm Payrolls and Average Hourly Earnings, which could significantly impact the Fed’s rate decision and, by extension, the EUR/USD pair.

Given the current environment, the EUR/USD could see further downside unless the Eurozone data surprises positively or the USD loses momentum. Traders should remain vigilant, with key levels in focus for potential trade setups.

This article provides a comprehensive overview of the current market dynamics affecting the EUR/USD and related pairs, offering insights for traders navigating this volatile period period.

That's TradingNEWS

Read More

-

GPIX ETF Climbs to $52.54 as 8% Yield Turns S&P 500 Volatility Into Income

02.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI $11.54, XRPR $16.35 And XRP-USD At $1.99 Aim For A $5–$8 Cycle

02.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Tests $3.50–$3.60 Floor Before LNG Wave

02.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds Near 157 as BoJ Caution and Fed Cut Bets Drive the Move

02.01.2026 · TradingNEWS ArchiveForex