EUR/USD TradingNEWS - Geopolitical Tensions and Economic Policies

An in-depth look at how global events and monetary policy differences between the ECB and the Fed are influencing EUR/USD trading strategies and market movements | Thjat's TradingNEWS

Analyzing EUR/USD Dynamics: Detailed Insights into Current Market Conditions

EUR/USD Overview: Navigating Through Economic and Geopolitical Currents

The EUR/USD has been navigating a turbulent financial landscape, influenced by geopolitical events and significant economic data releases. As of the last trading session, the EUR/USD pair was trading below the critical 1.0700 level, reflecting ongoing market pressures and investor sentiment shaped by global uncertainties.

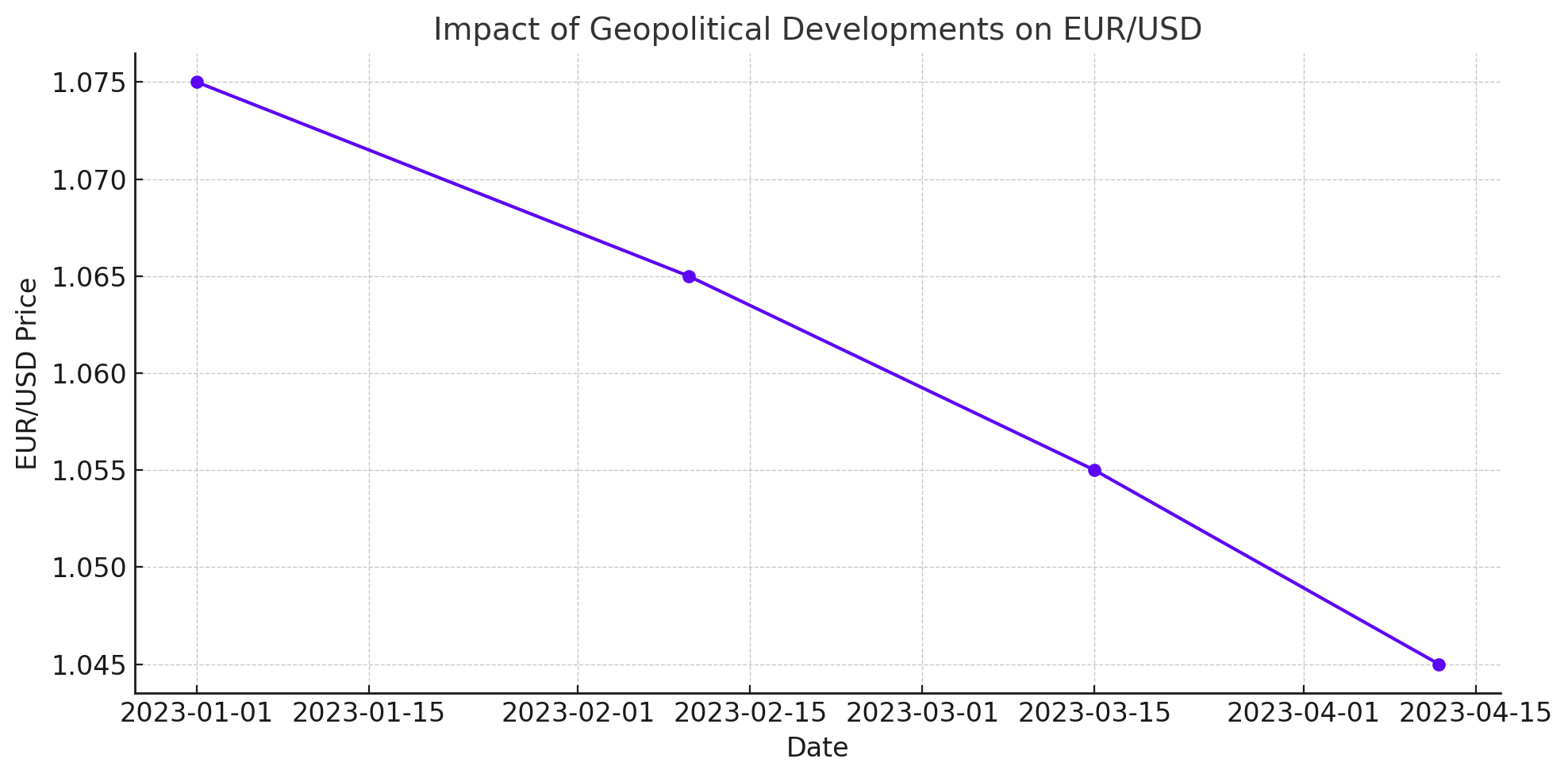

Impact of Geopolitical Developments

Recent tensions between Iran and Israel have had a pronounced effect on global financial markets. These events often lead to increased volatility, particularly for pairs like the EUR/USD. Following the escalation, the pair experienced a sharp decline, testing support levels not seen since November of the previous year. This geopolitical tension contributes to the risk aversion seen in the markets, impacting forex directly.

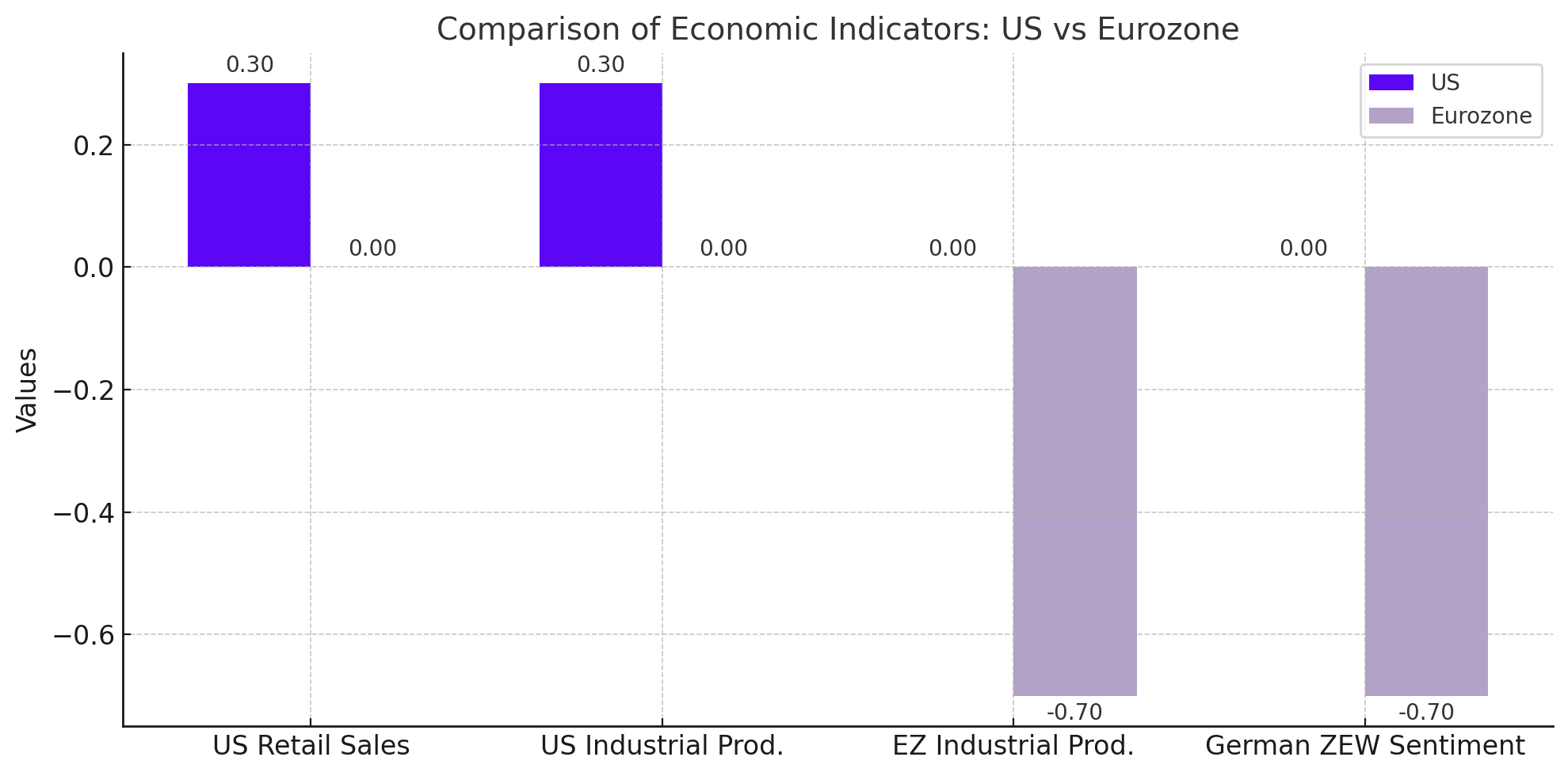

Economic Indicators and Their Implications

Key data points from the U.S. have shown impactful results:

- U.S. Retail Sales: Increased by a modest 0.3% last month, falling short of the market expectations of a 0.5% rise. This underperformance suggests potential weakness in consumer confidence and spending.

- U.S. Industrial Production: Reported a slight uptick of 0.1% against forecasts of a 0.2% increase, signaling a slower pace in industrial activity.

From the Eurozone:

- Eurozone Industrial Production: Decreased by 0.7% month-over-month, indicating a contraction in industrial activity which could impact the Euro's strength.

- German ZEW Economic Sentiment: This indicator fell to -49.5, well below the neutral 0-point mark, suggesting deteriorating investor confidence in Europe’s largest economy.

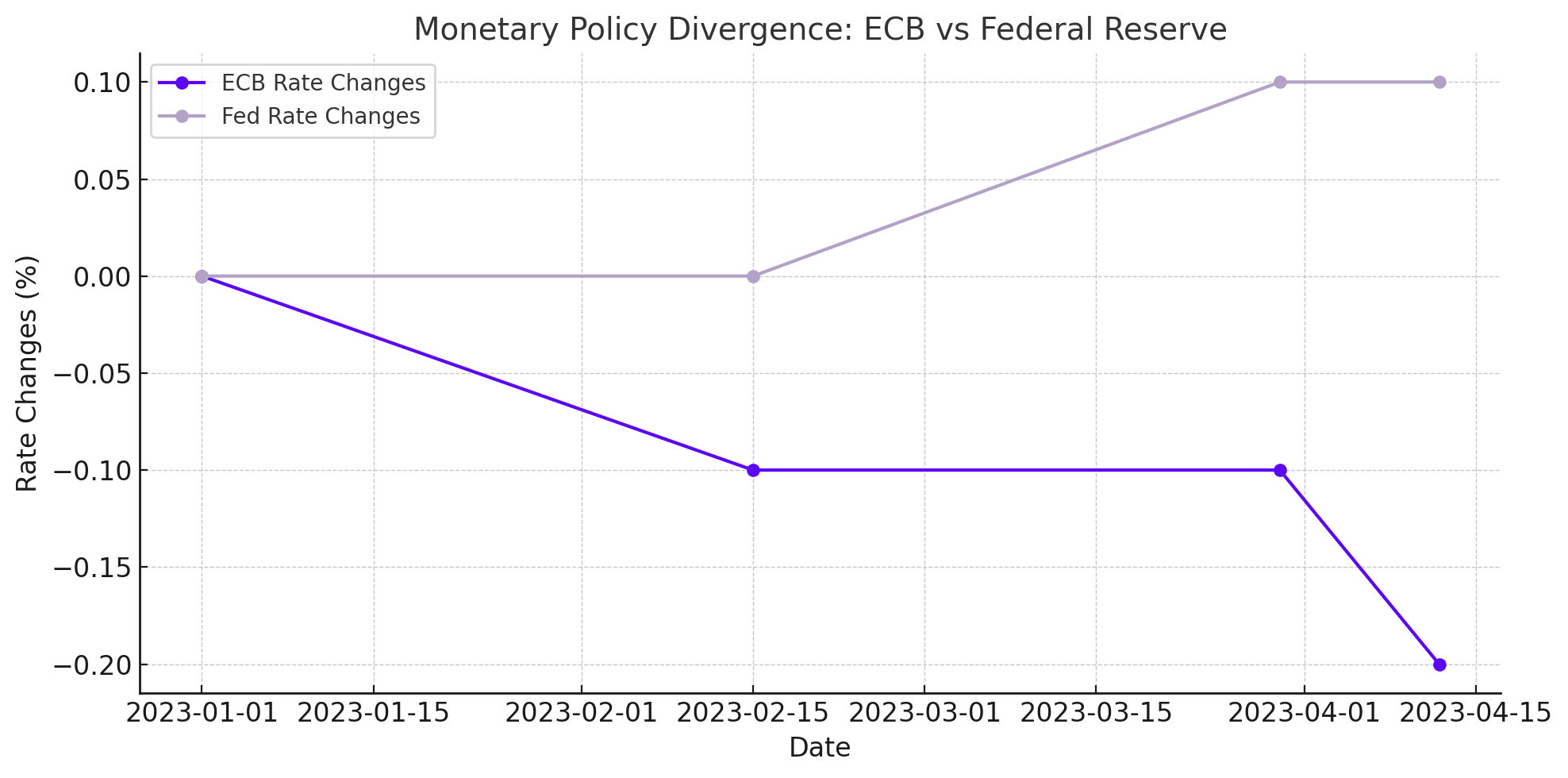

Monetary Policy Divergence

The divergence in monetary policy between the European Central Bank (ECB) and the Federal Reserve remains a critical factor:

- The ECB has signaled potential rate cuts with its forward guidance hinting at easing as early as June, while the Federal Reserve's rhetoric suggests a more cautious approach, possibly delaying any rate cuts due to persistent inflation pressures which remained at 3.5% in the latest CPI data, above the Fed's target of 2%.

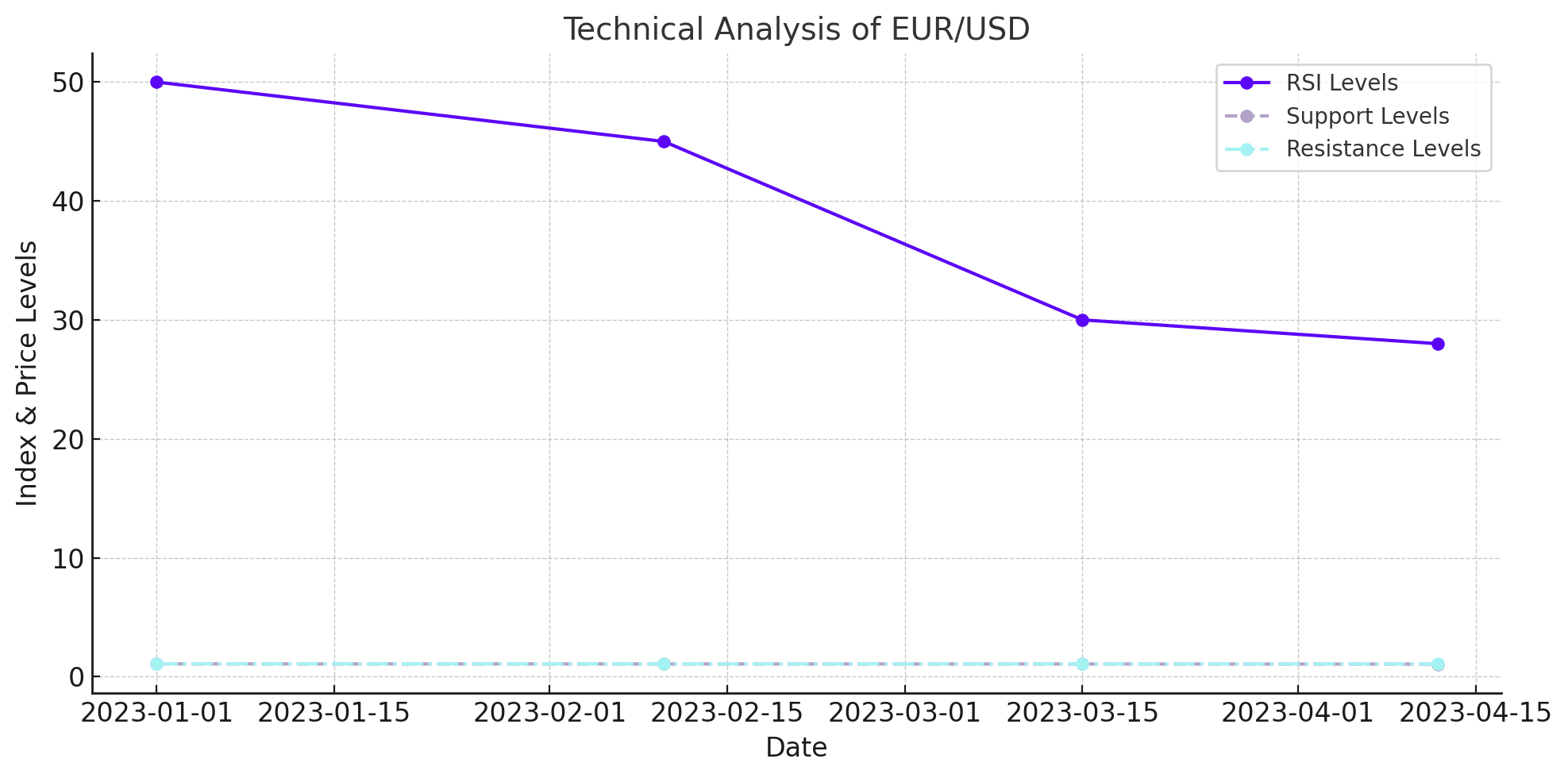

Technical Analysis: Key Levels and Indicators

The EUR/USD pair shows a bearish trend on technical charts:

- Relative Strength Index (RSI): Currently at 30, nearing oversold conditions which might indicate a potential for price stabilization or a corrective rebound.

- Support Levels: Immediate support is found at 1.0635, a breach of which could lead to further declines towards the 1.0550 mark.

- Resistance Levels: On any upward correction, resistance might be encountered first at 1.0695, followed by 1.0730.

Market Sentiment and Strategic Outlook

Given the current economic backdrop and market sentiment, the strategic recommendation for trading EUR/USD remains cautious:

- Sell on Rallies: This approach is supported by the technical breakdown and the bearish momentum indicated by the MACD and RSI levels.

- Traders should watch for any geopolitical developments over weekends, as these can lead to gap risks at the opening of the market, influencing EUR/USD’s opening levels on Mondays.

Conclusion

As the EUR/USD pair continues to react to global economic indicators and geopolitical news, traders must remain vigilant, basing their strategies on a comprehensive analysis of both fundamental and technical data. The current market conditions suggest a bearish outlook for the pair, with a focus on key economic releases and central bank communications in the coming weeks to guide further trading decisions.

That's TradingNEWS

Read More

-

GPIX ETF Climbs to $52.54 as 8% Yield Turns S&P 500 Volatility Into Income

02.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI $11.54, XRPR $16.35 And XRP-USD At $1.99 Aim For A $5–$8 Cycle

02.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Tests $3.50–$3.60 Floor Before LNG Wave

02.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds Near 157 as BoJ Caution and Fed Cut Bets Drive the Move

02.01.2026 · TradingNEWS ArchiveForex