Meta Platforms (NASDAQ: META): AI Powers Growth and Keeps Investors Bullish

From AI advancements to strategic platform expansions, here’s why Meta’s growth story is far from over—and why its stock is a must-watch for savvy investors | That's TradingNEWS

Meta Platforms (NASDAQ: META) Continues to Lead the Digital Ad Space with AI Integration and Strategic Growth Initiatives

Strong Q2 Performance Boosted by AI Integration

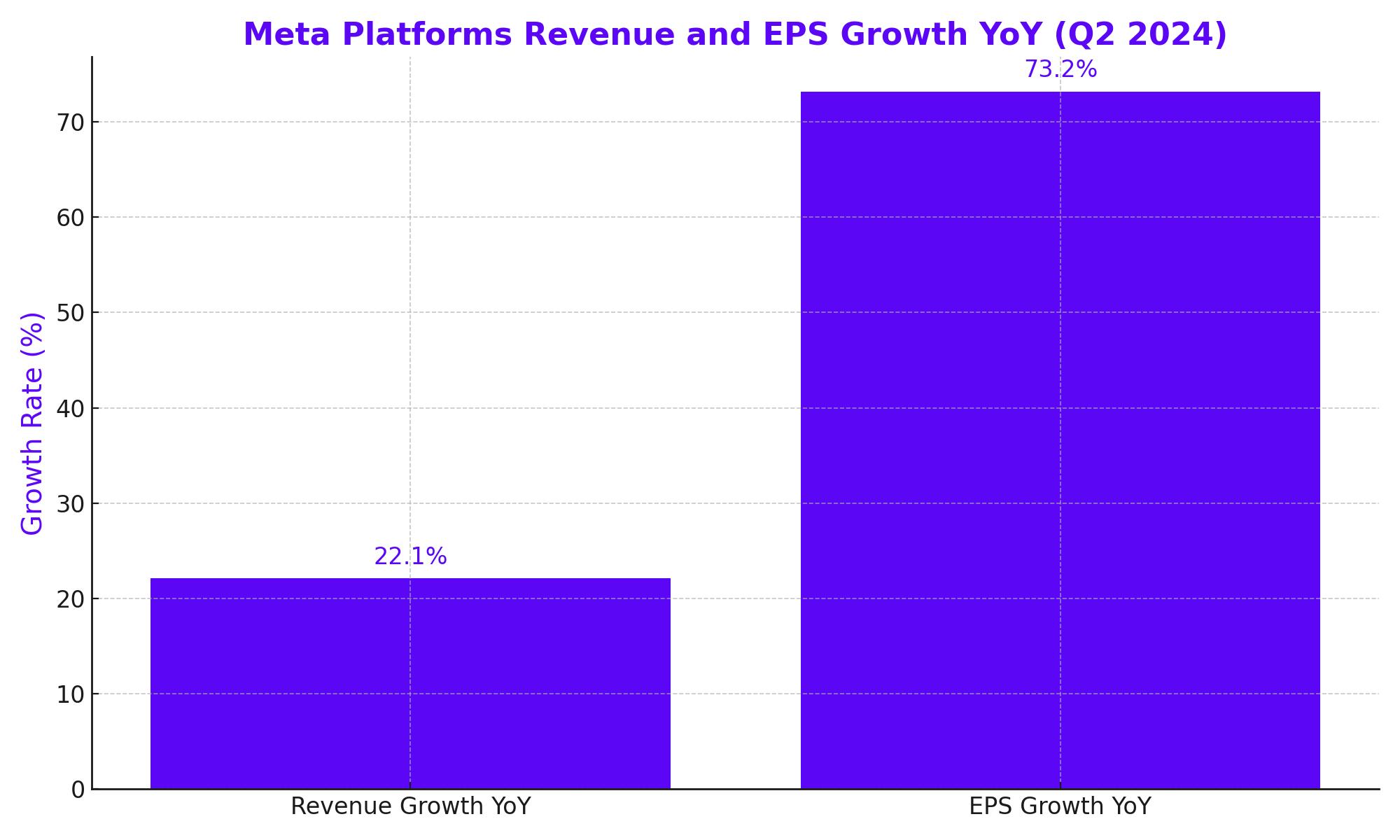

Meta Platforms Inc. (NASDAQ:META) has demonstrated remarkable resilience and strategic foresight, particularly with its Q2 2024 results. The company's revenue surged by 22.1% year-over-year, reaching $39.1 billion, significantly surpassing analyst expectations by $760 million. This growth was driven by a combination of factors, including a 7% increase in daily active people across its family of apps, now totaling 3.3 billion, and a 10% rise in ad impressions. Meta's ability to leverage AI to enhance ad targeting has resulted in a 10% increase in the average price per ad, reflecting the effectiveness of its AI tools in improving ad performance.

Meta’s diluted EPS soared by 73.2% to $5.16, also exceeding expectations by $0.40. This impressive bottom-line growth can be attributed to the company's disciplined approach to managing expenses, which only increased by 7.2% despite the revenue surge. This led to an operating margin expansion of 860 basis points to 38%.

Meta’s AI Strategy: A Game Changer in Digital Advertising

Meta’s significant investment in AI has been a key driver of its recent success. Unlike other tech giants such as Microsoft and Google, Meta has managed to rapidly monetize its AI investments. The company's AI tools have been seamlessly integrated into its advertising platform, allowing for better targeting and increased efficiency. This has led to a stronger demand for Meta's advertising services, which is reflected in the company's improved financial performance.

Meta's ability to quickly deploy AI in ways that immediately benefit its core business has set it apart from its peers. While other companies are still in the process of developing and refining their AI tools, Meta has already demonstrated the tangible benefits of its AI investments, which have contributed to the company’s continued growth in both revenue and profitability.

Capex and Long-Term Growth Prospects

Meta’s capital expenditures (Capex) have been a point of focus, especially as the company plans to increase its spending to support its AI infrastructure and product development. Meta's Capex is expected to reach $40 billion annually, reflecting its commitment to maintaining its competitive edge in AI and digital advertising. Despite the substantial investment, Meta's ability to generate free cash flow has remained robust, providing a strong financial foundation for its growth initiatives.

The company’s balance sheet is also a testament to its financial health, with a net cash position of $39.7 billion as of June 30, 2024. This financial strength, coupled with a disciplined approach to cost management, positions Meta well to continue its aggressive investment in AI while maintaining shareholder value.

Growth Drivers: Reels, Threads, and WhatsApp

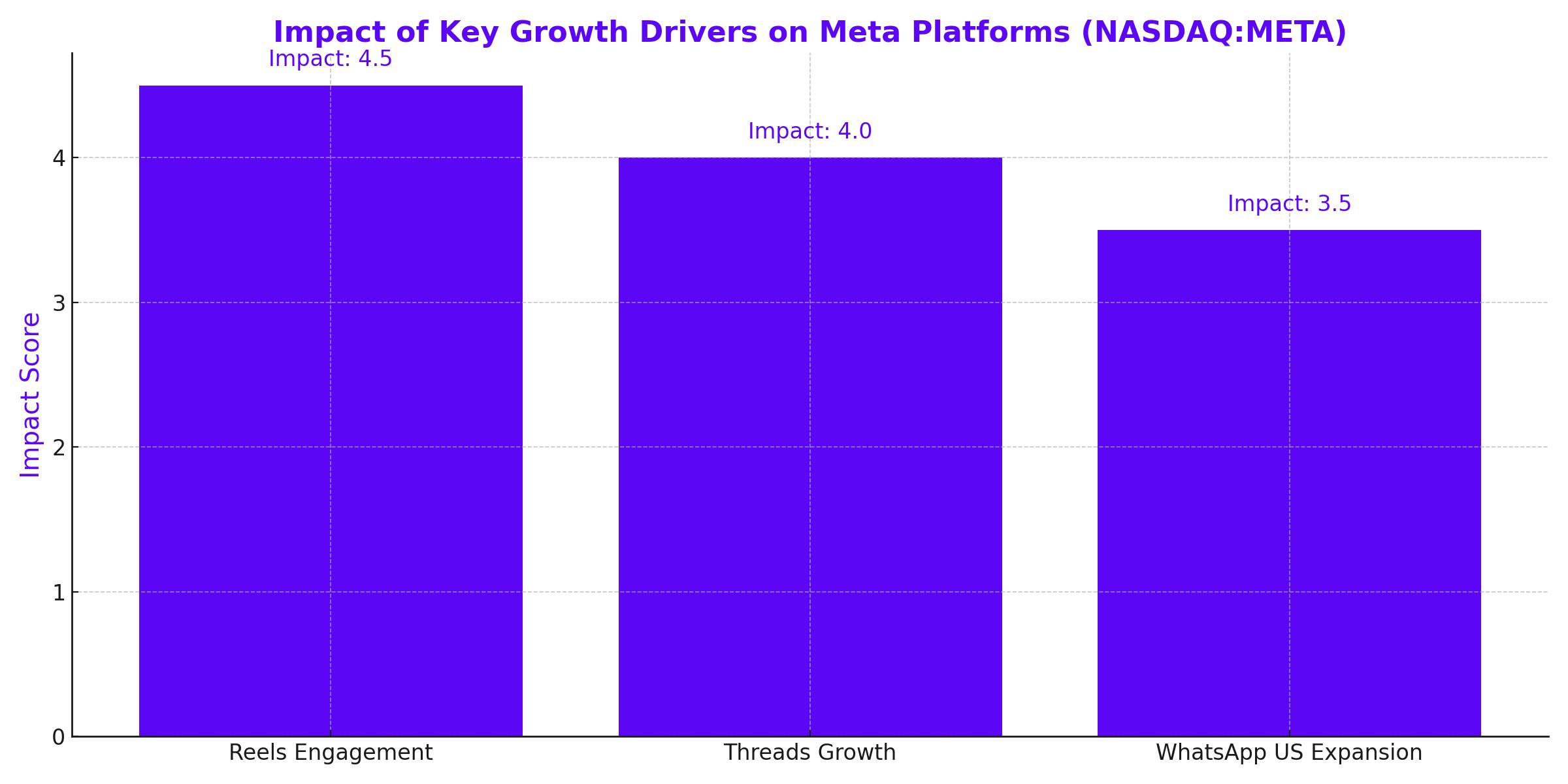

Meta is not just resting on its laurels with its traditional platforms like Facebook and Instagram; it’s actively expanding its footprint in the digital space through its newer platforms—Reels, Threads, and WhatsApp. Reels, Meta’s answer to TikTok, has seen increasing engagement, which is expected to grow further, especially if TikTok faces regulatory challenges in the U.S. A ban on TikTok could significantly boost Reels' user base, thereby enhancing Meta’s ad impressions and pricing power.

Threads, Meta’s text-based platform, has quickly gained traction, boasting 200 million daily active users. This growth is particularly significant as competitors like Twitter (now X) face advertiser backlash and declining user engagement. WhatsApp, already the most popular messaging app globally, continues to grow its user base in the U.S., with over 100 million monthly active users, further solidifying Meta's dominance in the social media ecosystem.

Valuation and Market Position

Despite a 50% YTD increase in its stock price, Meta remains one of the more reasonably priced stocks among big tech companies. The stock trades at a forward P/E ratio of 21.8 for FY 2025 and 19 for FY 2026, making it an attractive option for investors looking for growth at a reasonable price. With a projected EPS growth of 15% for both 2025 and 2026, Meta offers a compelling investment opportunity, especially given its strong fundamentals and growth trajectory.

Risks and Considerations

While Meta’s growth prospects are strong, there are risks that investors should consider. The company’s dependence on Apple’s ecosystem for app distribution remains a vulnerability, particularly given the rivalry between the two companies. Any changes by Apple that negatively impact Meta's ability to monetize its user base could pose a significant risk.

Additionally, Meta’s continued investment in Reality Labs and the metaverse, which has yet to show clear returns, represents a financial risk. The division reported a $4.49 billion loss in Q2 2024, up from $3.74 billion the previous year. While this is currently manageable within the context of Meta's overall financial performance, it could become a concern if the core business does not continue to perform as expected.

Outlook and Investment Potential

Meta Platforms Inc. (NASDAQ:META) has shown that it can effectively navigate the challenges of the digital advertising space while capitalizing on new opportunities. The company’s strong financial performance, driven by successful AI integration and strategic growth initiatives across its platforms, positions it well for continued growth. Given its current valuation and growth prospects, Meta remains a strong buy for investors looking to capitalize on the company’s ongoing success and future potential.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex