U.S. Dollar Surge Amid Economic Resilience

Introduction: The Dollar’s Strength in Context

In the current financial landscape, the U.S. dollar has exhibited significant resilience, reaching multi-month highs. This strength is largely attributed to economic indicators that suggest the Federal Reserve may postpone any policy easing. Here, we delve into the factors influencing the dollar's performance, underpinned by the latest economic data and forecasts.

Economic Indicators Driving Dollar Dynamics

DXY Index Analysis

The DXY index, a critical measure of the dollar's strength, has shown an upward trajectory, fueled by investor anticipation regarding Federal Reserve policy decisions. This uptick aligns with robust economic data, including labor market tightness and persistent inflation, diminishing hopes for immediate and substantial rate cuts.

Treasury Yields and Investor Sentiment

Treasury yields have witnessed a sharp rise, with the 2-year note nearing the psychological threshold of 5.0%. This increase reflects a broader investor sentiment that the Federal Reserve might delay rate reductions, favoring a more cautious approach in response to ongoing inflationary pressures.

Upcoming Economic Releases

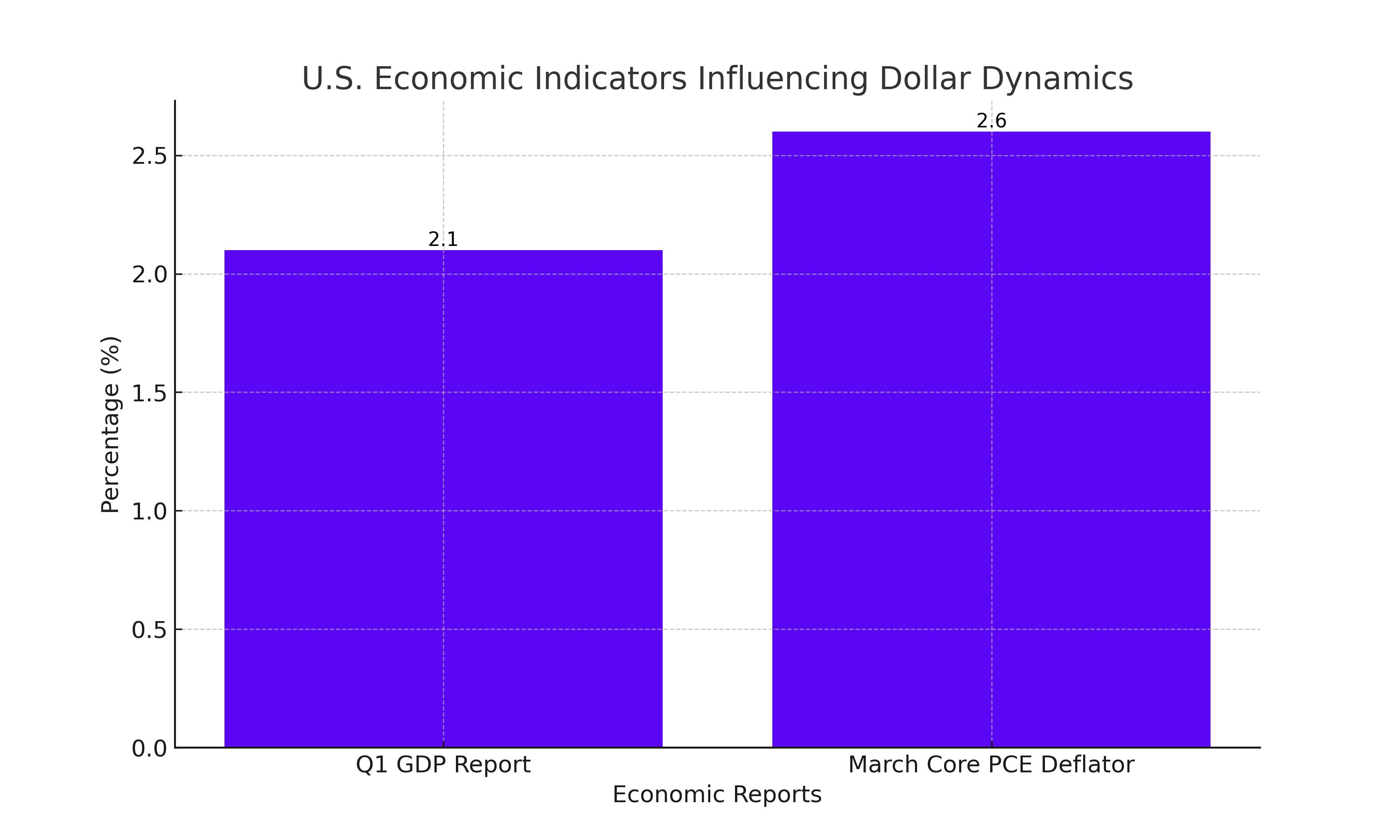

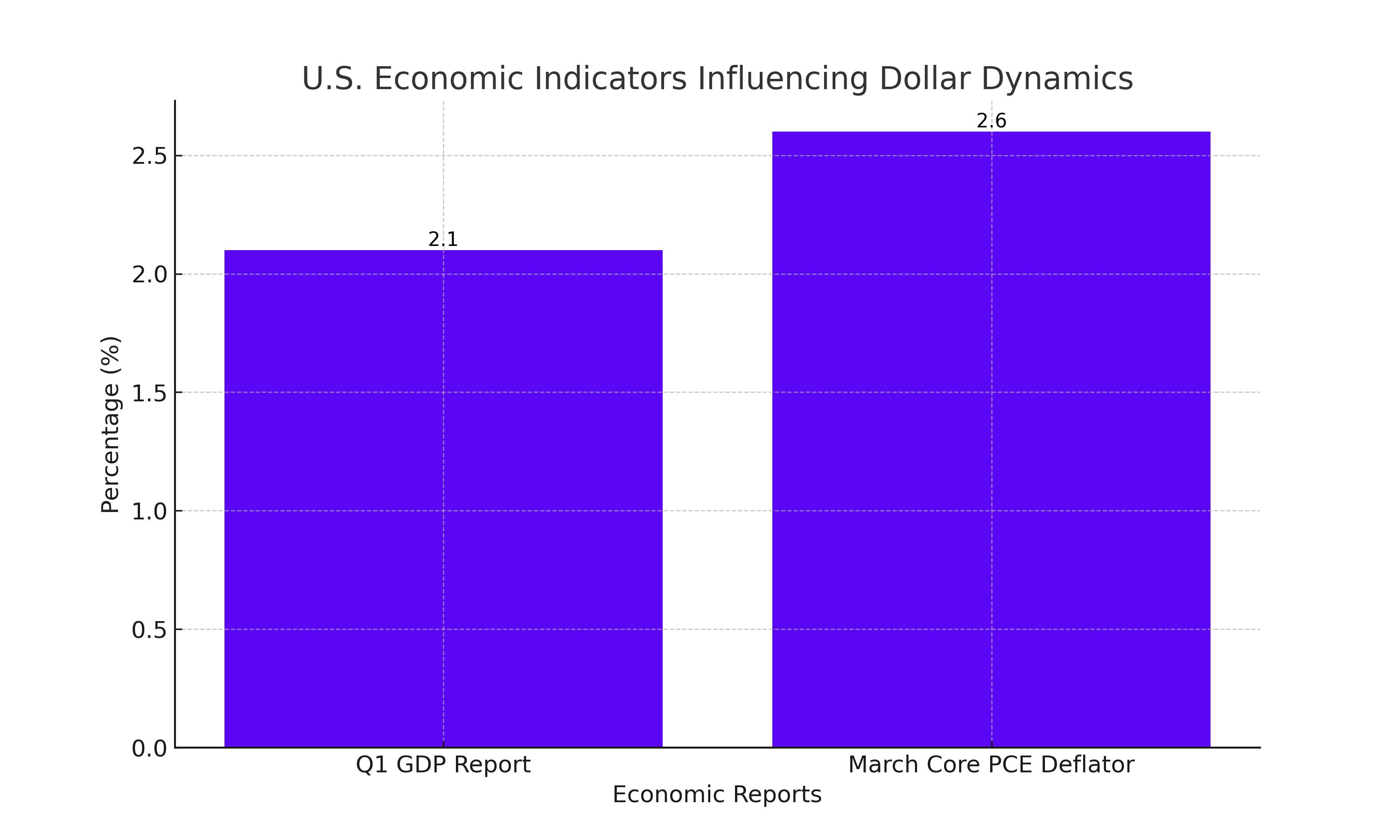

This week is pivotal with key economic reports on the horizon:

- Q1 GDP Report: Expectations are set for a growth rate of 2.1% annually, a slight deceleration from the previous quarter’s 3.4% but still above potential output, hinting at sustained inflationary pressures.

- March Core PCE Deflator: The Fed’s preferred inflation gauge is projected to rise by 0.3% month-over-month, with a year-on-year increase of 2.6%, suggesting that inflation remains sticky.

Currency Pairs in Focus

EUR/USD: Stability Amidst Economic Pressures

The EUR/USD pair has been navigating through a volatile landscape but has shown signs of stabilization recently. As of the latest data, the pair rebounded off the critical psychological level of 1.0600, rising to around 1.0650. Technical resistance is expected at 1.0695, with further hurdles at 1.0725. The euro's recovery, although modest, is underscored by a broader economic context that continues to exert downward pressure due to varying monetary policy stances between the ECB and the Fed.

USD/JPY: Evaluating the Surge and Retracement

The USD/JPY pair recently scaled multi-decade highs, touching 154.80 before witnessing a slight pullback. Current levels suggest a cautious bullish momentum, with potential resistance near the recent high at 154.80 and extending to 156.00. Market participants remain on edge due to possible interventions by the Japanese government, aimed at curbing excessive volatility and defending the yen against too rapid a depreciation.

GBP/USD: Navigating Through Sell-Offs

GBP/USD has been under considerable bearish pressure, breaking below the support level at 1.2430 and plumbing new lows towards 1.2320, a significant Fibonacci retracement level. The ongoing weakness in GBP/USD is driven by a combination of domestic economic concerns and broader USD strength. Resistance levels are now pegged at 1.2430 and 1.2525, which need to be watched closely for any bullish reversal signals.

Technical Analysis and Projections

The U.S. dollar's strength is supported by a robust set of economic data and soaring Treasury yields. The 2-year Treasury yield is flirting with the 5.0% mark, signaling strong market expectations of continued Fed policy firmness. Technical indicators across major USD pairs suggest that the dollar may maintain its strength, barring any significant economic setbacks or unexpected shifts in Federal Reserve policy.

Investor Strategies and Market Sentiment

Investor sentiment is decisively bullish on the U.S. dollar, driven by expectations that the Fed will maintain a restrictive monetary policy longer than some of its global peers. This has led to a strategy heavily weighted towards assets that will benefit from higher U.S. interest rates. Market participants are advised to keep a close watch on the upcoming economic data, particularly U.S. GDP figures and the core PCE index, as these could significantly influence the Fed's policy trajectory.

Conclusion: Adapting to a Dynamic Economic Environment

As we navigate through a period of significant economic releases and central bank decisions, traders and investors must remain vigilant. The ability to quickly adapt investment strategies in response to new data will be crucial. The U.S. dollar, supported by solid economic fundamentals and a cautious Federal Reserve, seems poised to continue its dominant performance, yet market dynamics are fluid and require constant reassessment.

That's TradingNEWS