Upcoming Week's Economic Releases: A Detailed Look

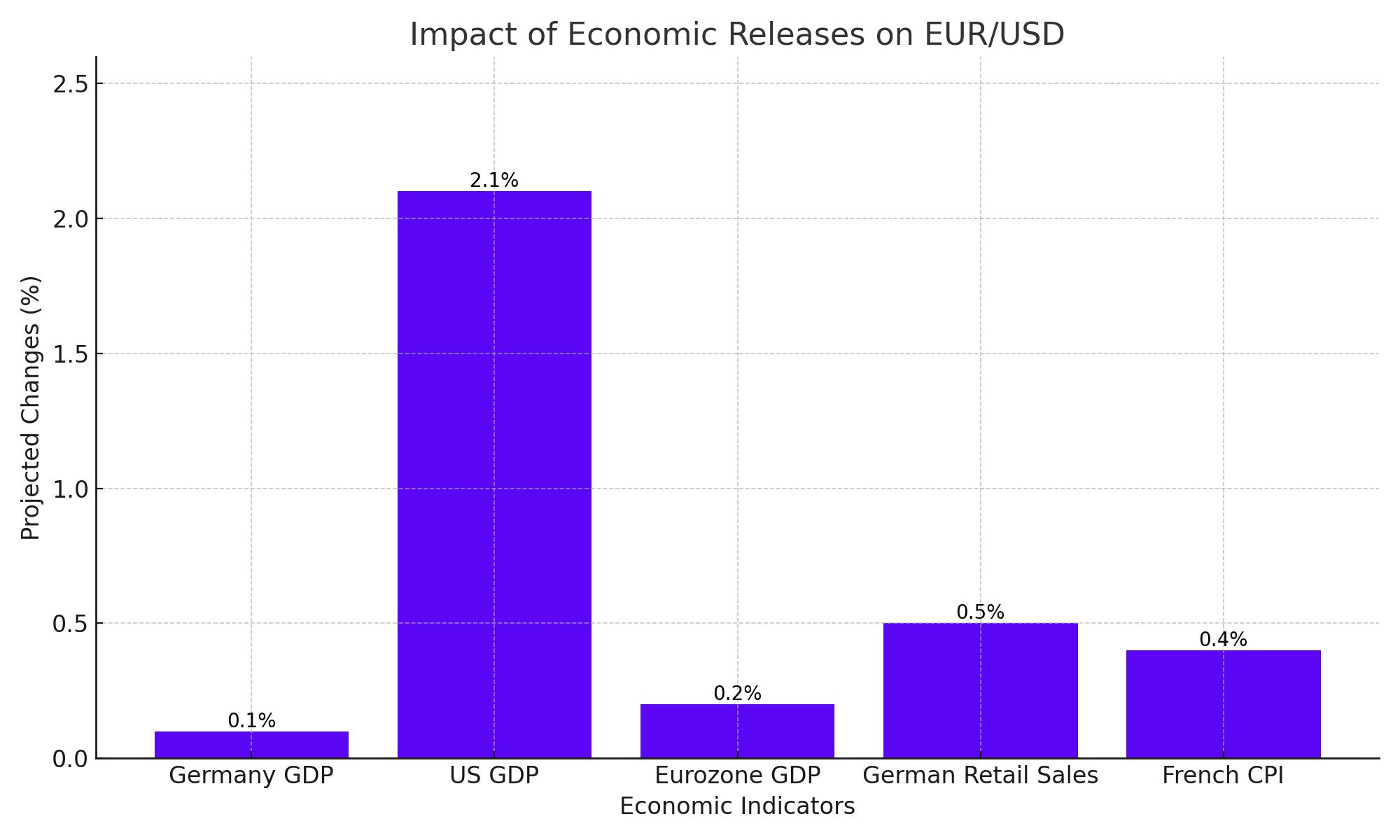

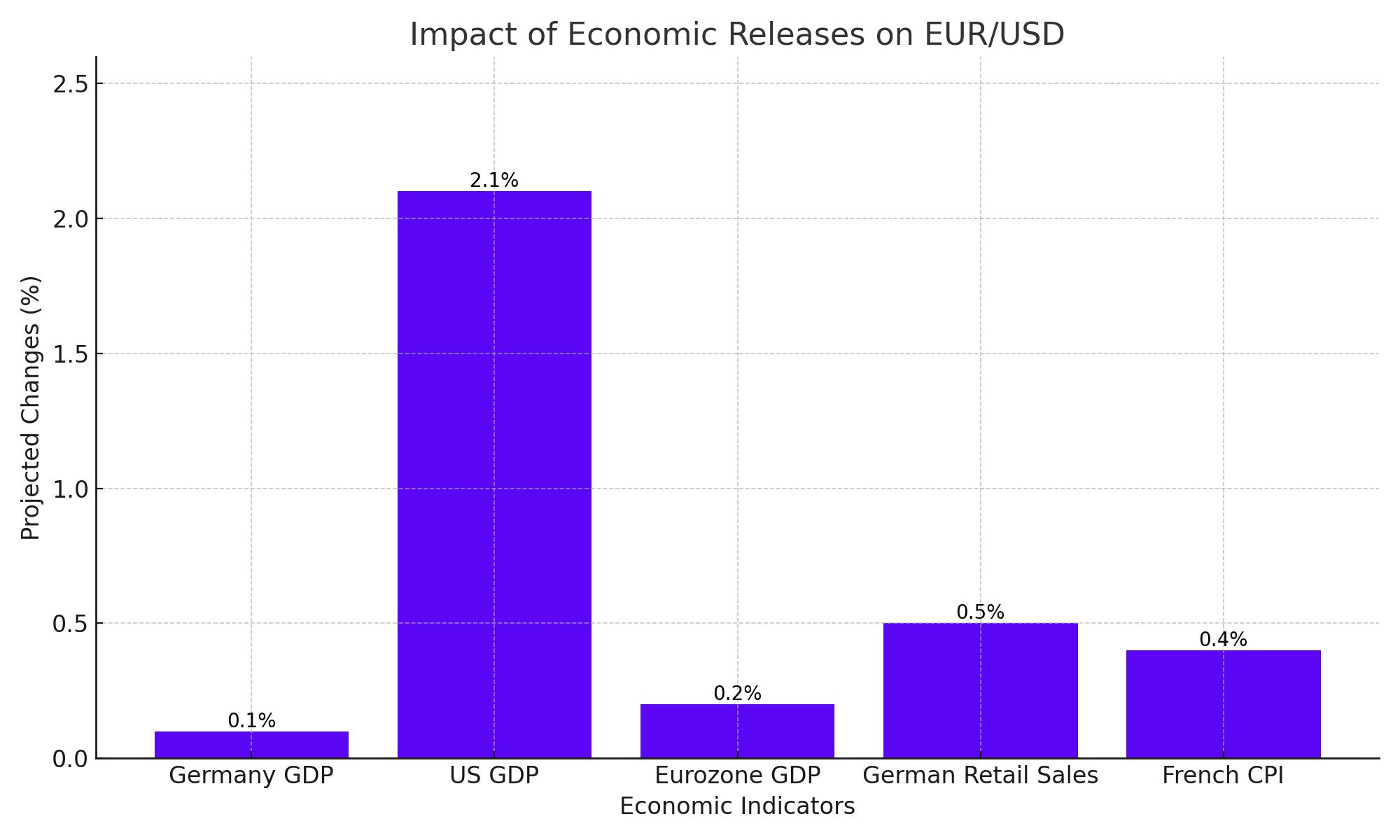

The EUR/USD pair is set to experience significant volatility in the upcoming week, influenced by key economic indicators from both Europe and the United States. We're looking at Germany's preliminary GDP which is forecasted to grow by 0.1% quarter-over-quarter, compared to a robust 2.1% annualized growth in the U.S. GDP. Additionally, the Eurozone's GDP is expected to see a slight increase of 0.2%. German retail sales are anticipated to show a modest rise of 0.5% month-over-month, while unemployment rates are projected to remain stable at 3%. On the French front, the Consumer Price Index (CPI) is predicted to increase by 0.4% month-over-month.

Comparative Economic Indicators: Eurozone vs. U.S.

There's a stark contrast between the Eurozone's subdued economic data and the stronger economic figures from the U.S., such as the latest Personal Consumption Expenditures (PCE) which increased by 0.6% last month. This disparity sets a complex backdrop for EUR/USD trading strategies, highlighting the importance of in-depth analysis for accurate currency movement predictions.

Technical Analysis and Trading Strategy

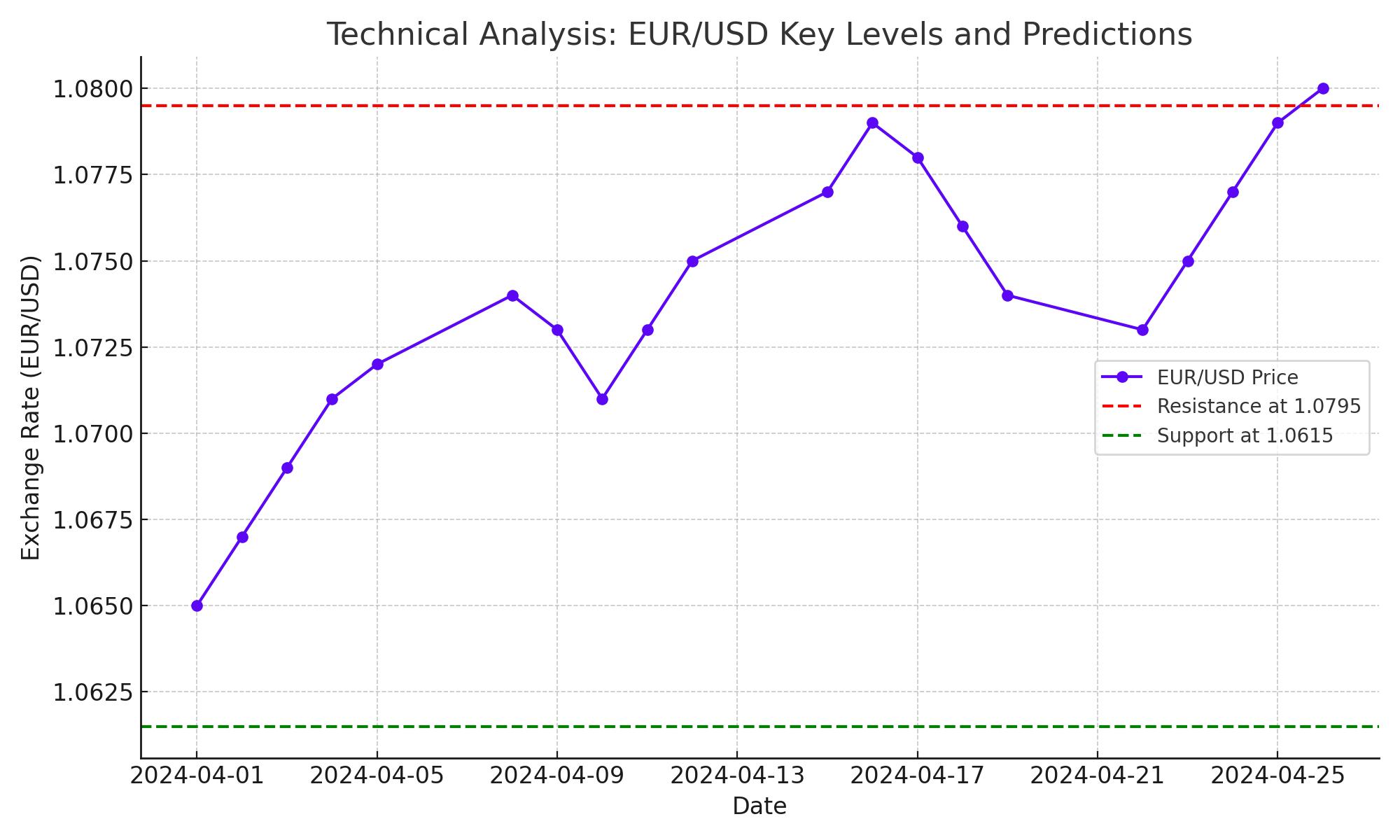

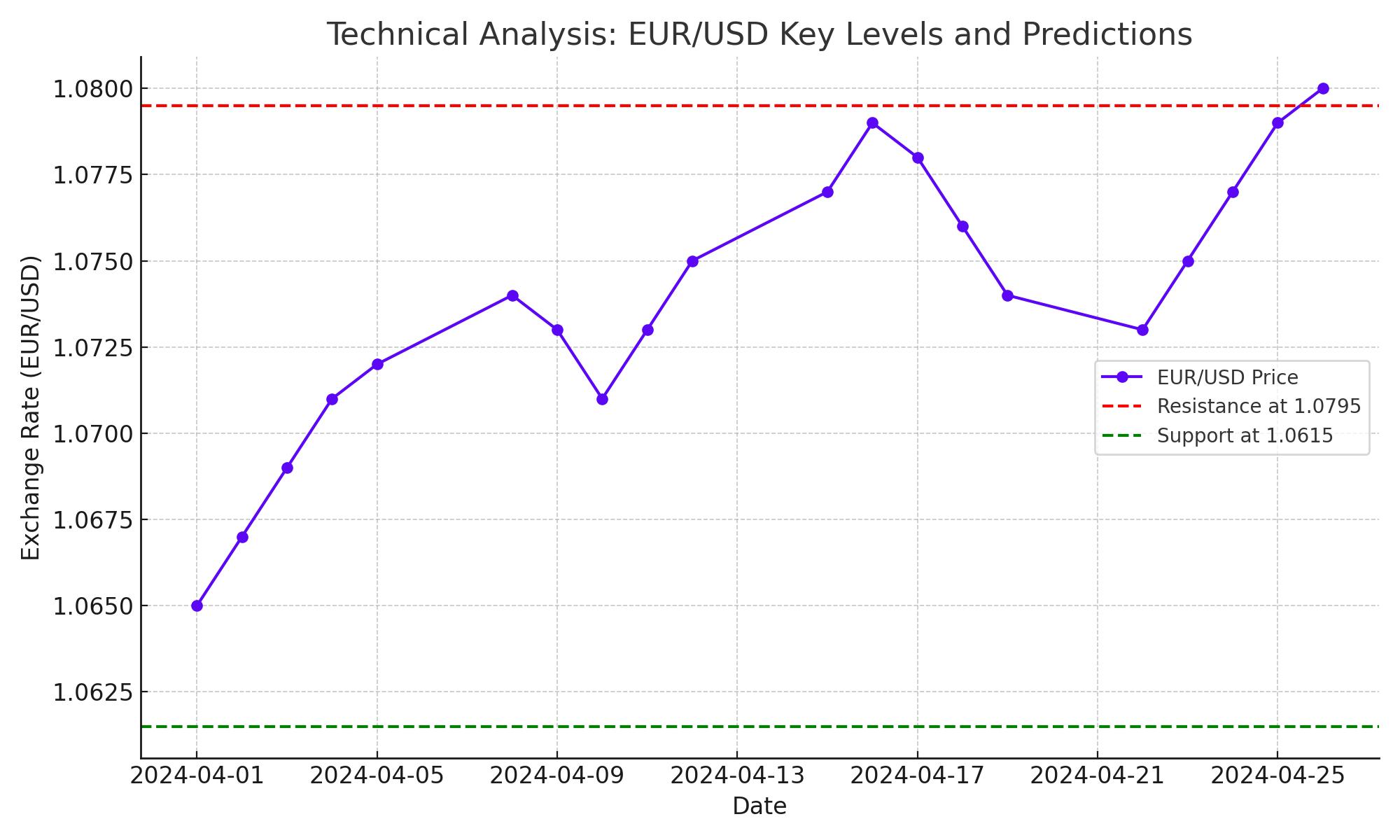

Technical indicators suggest strategic trading opportunities within the EUR/USD exchange. Currently, the pair finds support at 1.0694 and faces resistance at the 50-day and 200-day moving averages, positioned at 1.0805/07. Additional resistance is noted near the 100-day moving average at 1.0848. Traders might consider a short position targeting the 1.06 level, reflecting the expected economic data impact on the currency's strength.

Performance Outlook and Risk Assessment

This week, the EUR/USD's trajectory has been influenced significantly by real-time economic data and prevailing market sentiments. A potential downside breach below 1.0694 could trigger a test of the year's low at 1.0601, with possibilities of extending losses towards 1.0516 if the bearish momentum continues.

Strategic Market Positions: Analysis and Forecast

Investors and traders are encouraged to closely observe the upcoming economic data releases, including the German Ifo Business Climate Index, expected to rise to 90.1, and U.S. Durable Goods Orders, projected to increase by 2.5%. These indicators are crucial for refining market strategies and understanding deeper market dynamics. Monitoring these data points will equip traders with the insights needed to make informed decisions in the volatile EUR/USD market.

Conclusion: Tactical Approaches for EUR/USD Traders

In summary, the EUR/USD pair presents a complex yet intriguing week ahead. Traders should prepare for potential swings driven by economic disparities between the U.S. and Eurozone. As always, a nuanced approach, considering both technical setups and fundamental outlooks, will be essential for navigating the expected market volatilities. Stay updated on real-time changes and adapt strategies accordingly to harness potential market movements.

For a detailed daily technical analysis and more immediate updates on EUR/USD, investors and traders can follow real-time charts and expert commentary.

View real-time EUR/USD charts and in-depth analysis here

That's TradingNEWS